Report of the Commission of Inquiry into the Management of the Investment Corporation of PNG – Part 2

Mentions of people and company names in this document

It is not suggested or implied that simply because a person, company or other entity is mentioned in the documents in the database that they have broken the law or otherwise acted improperly. Read our full disclaimer

Document content

-

4.5 Terms of Reference 1(e) Tender Procedures

4.5.1 Introduction

In this part of the report, I will look into matters set out in TOR 1(e) which read:

Whether, in the performance of its functions and the exercise of its powers, particularly in the management of the Investment Corporation Fund, the Investment Corporation failed to comply with the provisions of the Investment Corporation Act (Chapter 140), the Public Finances (Management) Act 1995 or any other Act and with relevant policies and directions from the National Executive Council between the years 1998 and 2002 concerning but not limited to the following:?

whether there was any failure to comply with prescribed tender procedures in connection with

The Y2K upgrade at the cost of about 700,000. 00 paid to Bank of Papua New Guinea in or around September 1999

(ii) the engagement of Fiocco Possman and Kua as lawyers for the Investment Corporation;

the acquisition in 1999 of a VX Toyota Station Wagon registration No BBE 585 for the Managing Director and his purchase and disposal of the vehicle less than a year latter;

(iv) the acquisition in or around June 1999 of a VX Station Wagon registration No BBF 71 7 for the Managing Director and 3 units of Toyota Hilux for each for the Corporate Services Manager, the Investment Manager and the Fund Manager respectively; and

the sale and disposal of properties including those commonly known as Sea Park Apartments, Credit House, Monian House and Ilimo Farm

I will be examining and reporting on the manner in which contractors were engaged and how the assets of the Fund and the Corporation were disposed prior to and during the conversion of the Fund to the Paci?c Balanced Fund which occurred between the period of 1998 and 2002.

There were complaints and allegations that proper tender procedures were not followed to procure certain services and dispose assets. This re?ects adversely on the management and Board of the Corporation who acted as both trustee and fund manager of the Fund. Considering the fact that the interest of unit holders in the

-

Page 2 of 181

-

Fund is paramount, any transaction or dealings was to have been conducted in View of that interest.

41

4.5.2

It is imperative and prudent for any public body such as the Corporation to ensure that tender procedures are in place and are strictly adhered to so as to ensure accountability and transparency in the process to refute any possible suspicion or suggestions of mismanagement, abuse of power, imprudent management, breach Of ?duciary duties and so on.

Under this TOR, 1 will report on my ?ndings on the allegation of whether or not established tender procedures had been observed and complied with by the management and Board of the Corporation in procuring services and disposing of assets.

I do this by setting out the legislative framework for public tender procedures followed by the discussion of speci?c references under TOR I will discuss the TOR chronologically by highlighting the various contracts entered into and assets disposed during the term of both Mr Yamuna and Mr Ruimb.

Legislative Framework for Tender Procedures

The establishment and the operations Of the Corporation is governed by the Act. As a statutory corporation it quali?ed as a public body, and was therefore subject to the requirements of the PFM Act.

In May Of 1987, Sir Kingsford Dibela, the then Governor General made a declaration under the now repealed PFM Act declaring that the Corporation is a public body to which the PFM Act 1986 applied. That declaration was gazetted on the 15th May 1987 and is attached and marked as Exhibit ?94? in the Appendixes tO this report.

The general scheme of tender procedures in which the Corporation was to have been guided by is set out under the PFM Act, the Act and the Financial Manuals.

4.5.2.1 Investment Corporation Act

The Act does not contain any speci?c provision on tender procedures. However, section 30(1) of the Act makes reference to the general application of the PFM Act, which provides that:-

Subject to Subsection (3), the Public Finance (Management) Act applies to and in relation to the Investment Corporation

-

Page 3 of 181

-

However, section 30(3) of the Act sets out an exclusion provision with regard to the application of certain sections in the PFM Act, which reads:-

Sections 51the Public Finances (Management) Act 1995 do not apply to or in relation to the Investment Corporation

Sections 51the PPM Act, dO not apply to the Corporation pursuant to section 30(3) of the Act. For the purpose Of this topic, section 61 Of the

42

PFM Act is the appropriate section that establishes the legal framework for public tender procedures that is applicable to all public bodies.

The non?application of section 61 of the PFM Act as provided under section 30(3) of the Act will be further discussed under my discussion of the PPM Act.

4.5.2.2 Investment Guidelines

I have adequately covered discussion on Investment Guidelines of the Corporation under Chapter three of this Report. In summary the Board and Management must management the Corporation and Fund in accordance with ?sound business principles? as required by the Act.

Apart from this general rule under section 10(1), there has been no specific policy issued by the Minister at any one time in relation to tender procedures for the Corporation. However, there was an internal Tender Committee established to oversee the tendering process.

4. 5.2.3 Public Finances (Management) Act

Certain provisions of the PFM Act applied to the Corporation. The relevant provisions relating to tender procedures are provided under sections 59 61 while section 60 provides for the policy directions on tendering.

Section 59 of the PFM Act provides for contracts for works and services to public bodies in the following terms:?

Subject to subsection (2), tenders shall be publicly invited and contracts taken by a public body to which this Act applies for all works, supplies and services the estimated cost of which exceeds such sum as is specified in its constituent law or declared by the Minister.

(2) Subsection (1) does not apply to any works, supplies and services

that are to be executed, furnished or performed by the State, or an arm, agent or instrumentality of the State approved by the Minister for the purposes of this subsection; or

in respect of which the public body certifies that the inviting of

-

Page 4 of 181

-

tenders is impracticable or inexpedient?

In essence, section 59 provides that as the Corporation is a public body, the PFM Act applies to it in mandatory terms to ensure that all tenders must be publicly invited and any contract entered for all works, supplies and services must be so invited and contract entered if the cost for that work, supply or service exceeds an amount speci?ed in the Act or declared by the Minister. The only exceptions where section 59 of the PFM Act does not apply are in cases where such works, supplies and

43

services are supplied or performed by the State or its agent or if the process of inviting public tenders is not practical or expedient under certain circumstances.

Section 61 of the PFM Act provides the requirement for the approval for certain contracts in the following terms:-

The provisions of this section apply to and in respect of all public bodies notwithstanding any provision to the contrary in any other law and notwithstanding and without regard to any exceptions, limitations, conditions, additions or modi?cations contained in any other law.

(2) Subject to subsection (3), a public body shall not, except with the approval of the Minister, enter into a contract involving the payment or receipt of an amount, or of property to a value, (or both) exceeding

100,000.00; or

In the case of a public body declared by the Head of State, acting on advice by notice in the National Gazette, to be a public body to which this paragraph applies K5 00, 000. 00

(3) The provisions of subsection (2) do not apply to a contract relating to investments by a public body (including a subsidiary corporation) the subject of a declaration under section 5 7(3

The Act at section 30(3) states that sections 59 and 61 of the PFM Act does not apply to the Corporation while the PFM Act states otherwise:?

In such cases Where there appears to be inconsistencies between the provisions of the PFM Act and any other legislation relating to a subject matter, the provisions of the PFM Act overrides in so far as the inconsistency is concerned.

This position stems from section 48(4) of the PFM Act which provides:?

?Where any provision in this Part (Part ?Public Bodies) is stated to apply to all public bodies notwithstanding any contrary provision in any other law,

-

Page 5 of 181

-

then such provision shall apply, notwithstanding any provision to the contrary and notwithstanding and without regard to any exceptions, limitations, conditions, additions or modifications in any other law?

Section 61 (1) also reinforces section 48(4) of the PFM Act.

This goes to say that regardless of the exclusion provision in section 30(3) of the Act, the combined reading and effect of section 48(4) and 61(1) of the PFM Act is clear, in that, all provisions of the PFM Act applies to all public bodies including the Corporation irrespective of What its constituent law, in this case, the Act says.

44

Following from the above interpretation, Section 61(2) of the PPM Act further provides that subject to subsection (3), a public body shall not, except with the approval of the Minister, enter into a contract involving the payment or receigt of an amount, or of property to a value, or both) exceeding:-

?Kl 00, 000. 00; or

In the case of a public body declared by the Head of State, acting on advice, by notice in the National Gazette, to be a public body to which this paragraph applies –

In the case of the Corporation, any payment or receipt of monies exceeding K500, 000.00 requires the Finance Minister?s approval.

Pursuant to Section 61(3) of the PFM Act, the provisions of subsection (2) do not apply to a contract relating to investments by a public body (including a subsidiary corporation) the subject of a declaration under Section 57(3).

Section 57 makes provision for Investments. Section 57(3) of the PFM Act provides that:?

?The Minister may, by notice in the National Gazette, declare a public body (including a subsidiary corporation) to which this Act applies to be a public body which may, without the approval of the Minister, invest its moneys that are not immediately required, provided that each investment, whether a sale or a

purchase, does not exceed a maximum level 0f3% ofits total asset?.

Section 61(3) of the PFM Act does not apply to the Corporation as there was no declaration under Section 57(3) of the PFM Act. There was also no equivalent provision to Section 61(3) in the repealed 1986 Finance Act.

Section 61(4) of the PFM Act empowers the Minister to permit a public body to enter into a contract or class of contracts without obtaining his prior approval and to impose conditions for such permission. This sub?section (61.4) was repealed in 1998.

-

Page 6 of 181

-

Section 60 of the PFM Act deals with policy directions on the tendering process and states:-

?The provisions of this section apply to and in respect of all public bodies and subsidiary corporations notwithstanding any provision to the contrary in any other law and notwithstanding and without regard to any exceptions, limitations, conditions, additions or modifications contained in any other law.

The Minister may, from time to time, issue directions to public bodies and subsidiary corporations on policy to be followed in relation to the viewing of preference to national tenderers and local manufacturers in relation to tenders invited and contracts taken by public bodies.

