Public Accounts Committee Inquiry into the Public Curator’s Office – Volume 1

Mentions of people and company names in this document

It is not suggested or implied that simply because a person, company or other entity is mentioned in the documents in the database that they have broken the law or otherwise acted improperly. Read our full disclaimer

Document content

-

PUBLIC ACCOUNTS COMMITTEE

INQUIRY INTO THE OFFICE OF THE PUBLIC CURATOR

REPORT TO NATIONAL PARLIAMENT

VOLUME 1.

CONTENTS

CONTENT PAGE

INTRODUCTION 7

EXECUTIVE SUMMARY 7

CHRONOLOGY 11

LIST OF ABBREVIATIONS 12

THE INQUIRY 13

COMPOSITION OF THE COMMITTEE 13

LITIGATION 14

JURISDICTION AND PURPOSE OF THE INQUIRY 16

JURISDICTION 17

The Constitution of the Independent State of Papua New Guinea 17

The Public Finance (Management) Act 18

Permanent Parliamentary Committees Act 19

-

Page 2 of 104

-

PURPOSE OF THE INQUIRY 19

THE AUTHORITY TO REPORT 19

THE AUTHORITY TO REFER 20

METHOD OF INQUIRY 21

RELEVANT STATUTES 21

Public Finances (Management) Act 21

Financial Instructions 22

Organic Law on the Duties and Responsibilities of Leadership 22

Audit Act 23

Permanent Parliamentary Committees Act 1994 23

Parliamentary Powers and Privileges Act 1964 23

Public Curator Act 1951 23

Wills and Probate Administration Act 1966 23

Insolvency Act 1951 23

Public Health Act 24

FISCAL RESPONSIBILITIES OF THE GOVERNMENT 24

RESPONSIBILITIES OF THE AUDITOR GENERAL 24

OFFICE OF THE PUBLIC CURATOR – FUNCTIONS AND POWERS 25

INQUIRY BY AND REPORT OF THE AUDITOR GENERAL 27

FINDINGS OF THE AUDITOR GENERAL 30

2

-

Page 3 of 104

-

RECOMMENDATIONS OF THE AUDITOR GENERAL 34

General Recommendations 34

Short Term Recommendations 35

Longer Term Recommendations 37

RESPONSE BY THE PUBLIC CURATOR 37

SPECIFIC ALLEGATIONS AND FINDINGS BY THE PUBLIC ACCOUNTS

COMMITTEE 38PUBLIC CURATOR’S OFFICE STAFFING 38

Auditor General’s Findings 38

Response of the Public Curator 40

Findings of the Public Accounts Committee 41

INTERNAL CONTROLS 42

Report of the Auditor General 42

The Response of the Public Curator 44

The Evidence 44

Findings of the Public Accounts Committee 45

PUBLIC CURATOR’S OFFICE OPERATIONAL FUNDING 45

Findings of the Auditor General 45

Response of the Public Curator 46