45

4.5.3

A public body and a subsidiary corporation shall be bound by directions issued under Subsection (2)

Section 60(1) again reinforces sections 48(4) and 61(1) as to the application of the PFM Act while subsection (2) of section 60 empowers the Minister from time to time to issue directions to public bodies and subsidiary corporations on policy to be followed in relation to the giving of preference to national tenderers and local manufacturers in relation to tenders invited and contracts taken by public bodies.

Section 60(3) of the PFM Act renders any direction issued by the Minister binding on a public body and a subsidiary corporation.

I have found that no policy had been issued pursuant to section 60(2) of the PFM Act. Section 62(1) of the PFM Act provides that:-

Subject to Subsection (2), a public body or a subsidiary corporation to which this Act applies shall cause to be kept proper accounts and records of its transactions and a?airs, and shall do all things necessary to ensure that all payments out of its moneys are correctly made and properly authorized (my emphasis) and that adequate control is maintained over its assets, or assets in its custody, and over the incurring of liabilities by it.

(2) In the case of a public body or a subsidiary corporation that is declared by a constituent law or by the Minister to be a trading enterprise for the purpose of section 62, the accounts and records required by Subsection (1) must be kept in accordance with the accounting principles generally applied in commercial practice

Section 62 stipulates that all public bodies which include the Corporation must ensure that all transactions involving the payment of monies must be authorized and must be

-

Page 7 of 181

-

accounted for and records kept. This provision requires public bodies to ensure that there is adequate control over payments made; assets in its custody; and over liabilities incurred.

I have found that proper records of accounts and records of the affairs of the Corporation and the Fund were not properly kept and this has made my task during this inquiry somewhat dif?cult in tracing evidence in support or otherwise in respect to allegations raised in the TOR.

The Corporation?s Board and Management There were two separate Managing Directors and Boards who were responsible for

the affairs of the Corporation and the Fund over the period under inquiry (1998- 2002).

46

4.5.3.1 The Board of Directors

Section 9(1) of the Act establishes the Corporation?s Board of Directors. The Board is responsible for the proper management of the affairs of both the Corporation and the Fund.

Section 12 of the Act provides for the composition of the Board of Directors and theses included the following:-

I the Managing Director

. an of?cer of the Rural Development Bank appointed by the Minister through gazettal ?notice

an of?cer of the Department of Finance appointed by the Minister through gazettal notice

I a minimum of 5 and maximum of 9 members of whom 4 or more are citizens who ?-are appointed by the Minister through gazettal notice.

Under section 14 of the Act, the members of the Board of Directors are required to make a declaration of of?ce and declaration of secrecy before performing duties on the Board.

The chairman and deputy chairman of the board are appointment by the Minister who also determines their term on the board under section 18 of the Act.

The meetings of the Board can be called or set by the Board or as the Chairman or the Deputy Chairman directs and six members of the board can form a quorum.

-

Page 8 of 181

-

The Board considers submissions and recommendations prepared and put forward by the management of the Corporation and makes decisions for both the Fund and the Corporation if a matter requires the board?s input or approval.

The Board of Directors can authorize and exercise ?nancial discretion up to while any transaction involving the receipt or payment of money over K5 00,000.00 requires ministerial approval from the Treasury Minister.

4. 5. 3.2 The Management

The operations of the Corporation and the Fund were managed by the managing director and the deputy managing director who are required to act in accordance with the policies of the Corporation and with the directions from the Board of Directors pursuant to section 16(4) of the Act.

According to the PFM Act as discussed, the management?s financial limit is K100, 000.00 which can be exercised by the Managing Director.

47

4.5.4

Evidence given by Mr. Enoch PokaIOp confirmed (Transcript page 208) that:

or contract values up to K100, 000. That is at the discretion of the managing director; contracts up to ?ve hundred thousand, the board, and anything beyond that goes to the minister for approval

Mr. Ruimb also con?rmed Mr. Pokarop?s evidence.

In practical terms it is the management that recommends to the Board to approve monies within the Board?s limit and if the amount exceeds the Board?s limit the management advises the Board of the need to obtain ministerial approval and seeks the approval once the Board approves the recommendation.

To appreciate when the allegations Specified under the TOR 1(e) transpired, it is important to identify the management team and the Board of Directors who were party to decisions for or on behalf of the Comoration and the Fund in terms of whose services were engaged contractually, which assets were disposed, and the manner in which those services were obtained and assets were di5posed.

There were two different boards of directors and management team between February 1998 and January 2002 when the allegations raised under this TOR unfolded.

From period February 1998? mid 1999, the Comoration and the Fund was guided under the management of Wandi Yamuna and a separate Board of Directors. From August 1999 January 2002 John Ruimb and his management team managed the

-

Page 9 of 181

-

affairs of the Corporation and the Fund under a different Board.

Management under Wandi Yamuna

The management of the Corporation and the Fund under the leadership of Wandi Yamuna as managing director was from February 1998 to mid 1999. Wandi Yamuna?s management was responsible for the following matters referred to under TOR

I the Y2K upgrade at the cost of about K700, 000.00 paid to the Bank of Papua New Guinea in or around September I 999;

I the engagement of Fiocco Possman and Kua as lawyers for the Investment Corporation; and

i the sale and diSposal of properties including those commonly known as Sea Park Apartments, Monian House and [limo Farm.

4. 5. 4.1 The Management from February 1998 to I 999

The following individuals formed the Corporation?s management team during Mr Yamuna?s tenure as Managing Director:-

48

The Senior Executive Management Team

Mr. Wandi Yarnuna – Managing Director

Mr. Lincoln Taru Deputy Managing Director

Mr. Stephen Mokis Manager Personnel Administration Mr. Chris Gideon Corporate Secretary

Mr. Kris Bongare Investment Manager

Mr. Fred ‘Angoman – Financial Controller

Mr. Gerald Senapali Board Secretary

Mr. Enoch Pokarop Senior Investment Analyst

Mr Alu Tongia Fund Administrator

4.5.4.2 The Board of Directors from February 1998 – 1999

The following individuals formed the Board of Directors of the Corporation during Mr Yarnuna?s tenure as Managing Director.

Sir Dennis Young Chairman (removed in August 1999)

-

Page 10 of 181

-

Mr. Napolean Liosi Deputy Chairman

Mr. Robert Seeto Director (removed in March 1999) Mr. Jack Patterson Director (removed in August 1999) Mr. Demas Kavavu Director (removed in August 1999) Mr. Michael Varapik Director (removed in March 1999) Mr. Joseph Kumgal Director (removed in June 1999) Mr. Ben Pokanau Director (replaced in August 1999) Mr. Ted Taru – Director (removed in June 1999)

Mr Peter Jabri, Mr Peter Kopunye, Mr Rarua Gamu, and Mr Klei Kera were appointed in about May/June 1999 and were removed in October 1999.

There was no appointee from the Rural Development Bank. This was contrary to law under section 12 of the Act.

The ICPNG Accounting Policies and Procedures Manual comprehensively covered procedures for public tender and complimented the PFM Act. Strict adherence to the established tender process was lacking when Mr Yamuna was appointed the Managing Director of the Corporation and during his tenure the use of public tender system was abolished (Transcript page 208 to 209).

49

4.5.4.3 Internal Tender Procedures

Prior to Wandi Yamuna?s appointment as managing director, the tenders system use was guided by the PFM Act and complimented by the ICPNG Accounting Policies and Procedures Manual. A copy of the manual is attached and marked as Exhibit ?95? in the Appendices to this report. The relevant captions of the manual relating to the tender process is set out below:

ORPORA I 0N OF PAP UA NEW GUINEA A OUN TIN POLICIES AND PROCEDURES MANUAL 4.4 PROCEDURES FOR TENDERS AREA OF INTEREST: Procurement by Tender

OBJECTIVES: 0 provide guidelines that will ensure the most prudent

manner of ?nding the right samplier for goods and services required, by inviting tenders.

SCOPE: These guidelines will provide the correct policies procedures to be followed in Regard to,

Invitation of Tenders

– Handling of the Tender documents Approval of the Tenders

-

Page 11 of 181

-

The Tender Committee

Responsibiligz: The Tender Committee members listed in subsection below are jointly and severally responsible for the above objectives.

FUNCTIONS Invitation to Tender Receiving and Opening Tenders Approval of Tenders

The Tender Committee GUIDELINES:

(A) INVITATION TO TENDER

50

All Tenders should be allocated a unique tender number and this number should appear on all tender documents

For Contracts under K5 0,000 suitable suppliers may be invited to tender. The invitation should be restricted to suppliers with the necessary capabilities and financial viability to carry out the contract.

The possibility of getting a local supplier should be fully explored before extending invitations to foreign companies operating in Papua New Guinea, or to overseas supplies, to conform with the policy of the Government of

Papua New Guinea.

possible a minimum of three suppliers should be invited to tender for every contract.

For contracts over 50,000 the invitation to Tender should be by press advertisement, calling interested parties to register their interest, providing details about their background, experience in similar contracts and expertise of their sta?r members where appropriate.

The following information should be provided to interested parties along with the Tender documents.

(C)

(8)

Full description of the Corporation ?5 requirements.

-

Page 12 of 181

-

Other specific requirements such as delivery/completion time. Closing Date and time for the submission of Tenders

Name and Title of Contract Officers.

Amount of deposit required at the time of lodgement. (Refundable on return of documents if Unsuccessful).

The tender documents should be initialled by the tenderer in order that the initialed copies become the contract copies should the tender be successful.

The tender documents given to all tenderers should be identical. – Changes to tender documents, if absolutely essential, may be made

by the Tender Document and all the changes should be communicated in writing to all tenderers.

All tenderers should be instructed that the tenders should be submitted in sealed envelopes with the following information clearly shown on the envelope.

(ii) The Name and Address of the Tenderer.

51

Tender Number

(iv)A Brief description of the contract.

The closing date and time. RECEIVING AND OPENING OF TENDER Tender Period

Tender periods should be of adequate duration to suit both the Corporation and the tenderers.

– Ideally no extension of the tender period should be granted. However, under exceptional circumstances extension may be considered and if granted all interested parties should be noti?ed and confinned in writing.

The time for closing tenders should not be earlier than 3.00 pm on a working day other than Mondays and days immediately a?er a public holiday. 0n the closing date the Corporation?s Post O?ice Box should be checked shortly before the closing time of the tender.

– Tender submissions by Fax or Telex should not be accepted under any circumstances.

Late submission should be returned to the senders unopened. 2. OPENING OF TENDERS

-

Page 13 of 181

-

All Tenders received should immediately be put in the tender box.

The tender box should be in the custody of the Secretary of the Tender Committee.

Tenders Opened in error shall be rescaled by the Secretary of the Tender committee, initialed and put in the Tender box.

– At the time of opening the Tender box, at least three members of the Committee shall be present and all three members shall initial each and every tender.

A summary of all tenders received together with the relevant documents will be forwarded to the appropriate division/section or consultants for evaluation and subsequent return to the tender committee with their recommendation along with the summary.

– The tender may if necessary call upon the persons involved in the evaluation to assist thefinal decision.

52

3. APPROVAL OF TENDERS

Contracts under K1000 will be approved by the appropriate authority as per the delegation of authority issued by the Managing Director.

Contracts over K5, 000 and under 00, 000 shall be approved by the Managing Director.

– Contracts over K100, 000 but under should be submitted to the Board of Directors of the Corporation along with the recommendations of the Tender Committee for approval.

Contracts over [?300,000 or over should be referred to the Minister for approval with the endorsement of the Board of Directors.

The awarding of the tender to the successful bidder should ideally happen within 30 days of the opening of the tenders.

Unsuccessful bidders should be notified accordingly.

– The successful bidder will be issued a purchase Order specifying relevant details as per the tender documents.

THE TENDER COMMITTEE The tender committee members will include: The Managing Director The Deputy Managing Director The Financial Controller

-

Page 14 of 181

-

The Personnel and Administration Manager The Property Manager The Investment Manager For contracts below K100, 000 the Deputy Managing Director will chair the committee.

For Contracts over K100, 000 the Managing Director shall be the Chairman of the Committee.

Any one of the Committee members, other than the Managing Director and the Deputy

Managing Director, may serve as the Secretary of the Committee as directed by the Managing Director?

53

There is evidence that strict adherence to the established tender process changed when Wandi Yamuna was appointed the Managing Director of the Corporation and during his tenure the use of public tender system was abolished.

4.5.4.4 The Tender Committee

The establishment of the Tender Committee dates back to 1993 when the Corporation opted to outsource the management of its prOperties which were then managed in- house. Initially the property portfolio was managed in-house but due to very poor performance attributed to lack of pro?cient in?house management services, the Corporation resolved in late 1993 to have the balance of its properties still managed in?house, to be contracted out to professional property management ?rms to provide management services.

To implement the board?s resolution and in order to ensure a credible selection process was in place with tender provisions, a management team was established as a sub?committee called the Tender Committee. The establishment and ?inctions of the tender committee was guided by the PFM Act and the ICPNG Accounting Policies and Procedures Manual. This Tender Committee was also the Tender Committee for the Fund.

The composition of the Tender Committee comprised of the following management members:-

The Managing Director

The Deputy Managing Director

The Financial Controller

The Personnel and Administration Manager

-

Page 15 of 181

-

The Property Manager

The Investment Manager

Under the Accounting Policies and Procedures Manual, contracts valued below required the Deputy Managing Director to chair the committee. For contracts over the Managing Director shall be the Chairman of the committee. Any one of the committee members, other than the Managing Director and the Deputy Managing Director, may serve as the Secretary of the Cormnittee as directed by the Managing Director

The Tender Committee?s functions included drawing up the tender documents and selection criteria which were both approved by the Managing Director. The Committee then screens all tender submissions and makes its ?nal recommendation to the Managing Director for approval and the managing director then recommends to the Board of ICPNG to implement.

54

The committee deliberated on the screening for bids for sale of properties and considered the selection process in terms of tenders for property management, security services, cleaning services and others. The decisions reached by the Tender Committee would be presented as part of the submissions during board meetings for the board to consider and make its resolution in respect of those tenders. (Transcript page 332)

I noted from records that in actual practice after February 1998, there was no strict compliance as to who formed the tender committee. An example of this is noted from Board Submission?dated 07/06/ 9 Swhere a submission was presented from the tender committee who comprised of the following management team:

Investment Manager – Chairman – Personnel Administration Manager Member – Financial Controller – Member Property Administrator Member Senior Investment Analyst Member

A copy of the Board Submission referred to is attached and marked as Exhibit ?96? in the Appendices to this report.

I ?nd from Exhibit ?66? and evidence heard from Enoch Pokarop (Transcript page number 207) that the following persons fonned part of the Tender Committee when

it existed:? Wandi Yamuna (Managing Director) Chairman Gerard Senapili (Executive Of?cer) – Tender secretary Fred Anogoman (Financial Controller) – Member Kiis Bongare (Investment Manager) Member

-

Page 16 of 181

-

– Enoch Pokarop (Senior Investment Analyst) Alternate member

4,504.5 Abolition of the Tender System

According to Enoch Pokarop?s evidence, he never attended any of the tender committee meetings, he was only named as an alternate member in the event the investment manager (Kris Bongare) was not available.

Mr Pokarop in his written statement dated 26th November 1999, said that the standard practice was not followed. He stated:

55

?Note that as a standard practice in addition to the tender procedure, the Managing Director has always excluded himself from the tender committee in order to do an independent and impartial final decision on the tender committee?s recommendation. The rationale was to avoid any conflict of interest in the decision making of the tender committee.

However, when the new Managing Director Mr. Wandi Yamuna) took over in February 1998, a circular was issued to the Divisional Managers advising that the following personal form the members of the tender committee:?

Managing Director Wandi Yamuna (Chairman) – Financial Controller Fred Angoman (Member) – Investment Manager Kris Bongare (Member)

/Enoch Pokarop (Alternate Member)

Executive O?icer Gerald Senapili ??ender Secretaty)

The removal of the Deputy Managing Director is in contravention of the accounting manual and tender procedure. The change was also not submitted to the Board for approval.

Not that the applicable law in relation to the approval of contracts is the ?Public Finance (Management) Act 1995 as amended. In addition, ICPNG accounting manual also apply.viz,

Contract Value Approval Authority Contracts up -to K100, 000?00 Managing Director Contracts up to 5 00, 000?00 Board

Contracts over K5 00, 000-00 Minister for Finance

A copy of Mr. Pokarop?s written statement is attached and marked as Exhibit ?66? in the Appendices to this Report.

-

Page 17 of 181

-

Mr. Gideon who also gave evidence said (Transcript page 333), that the system of having the tender committee deliberate on public tenders was not working well and procedures were not followed. By April 1998 the tender committee ceased to operate effectively.

The management at the time failed to follow procedures or utilize the tender committee and eventually the committee ceased functioning.

56

4.5.5 Management under John Ruimb

Mr Ruirnb who initially held the position of Senior Investment Analyst and one time as acting Deputy Managing Director was appointed. He was appointed as acting Managing Director of the Corporation on or around the 26th August 1999 when the Management and Board of the Corporation was suspended following controversies relating to the sale of properties and allegations of mismanagement at the

Corporation.

Mr Ruirnb?s acting appointment was confirmed four (4) months latter in December 1999, and he held that position up to 31St January 2002 when he was retrenched.

The following engagements of professionals and sale of properties took place during John Ruimb? tenure as Managing Director.

I the engagement of Fiocco Possman and Kua as lawyers for the Investment Corporation;

I the acquisition in 1999 of a VX Toyota Station Wagon registration No BBE 585 for the Managing Director and his purchase and disposal of the vehicle less than a year latter;

I the acquisition in or around Jane 1999 of a VX Station Wagon registration No BBF 717 for the Managing Director and 3 units of Toyota Hilux for each for the Corporate Services Manager, the Investment Manager and the and Manager respectively;

4.5. 5.1 The Management from August 1999 to January 2002

The Corporation?s management team lead by Mr Ruimb as Managing Director also comprised of some of the staff under Mr Yarnuna?s tenure and included the following individuals:?

The Senior Executive Management

Mr. John Ruimb – Managing Director (acting as from August 1999 until con?rmed in December 1999)

-

Page 18 of 181

-

Mr. Lincoln Taru – Deputy Managing Director

Mr. Chris Gideon Board Secretary

Mr. Enoch Pokarop – Investment Manager

Mr. Nelson Wilson Senior Investment Analyst

There was no Financial Controller under Mr Ruirnb?s tenure. The former ?nancial controller, Fred Angoman, was administering the ?nancial division of the Corporation through Kincorp who were engaged to manage the ?nance division

57

4.5.5.2 The Board of Directors from:

4.5.6

when the Corporations accounting function was outsourced following the board and management?s decision to downsize the operations of the Corporation.

August 1999 January 2002

The following individuals formed the Board of Directors of the Corporation during Mr Ruimb?s tenure as Managing Director:-

Mr. Rex Augwi

Mr. Napolean Liosi Mr. Abraham Tahija Mr. Toffamo Mionzing Mr. Ambeng Kandakai Mr. John Tari

Mr. Mete Kahona

Mr. Puliwa Mapikon Sir Pato Kakaraya

Y2K Upgrade

Chairman

Deputy Chairman

Director

Director

Director (resigned in November 2000)

-

Page 19 of 181

-

Director

Director

Director (appointed in November 2000) Director (appointed in October 2001)

Whether there was any failure to comply with prescribed tender procedures in

connection with

he Y2K upgrade at the cost of about 700,000.00 paid to the Bank of Papua New Guinea in or around September 1999

Enoch Pokarop gave evidence (Transcript page 213) that the Central Bank issued a direction to all statutory bodies and departments to ensure their information and computer data base were compliant in response to the global Y2K scare. Mr. Pokarop?s evidence is also continued by record of the Corporation?s board meeting 133/99 (Exhibit held on the 17th December 1999:?