The Evidence 47

Findings of the Committee 50

3

-

Page 4 of 104

-

CHARGES BY THE PUBLIC CURATOR 51

Findings of the Auditor General 51

Response of the Public Curator 53

Evidence Before the Committee 54

Findings of the Public Accounts Committee 53

EXPENDITURE FROM ESTATE TRUST ACCOUNT 55

Report of the Auditor General 55

Response of the Public Curator 56

Findings of the Public Accounts Committee 56

PUBLIC CURATOR’S OFFICE ACCOUNTS AND RETURNS 57

Report of the Auditor General 57

Public Curator’s Response 57

Evidence Before the Committee 58

Findings of the Public Accounts Committee 58

BANK ACCOUNTS AND INVESTMENTS 58

REPORT OF THE AUDITOR GENERAL 58

INVESTMENT WITH FINANCE CORPORATION LIMITED 59

INVESTMENTS IN TREASURY BILLS 61

SAVINGS ACCOUNTS 62

INSOLVENCY ACCOUNT 63

ARREARS SETTLEMENT TRUST ACCOUNT 64

4

-

Page 5 of 104

-

CORPORATE TRUST ACCOUNT 66

SYSTEMS AND RECORDS 68

Report of the Auditor General 68

Response of the Public Curator 69

The Evidence 70

Findings of the Public Accounts Committee 70

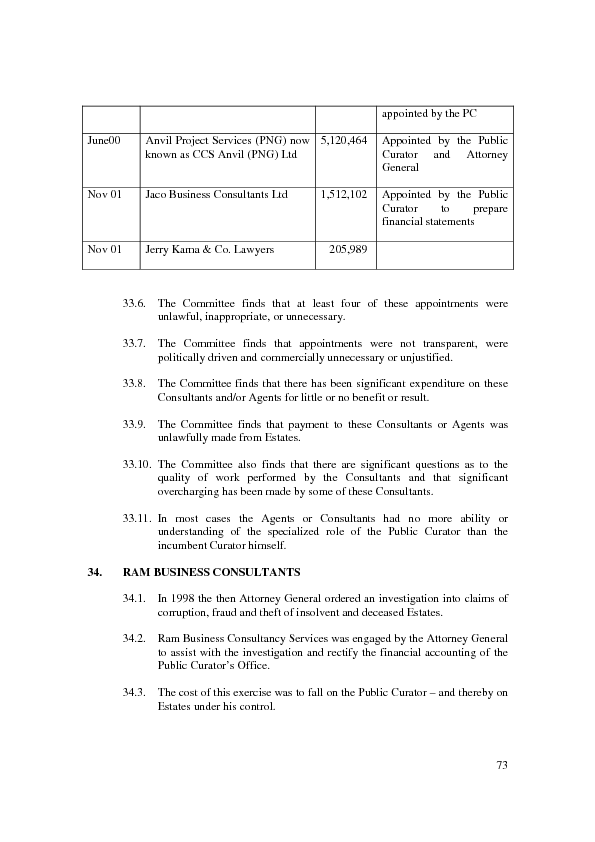

EXTERNAL CONSULTANTS AND AGENTS 71

RAM BUSINESS CONSULTANTS 73

L.J. HOOKER 75

JACO BUSINESS CONSULTANTS 76

ANVIL PROJECT SERVICES 78

INAPPROPRIATE FINANCIAL TRANSACTIONS 80

FINDINGS OF THE AUDITOR GENERAL 80

FRAUDULENT CONDUCT BY EMPLOYEES OF THE PUBLIC CURATOR’S

OFFICE AND THIRD PARTIES 81RESPONSE OF THE PUBLIC CURATOR 87

FINDINGS OF THE PUBLIC ACCOUNTS COMMITTEE 87

TST SUPERMARKETS 88

Report of the Auditor General 88

Response of the Public Curator 88

Findings of the Public Accounts Committee 88

LEGAL ACTION BY BENEFICIARIES 89

5

-

Page 6 of 104

-

FINDINGS 89

OTHER ISSUES 89

PUBLIC OFFICERS SUPERANNUATION (POSF) 89

ESTATE PROPERTY MANAGEMENT 90

FINDINGS 90

POTENTIAL LIABILITY OF THE STATE 97

FINDINGS BY THE PUBLIC ACCOUNTS COMMITTEE 93

RESOLUTIONS AND RECOMMENDATIONS OF THE PUBLIC ACCOUNTS 97

COMMITTEEREFERRALS BY THE PUBLIC ACCOUNTS COMMITTEE 99

CONCLUSION 102

LIST OF WITNESSES – LIST OF WITNESSES 103

SCHEDULE 2 – LIST OF DIRECTIVES AND SUMMONSES 103

SCHEDULE 3 – DOCUMENTARY EVIDENCE BEFORE THE COMMITTEE 103

6

-

Page 7 of 104

-

PUBLIC ACCOUNTS COMMITTEE

INQUIRY INTO THE OFFICE OF THE PUBLIC CURATOR

REPORT TO NATIONAL PARLIAMENT

VOLUME 1.