?133/99/ 2(d) Y2K Computer Upgrade

Board was infomed that its resolution of the previous meeting was not pursued as the Bank has exercised its powers under the Banks and Financial Institutions Act to take control of the tqagrading works. As a result of this new development, the Bank has appointed its Y2K Consultant Mr. Jack Bar?T or to review and institute immediate remedial actions to attain Y2K Compliance by

the rollover date.

Mr. Bar?T or has come up with three approaches that will run simultaneously to achieve compliance. The estimated total cost of this is 000, which falls within the previous approval given by the Board.

58

In view of the timing constraints, directors resolved to commend management for the pro?active steps taken to execute agreements with the Bank of PNG project team and the positive developments that have been attained since the last meeting.

Moved: A.Kandakasi Seconded: T. Mionzing?

The Y2K compliance computer upgrade was ?rst mentioned by the Corporation?s Board in board meeting number 128/98 tendered as part of Exhibit ?61? held on 11th September 1998 as agenda 3(a) but the board resolved to defer that paper. There are no further records from which I could ascertain if the Board did consider the paper on the Y2K compliance and approved C?Vision?s engagement to address the compliance

-

Page 20 of 181

-

issue.

From the evidence on this aspect, I ?nd that the Tender Committee did consider and recommend to the Board to approve and award the contract to C-Vision. There were 12 tender applications received following publication. This is evidenced from an internal memorandum from the Financial Controller, Fred Angoman to the Managing Director, Mr Yamuna dated 15111 October 1998 the purpose of the memorandum was to brief the Chairman, Sir. Dennis Young on the Y2K project:

CPNG BOARD CHAIRMAN BRIEF YEAR 2000 BUG COMPLIANCE PROJECT I. PURPOSE

The purpose of this paper is to brief the ICPNG Board Chairman Mr. Denis Young on the year 2000 compliance (Y2K) project.

2. PROJECT

The Y2K project is the replacing of the Share Register System (SRS) and the Pay Deduction Scheme (PBS) with year 2000 compatible softwares and the acquisition of appropriate software to run the Pension Fund.

The current systems are not year 2000 compatible and they are corrupt. The memory available has also run out and there is only 10% capacity left. This is enough to operate the system for a few months only. The above problems have caused the computer to produce incorrect reports and the frequent system failure. We have no lucky so far to keep the system operating. This will not be long and it will collapse any time. Installing of additional hard disk will not fix the problem.

Further the current system is not user friendly meaning the data entry can

not be done on line. This has caused the delays in producing required customer and management information and end products.

59

The complete system (software hardware) must be replaced as soon as possible before it collapses. The software required must be o? the shelve meaning they can be upgraded when current version is superseded, must be user friendly and its performance must be similar to current system. The hardware must have the maximum hard disk capacity, maximum operating capacity, must be user friendly and must be able to integrate with the accounting so?ware and the printers must perform all required prints (edit reports, cheques, certi?cates, statements, inquiry information etc.)

CALL FOR BID

-

Page 21 of 181

-

Twelve interested ?rms sent their bids for the project. The complete list of the bidders is attached as Appendix J.

Quotation and tender were called between July and October 98 for the supply and installation of appropriate software and hardware. The twelve bidders were screened by the Tender Committee on Tuesday the October 98 as follow;

PMSC good of the shelve software, no hardware, price in SA UD too high.

3.2 Computer Spot pr0pose to rewrite SRS PDS, of the shelve Pension Fund software, no hardware. Does not meet requirements.

3.3 Concept Software Propose to convert the current SRS PDS, write/develop a Pension Fund, can not provide Hardware, cost too high.

3.4 Computers Communication Proposed two options for hardware, hardware not comprehensive, can not provide software.

3.5 Able Computing Price for hardware only, they can not provide software.

3.6 Data General Price for hardware only, they can not provide software.

3.7 C?Vision quoted for of the shelve software and hardware, they spent more time studying the existing system and inquire on the proposed Pension Fund. Their hardware proposal is also very comprehensive. Their proposal includes two additional software a Property database and Investment Analysis Tool. Their price is reasonable.

60

3.8 Datec PNG Propose both software and hardware, they supplied the current SRS PDS software and hardware. Propose to convert SR8 PDS, supply of the shelve Pension Fund software. Price too high.

3.9 Award Technologies Propose both software hardware, though off the shelve programs for SRS PDS they are not quite certain if the software will perform all required ?tnctions, can not quote for Pension Fund. No details of hardware to provide.

3.10 Daltron Electronics Propose to provide hardware only, not

-

Page 22 of 181

-

comprehensive.

3.11 PNG Micro Computers Propose for both software

hardware, propose software too cheap, some good hardware included.

3.12 Workers Mutual Proposed for both software hardware, propose to develop software, hardware not comprehensive.

BIDDER RECOMMENDED

The bidder recommended by the Tender Committee for approval by the Board is the Vision. They are Australian based company. They have a branch in PNG located at Pacific View Place. Their tender amount is K397, 998.l8.

FUNDING

The budgeted amount for computer related cost is K255, 000. About a 1000.00 ofthis was spent sofar. The rest ofthefund is to comefrom the K500, 000 budgeted for the repair and maintenance of the Investment House now that the property was sold.

COMPLETE OF PROJECT

The project will take three months from the date of award of contract to complete. Once the date is transferred to the new system the entry to data will be done on line by the Fund Division and Accounts section.

The Accounting information from the SRS, PBS and Pension Funds will be imported direct. Further the property data and valuations of investments will also be imported direct. This means a lot of time saving, error omissions, reduction in manual labor and efficient periodical management accounts-

61

Further more the outstanding matters such as the Share Spilt and Bonus Issues can be a?ected

A copy of the internal memo from Mr. Angoman to Mr. Yamuna referred to above is attached and marked as Exhibit ?97? in the Appendices to this report.

C-Vision?s engagement was rushed given the urgency to ensure the Corporation?s computers were Y2K compliant before January 2000. The Corporation?s Board on the 30:11 October 1998 during its special board meeting number 2/98 (Exhibit considered the proposal which was sanctioned by the Tender Committee and resolved

-

Page 23 of 181

-

that the work be awarded to C?Vision for a fee of and that the required work be completed within three (3) months.

75% of the total cost (K397, 998.18) was paid up front on a contract however, Vision failed to complete the contract work. During the Commission?s hearing Enoch Pokarop and John Ruimb both gave evidence (Transcript page 214 410-411) to the effect that C?Vision failed to deliver the services it was engaged to provide. Consequently, on the 28th October 1999, the Board in meeting number 132/99 (Exhibit resolved to re?award the contract to Datec who also bided for the tender at a cost of K1 .5 million. The Board minutes reads:-

?I32/99/2(c) Y2K Compliance Program

Board noted the unsatisfactory progress made by C-Vision and resolved to re? award the project to Datec Limited for million and approved K5 00, 000 which was within its authority for Datec to start the upgrading work and that management make a submission to the Treasurer for his approval of the full amount to comply with the Public Finances (Management) Act.

Moved: A. Kandakasi Seconded: TMionzing

John Ruimb through his statement tendered as Exhibit (a copy is attached in the Appendices to this report) gave evidence that:?

?The company called Vision Limited was engaged to undertake the Computer systems upgrade to Y2K compliant at the beginning of I 999 by the previous management to be delivered by March 1999. At the time of my re? appointment on or about 26th August I999, not much work was done and delivered despite some upfront payment already made. This company was unknown in the market place at the time and neither was there any contract outlining the terms. The management at the time left this matter to the Investigation team to examine considering the urgency of time to 31? December 1999, and recommended to the Board the appointment of Datec PNG Limited to undertake the Systems up grade to Y2K Compliant. Before arrangements for the engagement of Datec could be ?nalized, Bank of PNG undertook an inSpection on the .28? October 1999 which revealed that in the assessment of the Bank of Papua New Guinea, the Investment Corporation does not meet the minimum preparatory requirements necessary to address the risks brought

62

about by the Millennium Bug and that the Bank of PNG was concerned that depositors funds might be at risk. The Bank of Papua New Guinea wrote to ICPNG on 015I November 1999 advising their inspection result and further advised that in accordance with section 18(2) of the Banks (.9: Financial Institutions Act, the Bank of Papua New Guinea has decided to engage Mr. Yaacov (Jack) Bar?Tor, a Y2K Consultant to review the existing systems and related Y2K issues) and o??er expert advise on ways to address identi?ed problems, at the cost of Investment Corporation. As a licensed financial institution at the time, ICPNG was subject to the regulatory supervisory

-

Page 24 of 181

-

control of the Bank of Papua New Guinea, hence this was taken as a lawful regulatory direction and ensuring arrangements were made to cooperate with the Bank of PNG to make the systems Y2K compliant including the payment of AUD 350,000.00 to Bank of Papua New Guinea Trust Account in December 1999 and not in or around September 1999 as stated in the Terms of Reference. Funds were controlled and disbursed by Bank of Papua New Guinea?

Due to intervention Datec was not allowed to complete its engagement.

1 also noted from an assessment from in 2002 that a sum of K700, 755.00 was paid into an account opened with the Bank of PNG in 1999. The account was managed by designated of?cers of the Bank of PNG for the sole purpose of paying expenses that would be incurred by consultants engaged to work on the Y2K compliance requirements. This full amount was paid to the Bank of PNG for the Y2K compliance consultants to commence work.

A copy of PwC?s report is attached and marked as Exhibit in the Appendices to this report.

My investigations of the Bank of PNG records show that the said Bank utilized almost all of the money by paying the consultant it engaged. Only a small portion of it was returned to the Corporation.

The amount paid by the Corporation was in excess of K500, 000.00 which required ministerial approval at the time. There is no evidence to suggest that there was compliance with section 61(2) of the PFM Act. I therefore ?nd that the payment of 700,755.00 to the Bank of PNG, while it may have been paid in line with lawful direction, was done without obtaining the mandatory approval from the Minister for Treasury. This rendered the payment unlawful and in breach of the public tender

procedure set out under the PFM Act.

I should also add that the Board on the 13th December 2001, in its meeting number 137/2000 (?Exhibit resolved and directed that the Corporation?s Management continue to pursue the recovery of moneys paid to the Y2K Team with the Bank of PNG. Whether that has eventuated is a matter for further investigation.

63

4.5.7

I have noted in this section of my report on the proposed K37 million write off that this amount has been proposed for write off. However, the amount is recoverable and should not be written off.

Engagement of Lawyers

Whether there was any failure to comply with prescribed tender procedures in connection with

-

Page 25 of 181

-

(ii) the engagement of Fiocco Possman and Kna as lawers for the Investment Corporation;

Posman Kua Aisi Lawyers was one of the law ?rm engaged to provide necessary legal opinions and advises to the board and management of the Corporation. According to Lincoln Taru?s Final Report on ICPNG dated 22nd July 2005 (a copy of which is marked and attached as Exhibit ?12? to the Appendices to this report), that ?rm was principally engaged from 1998 – 2004. According to that report, advice and opinions provided by FPK Lawyers covered the controversial purchase/sale agreement of Ilimo Poultry Products to Athmaize and Peak Performance Feed of Australia as well as conveyancing on the sale of all institutional houses sold under the Corporation Home Ownership Scheme.

Evidence was also given by Managing Directors, Mr Ruimb in his written statement dated 8th November 2006 and Mr Yamuna in his written statement dated 4thl December 2006 that the Corporation did not engage any one particular law firm on a retainer basis but opted to engage various law ?rms to provide legal services for different legal work and these ?rms include:-

I Carter Newell Lawyers;

I Young Williams Lawyers;

I Pato Lawyers;

I Mawa Lawyers;

I Peter Pena Associates;

I Thirwall, Aisi Koiri Lawyers; I Parua Lawyers;

I FPK Lawyers;

I Mai Lawyers;

I Liosi Lawyers; and

64

. Parua Lawyers

My investigation revealed that there was nothing improper or unlawful about the engagement of FPK Lawyers. There was no need for tender process, and in any case there is no evidence to suggest that their engagement were unlawful or improper.

A copy of Mr. Ruimb? statement dated 8th November 2006 is marked Exhibit

-

Page 26 of 181

-

and Mr. Yamuna?s statement dated 4th December 2006 is marked Exhibit both exhibits are attached in the Appendices to this report.

4.5.8 Purchase and Disposal of Vehicles

4.5.8.1 VX Toyota Station Wagon BEE 585

Whether there was any failure to comply with prescribed tender procedures in connection with

the acquisition in 1999 of a VIX Toyota Station Wagon registration No BBE 585 for the Managing Director and his purchase and diSposal of the vehicle less than a year latter;

In respect to this the Commission heard on the 9th November 2006 the evidence of Mr. John Ruimb, who gave evidence by his statement dated 8th November 2006 refer to Exhibit attached to the Appendices to this report) by making the

following statement:

?The Toyota VX Station registration number BBE 585 was not acquired in 1999 as per the Terms of Reference. This vehicle was purchased for the previous Managing Director Mr. Wandi Yamuna some time on or about 24: March 1998. Upon Mr. Yamuna?s suspension and my appointment, I assumed use of this vehicle in September 1999. I later purchased this vehicle some time in the year 2000 by choosing to utilize the motor vehicle provision of my contract of employment where I had an option to purchase at a sum of or written down value which ever was lower. 1 elected to utilize that provision by paying K45, 000. 00 to ICPNG

According to John Ruimb?s evidence, he purchased the subject vehicle two (2) years after it was purchased in March 1998. At the time of his purchase no valuation was done to the vehicle to determine its market value.

Prior to the purchase of the of?cial vehicle, John Ruimb was using an of?cial issue of the Investment Corporation?s vehicle.

This Commission does not have a copy of Mr. Ruimb?s second contract of employment despite requests to his lawyers to provide a copy. Hence, my ?ndings in relation to this TOR will be reserved as I have not had the bene?t of perusing Mr. Ruimb?s second contract of employment.

65

4. 5. 8.2 VXStation Wagon BBF 717 and Toyota Hilux

Whether there was any failure to comply with prescribed tender procedures in connection with

-

Page 27 of 181

-

(iv) the acquisition in or around June 1999 of a VX Station Wagon registration No BBF 717 for the Managing Director and 3 units of Toyota Hilux for each for the Corporate Services Manager, the Investment Manager and the Fund Manager respectively;

The Corporation?s former corporate secretary, Chris Gideon, gave evidence (Transcript page 334-335) that those four (4) vehicles referred to in 1(e) (iv) were obtained from Credit Corporation through a three (3) year lease arrangement and due to the retrenchment exercise which commenced in the beginning of 2002 the operations of the Corporation were scaling down so the Board approved the sale of those vehicles through public tender. The Board also approved the tender prices. Mr. Gideon also gave evidence that he did not acquire any of the Toyota hilux referred to in the when the Corporation decided to tender the sale of the vehicles.

John Ruimb also gave evidence that the vehicles were purchased as normal replacement vehicles from Credit Corporation for the Corporate Services Manager, Investment Manager and Fund Manager respectively. By 31St January 2002 when the retrenchment exercise at the Corporation became effective all those vehicles were locked away and the Board of the Corporation in September 2002 approved that they be sold through public tender.

1 found that none of the management team of the Corporation was successful in the bid for all four vehicles.

The following are records of the sale of the vehicles: Sale of VX Toyota Station Wagon, Registration Number BBF 717

With respect to the tender of Toyota VX BBF 717, the Board in meeting number 141/2002 held on the 30th August 2002, considered 6 short listed bidders from a total of 86 bidders after notice of public tender was made. There were two bidders who bided for the Toyota Land Cruiser; Leonard Tale and Tourism Promotion Authority. Those two bidders both bided which was the highest bid. The Board noted the recommendation that the vehicle Toyota Land Cruiser BBF 717 ?be sold to any of the short Zisted bidder ?rst to come up with the cash?. A copy of the board meeting minute 141/2002 is attached and marked as Exhibit ?98? in the Appendices to this report.

There were two payments made by a Leonard Tale to purchase the Toyota Land Cruiser, BBF 717 for 150,000.00. The ?rst payment was the 10% deposit made by a Westpac bank cheque dated 3rd September for under cover letter dated 2’1d September 2002 for which an of?cial receipt No 11419 was issued on 3rd September 2002:

66

The letter of 2nd September 2002 reads:?

-

Page 28 of 181

-

?Dear Sir, RE: ICPNG TENDER TOYOTA VX (BLUE) 717

Reference is made to my tender dated 26/06/02 in relation to the above motor vehicle.

As per your telephone advise of today that the Board of ICPNG has accepted my above tender, attached herewith is a Bank Cheque for the amount of Fifteen Thousand Kina

being 10% deposit on the accepted tender price. I shall arrange to pay the balance K135, 000?00 within 30 days. Please acknowledge receipt of this payment by way of a receipt or letter.

Yours faith?dly,

Leonard Tale?

A copy of the letter referred above and the copy of the of?cial receipt issued by the Corporation is attached and marked as Exhibit ?99? in the Appendices to this report.

A further payment of was received from Leonard Tale by another Westpac bank cheque dated 17th September 2002. An of?cial receipt from the Corporation numbered 11425 and dated 17th September 2002 was issued as receipt of the payment. The letter of 17th September 2002 reads:?

?Dear Sir,

RE: ICPNG TENDER ACCEPTANCE TOYOTA VX (BLUE) BBF 717

Further to my letter of 02/09/02 together with a bank cheque being 10% deposit,

Attached herewith is another bank cheque being for further payment of as part payment of the remaining balance of 135,000?00.

After this payment, A balance of 50, 000?00 remains to complete the purchase of the above vehicle.

Please acknowledge receipt of this payment by way of a receipt or letter.

Yours faith?tlly,

67

Leonard Tale?

-

Page 29 of 181

-

A copy of this letter referred to and a copy of the receipt issued by the Corporation is attached and marked as Exhibit ?100? in the Appendices to this report.

From the PEIL Final Corporate Managers Report on the Corporation to IPBC dated May 2004, (a copy is marked and attached as Exhibit to the Appendices to this report) at page 6 I noted that:

?The Corporation disposed of its four (4) leased motor vehicles for a total consideration of during 2002 where proceeds of [080,000 was received. The balance of the proceeds of K5 0, 0000 was received in early 2003. The sale of these vehicles was approved by the ICPNG Board following Public Expressions oflnieresi in the local newspapers

From the evidence before me, I ?nd that was received from Leonard Tale as part payment for the subject vehicle. But I have no evidence to verify if Mr. Tale in fact paid the balance of or not.

There is no further record in this Commission?s possession to con?rm this uncertainty. Hence, the issue of whether or not Mr. Leonard Tale completed payment for the tender of Toyota VX BBF 717 is a grey area that remains unresolved.

For purposes of con?rming if pr0per tender procedures were followed in the diSposal of this subject vehicle, I ?nd that the Board did approve the disposal of this vehicle for in its meeting number 141 142 of 2002. 1 also ?nd that public tender was called for the disposal of this vehicle of which Mr. Leonard Tale was the successful bidder who ?rst came up with the funds by way of a deposit to purchase the Toyota VX.