1. INTRODUCTION

1.1. On the 13th April 2005 the Permanent Parliamentary Committee on Public

Accounts commenced a long running Inquiry into the operations of the

Office of the Public Curator.1.2. On the 1st March 2006 the Public Accounts Committee concluded the

Inquiry into the Office of the Public Curator.1.3. As a result of evidence taken in this Inquiry, the Public Accounts

Committee has made findings which were highly critical of the

performance of the Office of the Public Curator over many years. In

particular, the Public Accounts Committee has identified incidents of

fraud and criminal conduct, mismanagement of Estates, breach of trust and

breach of fiduciary duties on the part of the Public Curator and his Agents,

Contractors or Consultants.1.4. As a result of evidence and documents tendered to the Inquiry, the Public

Accounts Committee makes referrals of various persons for further

investigation and possible prosecution for breaches of their statutory

obligations.1.5. As a result of evidence and documents tendered to this Inquiry, the Public

Accounts Committee unanimously resolved to make a full and complete

Report of its Inquiry and findings to the National Parliament in accordance

with Section 17 of the Permanent Parliamentary Committees Act 1994

and 86(1) (c) and (d) Public Finances (Management) Act 1995.1.6. The Public Accounts Committee now tables the Report with strong

recommendation that remedial action be immediately taken by the

Government in accordance with findings and resolutions of the Public

Accounts Committee.2. EXECUTIVE SUMMARY

7

-

Page 8 of 104

-

2.1. The Office of the Public Curator is a national disgrace.

2.2. 19,600 Estates remain unresolved – some for more than 15 years.

2.3. 680 properties remain under trust – many for years with no resolution of

Estates.2.4. Over 700 properties have been mishandled or cannot be found or

accounted for.2.5. The history of the Office of the Public Curator over the last decade, shows

a disregard of the requirements of Law by managers and staff of the

Office, a failure to carry out statutory duties, a clear failure to understand

or implement the basic duties of a Trustee, instances of theft and fraud by

staff and third parties and an almost total failure of the Office to keep,

submit or understand accounts and financial Reports.2.6. The failure of the Office of the Public Curator has been contributed to by

failures of successive Governments to adequately or properly fund and

resource the Office.2.7. The failure of the Office of the Public Curator to attend to its duties and

properly and lawfully service Estates may have exposed the State to

significant liability.2.8. Monies allocated to the Office of the Public Curator by Government have

been misused and misapplied by the Public Curator and the Office of the

Attorney General.2.9. Estate monies, property and assets have been misused and misapplied by

the Public Curator and the Office of the Attorney General.2.10. The Public Curator has failed to lawfully retain Agents and Consultants to

the detriment of Estates and the liability of the State.2.11. The Public Curator and the Secretary for the Department of Justice and the

Attorney General have failed to lawfully appoint Agents, Consultants or

Contractors, paid those Contractors, consultants or Agents unlawfully,

failed to supervise or control those Contractors and wrongfully applied

Trust Monies to pay Contractors or Agents.2.12. Despite very considerable expense to Estates, there is little (if any) lasting

benefit from those Consultants and Agents.2.13. Trust monies are mixed between various accounts with no hope of

reconciling what money is owed to which Estate. The ability to trace trust8

-

Page 9 of 104

-

monies and assets is a basic duty of any Trustee. It has not been met by the

Public Curator.2.14. The Public Curator, the Attorney General and the Secretary for Justice

have failed to take action to recover property, money and assets

unlawfully detained or withheld by Consultants, Contractors or Agents to

the Public Curator.2.15. Estates have been overpaid or are owed large amounts of untraceable

money. The State may well be liable for these failures.2.16. The Public Curator has made unauthorized investments of Estate monies

and has failed to pay money back to Estate accounts or to maintain such

records as would enable that money to be paid to identified Estates.2.17. The Public Curator has unlawfully applied Estate monies to Operational

and administrative costs.2.18. The Public Curator has overcharged Estates for administration costs.