I ?nd also that the amount approved by the Board was Within its ?nancial limit and there was no breach of public tender procedures under the PFM Act.

Sale of 3 Units of Toyota Hilux

The evidence from Mr. Ruimb, Transcript page number 412) show that the three units of Toyota Hilux were purchased sometime in 2001 as replacement ?eet and not in or around June 1999 as stated in the Those vehicles were sold through public tender with the Board?s approval sometime in September 2002.

The three units of Toyota Hilux referred to are not speci?ed by classifying them under their registration numbers which made my task dif?cult, as there were a number of Toyota hilux vehicles comprising the Corporation?s ?eet which were sold through public tender as shown in the Board Meeting Minute 140/2002 held on the 8th March 2002. A copy of this minute is attached and marked as Exhibit ?101? in the Appendices to this report.

68

The Board submission prepared by the Corporation?s Corporate Services dated 5th

-

Page 30 of 181

-

March 2002 and for purpose of this TOR, agenda item: 140/02/2(i) refers to the sale of Motor Vehicles.

1.

PURPOSE

inform the Corporation?s Board on the progress of selling the motor vehicle fleet.

BA CK GROUND

The Corporation has a ?eet of eight (8) motor vehicles comprising:? a) One Toyota Landcruiser s/wagon

b) Four Toyota Hilux 4wd utes

c) One Toyota Hilux 2 wd ute

d) One Toyota Carina Sedan

e) One Toyota 15 seater bus

The landcruiser and three (3) white hilux 4wd are currently under lease ?nancing with Credit Corporation at repayments of K18, 300.00 per month for the remainder of the term of twenty (20) months to June 2003.

The rest of the vehicles are now owned by the Corporation having been bought through leasing arrangements with various financiers.

STATUS

The four (4) Corporation owned vehicles were valued and sold by tender to outgoing sta? of the CorporatiOn early this year. The maroon Toyota hilux 4wd ute was sold for K20, 000. The Carina sedan was to have been transferred to the new owner on 7?!1 February 2002 but was discovered missing from the Pacific Place carpark. The loss is now the subject of an insurance claim.

The Toyota ute 2wd will be sold for K3, 000 while the bus is being transferred to the Fund for K9, 000.00. Market valuations are appended.

Tenders were called for the four leased vehicles and the short listed bids form part of this paper for the Board?s deliberations.

TENDER Tender notices were published in the two daily newspapers for three (3)

-

Page 31 of 181

-

days from 27fh February to 15: March. Fifty ?ve (5 5) bids were received of

69

which six (6) have been selected as genuine bids on the basis that the prices are close to the payout price quoted by Credit Corporation.

As of this month, the payout price for the four vehicles will be broken down at landcruiser two hilux utes at K68, 000. 00 each and the last one at 72,000. 00.

5. GENUINE BIDS

Six bidders appear to be genuine are listed hereunder:?

Mdej Landcruiser 1117M

Sir Pato Kalcaraya K190, 000.00 K70, 000 each for all

Amon Nelson K190, 000. 00 K70, 000 each for all

Robert Enga 70, 000. 00

Waimen Kwale 70, 000. 00

Jim Kendi – K65, 000 each for two only

Chris Kopyoto K65, 000 each for all

6. RE OMMENDA I 0N

That the Board note this paper and authorize the Corporate Manager to sell the four (4) leased motor vehicles at the best price obtainable to whoever that comes up with the ?nance first

A copy of the submission is attached and marked as Exhibit ?107? in the Appendices to this report.

The following may be the registration of the three Toyota Hilux utes referred tothe unavailability of records, I am unable to ascertain or con?rm information as to the registration of the vehicles or as to which persons the three Toyota utes were sold to, or if public tender procedures were observed. However in general, I have heard evidence from John Ruimb and Chris Gideon that the vehicles referred to in this TOR were sold through public tender with Board approval.

70

-

Page 32 of 181

-

4.5.9

In the absence of any evidence to the contrary, I ?nd that proper public tender procedures were followed to in the sale of the three Toyota Hilux Utilities.

Sale of Properties

Whether there was any failure to comply with prescribed tender procedures in connection with

Sale and disposal of properties including those commonly known as Sea Park Apartments, Credit House, Monian House and Ilirno Farm.

The sale of properties and Ilimo are covered under Chapters 4.6 and 4.7 respectively of my Report.

4.5.10 Other Cases of Tender Procedures not followed

4. 5.1 0.1 The Engagement of Property Managers: Port Moresby First National Real

Estate.

By the time Mr Ruimb was re?appointed as Managing Director of the Corporation in August 1999, the Corporation had disposed of all its major investment properties while the Fund retained four (4) of its major properties.

A Board submission dated September 2000 was prepared by the Deputy Managing Director regarding contracts on property management awarded to revealed that this real estate company was also contracted to manage other properties belonging to the Fund and the Corporation and that due process was not followed in most cases. The submission read as follows:-

BACKGROUND

As at the end of 1997, the Investment Corporation of Papua New Guinea (ICPNG) and the Investment Corporation Fund ofPapua New Guinea the Fund) owned the following commercial and residential investment properties either directly or through wholly owned subsidiary companies:

a) Investment Corporation ofPapua New Guinea

Property Description Owned By ANG House 12 Level O?ice Complex ICPNG (ii) Cascade Apts 6 Level 15 Unit Apts Cascade Apts

Investment Hans 10 Level O?ice Complex ICPNG

b) Investment Corporation Fund ofPapua New Guinea

-

Page 33 of 181

-

71

Property Description Owned By (2) Mana Matana Apts 12 Level Off Complex

(ii) Paci?c Building O?ice Complex Nowra No.8 td

Sea Park Apartments Residential Sea Park td

(iv) Sunset Apartments Residential Sunset Apts

Yandama Townhouses Residential Yandama dg Co.

During the year 1998 and first half of 1999, all of the properties listed under above as owned by ICPNG were sold.

Only one?) property listed under is owned directly by the Fund being Mana Matana Apartments, which was sold in April 2000.

The Corporation has no major investment property in its portfolio now whilst the Fund has four (4) investment properties.

PROPERTY MANA GEMEN CONTRA

Prior to the sale of some properties, the property management contracts of all properties listed above under (1) were awarded to Port Moresby First National Real Estate Limited.

The tendering procedure and selection appears highly questionable. All of the remaining commercial investment properties are managed by Pom First National Real Estate Limited. These prOperties are

1. Pacific Building 2. Sea Park Apartments 3. Sunset Apartments

4. Yandama Townhouses

Pacific MMI and Sea Park Apartments have separate property management Agreements between the respective property owning subsidiary companies and Pom First National Real Estate Limited.

The Agreements are for a term of three (3) years commencing in May 1999. The ICPNG executed another Agreement on 26th May 1999 between itself and Porn First National Real Estate Limited in an e??ort to consolidate and strengthen the respective Agreements between the

72

-

Page 34 of 181

-

respective property owning subsidiary companies and Pom First National Real Estate Limited.

ICPNG was required under that Agreement to cause its subsidiaries to observe the terms of the Agreement as if they themselves had executed it.

Sunset Apartments Limited and Yandama Trading Limited do not have separate property management Agreements as the other two mentioned above. They are not even specifically mentioned in the Agreement with ICPNG.

There however, exists a one (1) page endorsement, which purports to give management rights to Pom First National Real Estate Limited.

On the basis of that endorsement, Pom First National Real Estate Limited manages the two (2) properties.

LEGAL AD VISE

Following the change of Board and Management at I CPNG in September 1999, a legal review of the contracts were sought from Blake Dawson Waldron Lawyers. Refer copy of Acting Managing Directors letter of 26th November attached herewith

Blake Dawson Waldron Lawyers provided the review advise through their letter of 9m December 1999 to be tendered separately A copy of which is attached herewith.

In summary, Blake Dawson Waldron Lawyers advise that:

Property Management Contracts relating to pacific MMI Building and Sea Park Apartments may be legally binding.

(ii) The endorsement for the Management of Yandama and Sunset Apartments is no; effective (void).

There is therefore no Agreement in relation to the Management of Sunset and Yandama.

CON CL USION

The awarding of all property management contracts to only one property management company is without proper justifiable basis.

The tendering procedure and selection remains questionable. The process

appears to have been rushed and contracts executed prior to the eminent change of’Government in July 1999.

73

-

Page 35 of 181

-

Whilst the review of the Agreements were undertaken in December 1999, Management opted to shelf his matter for a while in view of ongoing investigations and considering the high number of legal matters being run by I CPN at that time. The I CPN Board was advised accordingly.

The Board at its meeting held on Wednesday 19th July 2000 resolved to consider the legal review on the property management contracts at its next meeting, hence this paper discusses the review.

Since the contracts relating to Pacific Building and Sea Park Apartments may be legally binding, they should remain as is.

However, legal advise is that the endorsement for the management of Sunset and Yandama is n_ot e??ective.

ICPNG has two (2) options:

Option 1 Advise Pom First National Real Estate Limited that the endorsement for the management of Sunset and Yandama is n_ot e?ective (void) and that there is no contract, hence they should cease providing property management services and vacate premises.

Option 2Initiate legal proceedings to get the Court to declare the endorsement not e?ective (void) and that there is no contract.

RE OMMENDA I 0N

It is recommended that the Board consider and resolve to approve either of the above two (2) Optional course of action

A copy of Board Submission dated 1St September 2000 is attached and marked as Exhibit ?102? in the Appendices to this report.

In board meeting number 136/2000 held on the 8th September 2000 (Exhibit the Board noted that legal advise was obtained advising that the property management contract awarded to for the management of Sunset and Yandama Apartments were void and could be terminated. The Board then resolved to terminate the service of as the property manager from Yandama and Sunset Apartments.

On the 1311? December 2001 the Board met again in meeting number 137/2000 (Exhibit in which the minutes capture the following:

?13 7/00/3 Property Management Contracts

Investment Manager presented the paper where he informed the Board that

-

Page 36 of 181

-

based on legal advise, Management has since mid November, 2000 terminated

74

the services of the contract property manager for the Fund?s four (4) properties. This function is now brought in?honse and Management is now recruiting a Building Manager for the Pacific MMI Building. The three (3) residential properties will continue to be managed

Accordingly I ?nd that the following properties, prior to their disposal between 1998 and 2000, were managed by

Investment Haus 10 level of?ce complex ANG Haus 12 level of?ce complex Cascade Apartments 6 level unit apartments

Mana Matana Apartments 12 level of?ce complex

I have found that public tender procedures were not followed in awarding the management contract of these properties to

The following investment preperties of the Fund were also managed by as evidenced from a Property Management Agreement.

NIC Hans

Sea Park Apartments Sunset Apartments

Yandama Apartments

On the 26th May 1990, the Corporation executed a Management Agreement with That agreement was for the management of Sea Park Apartments and NIC Haus for a term of three years respectively. The same agreement also had an endorsement for the agreement to cover Sunset Apartments and Yandama Apartments which was to be effective as of 15t of August 1999. However, there appears to be serious legal implications in regard to the applicability and the validity of the endorsement.

No proper tender procedures were followed by the Management and Board of the Corporation in calling for public tenders and screening of bids for the management of the four (4) Fund properties.

There is no record of a Board Submission recommending the engagement of There are also no Board minutes in relation to awarding of management contracts to I ?nd therefore that there was no Board approval for the engagement of

’75

-

Page 37 of 181

-

A copy of the Property Management Agreement referred to which was executed on the 26Lh May 1990 between and the Corporation is attached and marked as Exhibit ?103? in the Appendices to this report.

On engagement of an amount of was paid as commission to for the purported sale of Ilimo. However, I have noted in my report on Ilimo that was not involved in the negotiation and there was no sale of llimo. Therefore I have found that the payment made to be improper and illegal. I recommend that the IPBC should persue recovery. For further details refer to Chapter 4.7 of my Report.

4. 5.10.2 The Engagement of Kincorp

During the restructuring phase of the Corporation, the Board resolved to abolish the Finance and Personnel Administration Division and retrenched all staff in that division. The management and Board opted to outsource the Corporation?s accounting functions. This resulted in the idea of the forming of Kincorp. This was ?rst considered by the Board in meeting number 130/99 (Exhibit held on the 18th March 1999. The Board made a resolution to refer the outsourcing of the accounting function as a matter for the sub-committee to consider with the intention to create a subsidiary company called Kincorp.

The establishment of Kincorp was purposely to takeover the accounting functions of the Corporation and the Fund which was initially performed by the Corporation?s ?nance division.

Kincorp commenced operations in May 1999 by subleasing of?ce space within the Corporation?s of?ce. The contracted cost of the outsourcing was per annum for three (3) years with the option to renew. The decision to outsource was considered sound in view of the annual cost of envisaged to be saved. A copy of the Board Submission containing the information paper on Kincorp dated 22? June 1999 is attached and marked as Exhibit ?104? in the Appendices to this report.

The report ?om PEIL Final Corporate Managers Report on the Corporation to IPBC dated in May 2004 (Exhibit at page 13) reports that:

?Kincorp was appointed by the Wandi Yamana management team in 1999 to provide accounting services to the Corporation following the outsourcing of the in?house accounting ?mctions.

The decision to outsource the ICPNG accounting ?mction was part of the Corporations? rationalization programme. However, the appointment of Kincorp Limited was not done through the normal public tender as required.

Mr. Fred Angoman, former Financial Controller for ICPNG, prepared and submitted a submission to the Board in its meeting No 13 0/99 seeking approval to establish Kincorp Limited to provide accounting services to ICPNG.

-

Page 38 of 181

-

76

The company was set and the shareholders of the company were and are as

follow:

Shareholder #Shares Held Fred Angoman

Associates 35, 000 35% Philip Eludeme 35,000 35% Wandi Yamuna 29,999 29%

I CPN 1

100, 000 100%

A company search at IPA showed that ICPNG holds only I share in Kincorp

In the late 1999, the Corporation ?5 board reviewed the appointment and decided to terminate it and appointed Price Waterhouse Coopers to provide the service.

The termination ofKincorp was on the basis that the manner in which it was set was improper and illegal. In fact the former managing Director, Mr. Wandi Yamuna had arranged to incorporate Kincorp and executed a 3 year contract to provide accounting services for ICPNG for a total contract value of K975, 000.00. This was done without the Board and Ministerial approvals.

Kincorp then instituted Court action against the Corporation for its termination claiming Klmillion in damages.

The case went to trial in 2002 and the National Court dismissed it. Plainti? has appealed the decision to the Supreme Court and the high Court is yet to make its ruling.

The appeal, however was dismissed by the Court on 29th April 2004 on grounds of failure to obtain the Section 61 approval under the Public Finance Management Act and that the advertisement for tender was a sham.

It is interesting to observe that the Corporation had only 1% shareholding in Kincorp while 99% was held by private individuals. Evidence was given by Mr. Fred

-

Page 39 of 181

-

Angoman on the 7th November 2006 that Mr.Wandi Yamuna held shares on behalf of the Corporation in trust and that trust instruments were drawn and executed. Mr.Yamuna also gave evidence that he held shares in trust for the Corporation and

77

that he had signed instruments (Transcript page 1011). However, I have not found documentary evidence of the trust instruments to support the evidence of Mr. Yamuna and Mr. Angoman.

The engagement of Kincorp was terminated ahnost three (3) months after it was set up when there was a change in the management with John Ruimb as the new acting Managing Director. The termination of Kincorp was primarily based on the ground that the three principals of Kincorp Ltd: Fred Angoman; Mr Yamuna; and Philip Eludeme were non?registered practicing public accountants at the time as required under the Accountants Registration Act of PNG.

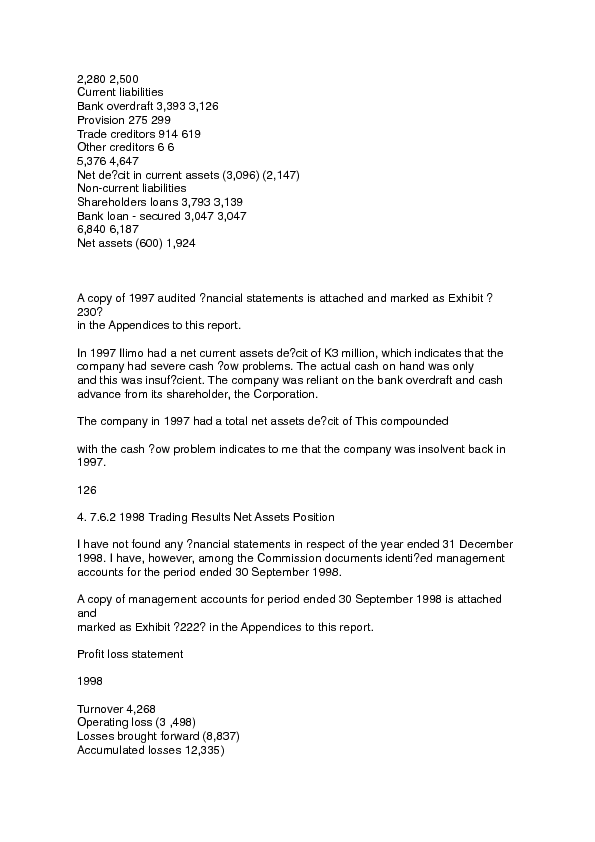

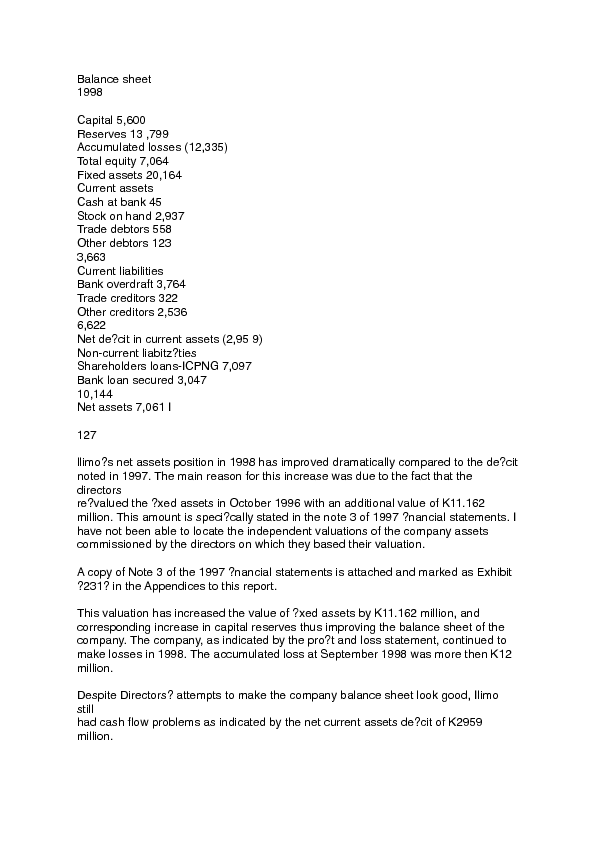

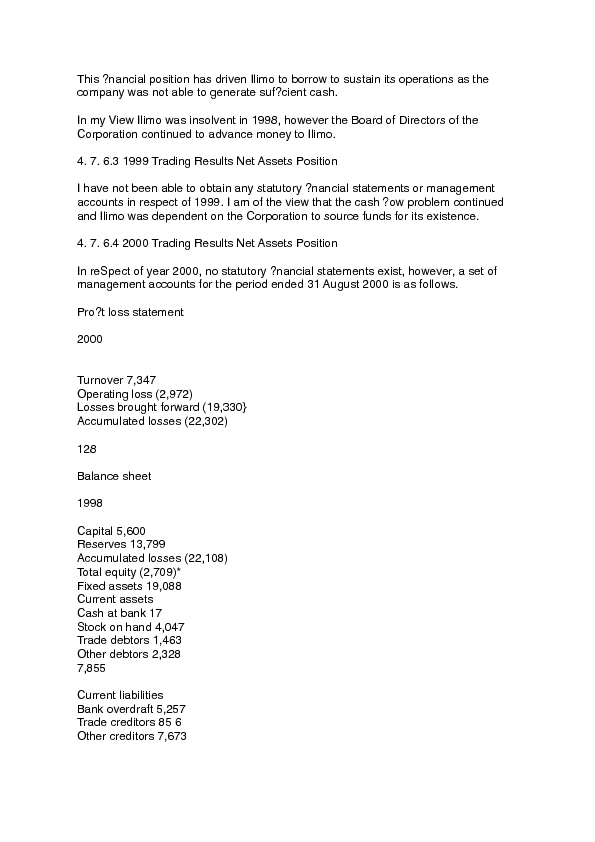

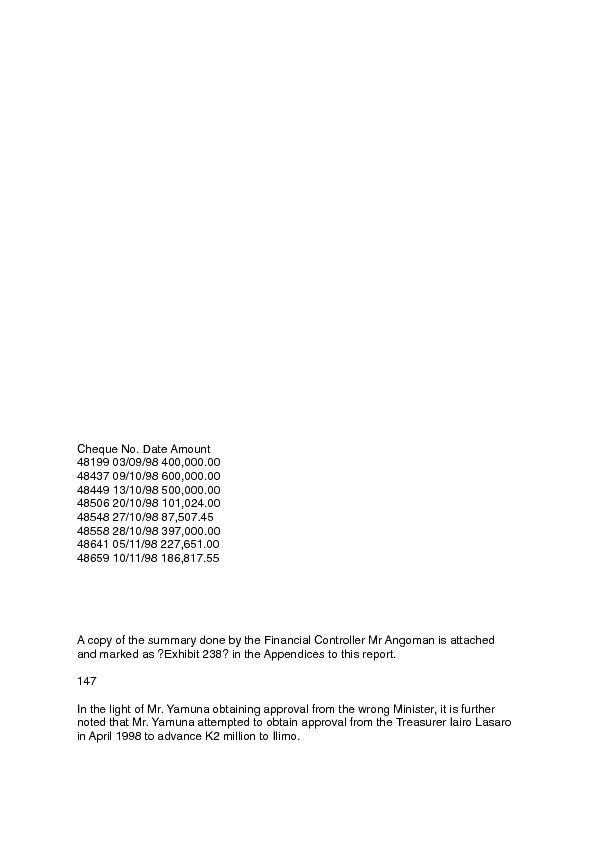

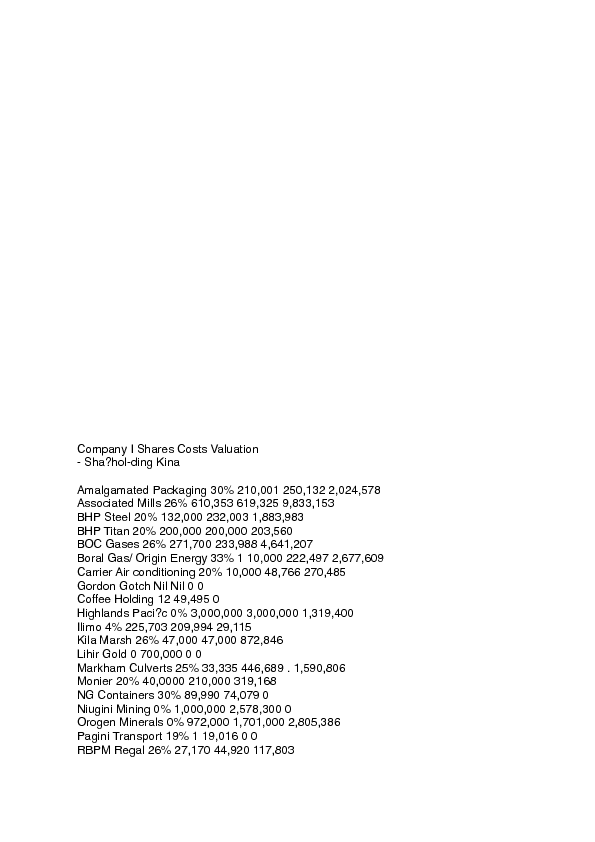

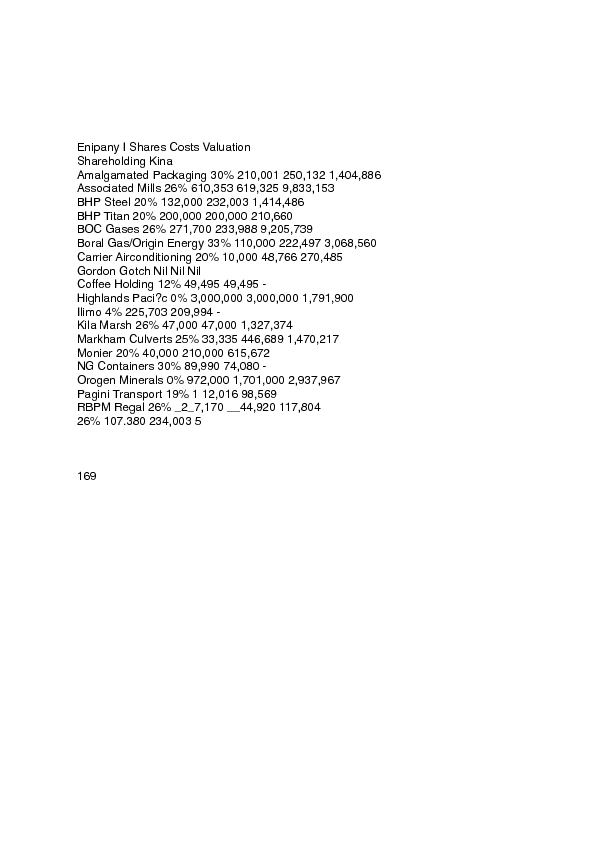

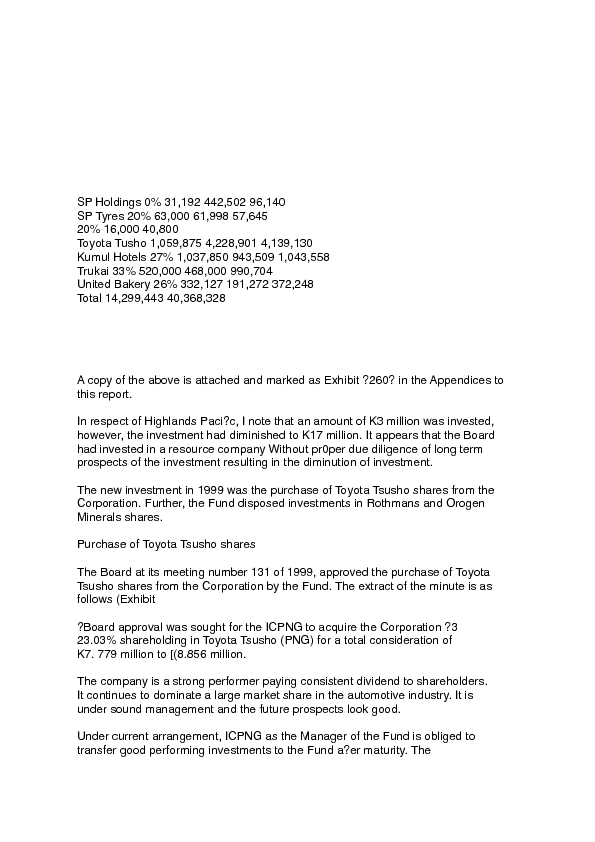

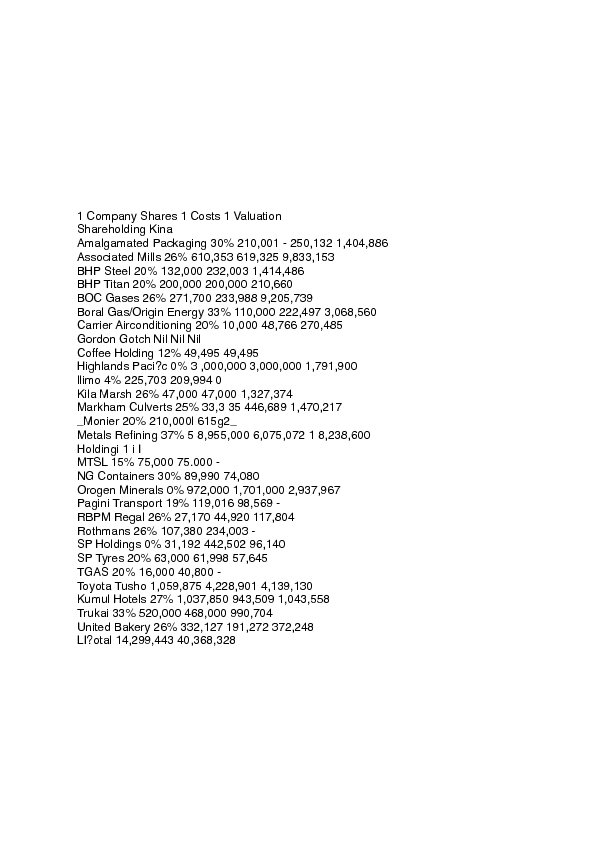

Thereafter, the Board in meeting number 132/99 held on the 28’11 October 1999 (Exhibit noted the termination of Kincorp?s services and resolved to accept the management?s recommendation to award the Accountancy Support Services Tender