2.19. The Public Curator has created a deficiency in Estates of millions of Kina,

which the State may be liable to pay.2.20. The Public Curator, the Attorney General and the Secretary for the

Department of Justice have failed to take recovery action on behalf of

Estates against Agents, Contractors, Consultants and other entities to

recover money that was wrongly paid.2.21. The Public Curator and/or the Attorney General have failed to seek or

enforce an account from Consultants, Agents or Contractors to the Public

Curator, of all monies had and received by those entities for or on behalf

of the Public Curator or individual Estates.2.22. The Office of the Public Curator has failed to take reasonable care and use

due diligence to protect Estates under his management.2.23. Public Curators, past and present, have failed to understand or comply

with the obligations of a Trustee.2.24. Public Curators past and present have failed to take any or any adequate

care to identify, secure, preserve or realize monies, bank accounts, shares,

property and real estate assets of Estates.2.25. Public Curators have, in various ways, breached the terms of the Public

Curator Act and Regulations, Insolvency Act, and the Health Act.9

-

Page 10 of 104

-

2.26. Public Curators and Attorneys General, past and present, have failed to

comply with the terms of the Public Finances (Management) Act and the

Financial Instructions.2.27. Attorneys General have failed to account for or refund monies removed or

used from Estates.2.28. Consultants, Contractors and Agents have failed to account for or remit

monies received from Estates.2.29. Attorneys General, Secretaries for Justice and the Government have failed

to heed or action warnings and reports concerning the state of the Office

of the Public Curator.2.30. The Office of the Public Curator has failed to follow up and to commence

recovery action in respect of monies fraudulently taken from Estates.2.31. The Public Curator has failed to implement or maintain internal control

and accounting systems.2.32. The Public Curator has failed to give service to any acceptable level to

beneficiaries and Estates for many years and responds only to threats or

Court Action.2.33. Beneficiaries have been deprived of their entitlements by the failures of

the Public Curator.2.34. The Public Curator has failed to remit monies to Consolidated Revenue as

required.2.35. The Public Curator has failed to make Financial Reports as required.

2.36. Management, oversight, accountability and basic performance standards

are entirely lacking in the Office of the Public Curator with a resultant

lack of public confidence in the Office.2.37. Urgent action is required to restore any credibility to the Office of the

Public Curator.2.38. The Committee commends the findings and recommendations made in

this Report, in the Report of the Auditor General and by the Office of the

Public Curator itself, as a basis for rebuilding the Office of the Public

Curator.2.39. The Government must move to establish a method whereby aggrieved

persons can have their entitlements quickly assessed and paid.10

-

Page 11 of 104

-

2.40. The Government must, as a matter of urgency, establish an Inquiry to

investigate and conclude on the likely extent of State liability arising from

failures of the Office of the Public Curator.2.41. The State must then make provision to meet its liabilities to Estates and

beneficiaries.2.42. Interim Trustee arrangements must be quickly established to take control

of the Office of the Public Curator pending long term rebuilding.2.43. The Statutes under which the Public Curator operates must be modernized

and a long term, credible trustee arrangement be established.2.44. Urgent recovery action must be taken to recover monies identified by the

Auditor General and this Committee, as wrongly withheld or removed

from Estates.2.45. The Public Curator and his management team should be replaced by

competent, experienced interim trustees – possibly from POSF or

Nasfund.2.46. The Government should recruit, by domestic and International

advertisement, a competent and experienced Public Curator and

management team experienced in Trustee obligations and accountability to

rebuild the Office of the Public Curator.2.47. Certain further findings are made by the Public Accounts Committee. See

Para 45.2.48. Certain further recommendations are made by the Public Accounts

Committee. See Para 46.2.49. Certain Referrals for Investigation and possible prosecution are made by

the Public Accounts Committee. See Para 47.3. CHRONOLOGY

3.1. The Public Accounts Committee commenced its Inquiry into the Office of

the Public Curator on the 13th April 2005.3.2. The Inquiry again convened on the 28th November 2005.

3.3. The Inquiry again convened on the 1st March 2006 and finished on that

day.11

-

Page 12 of 104

-

3.4. On the 13th April 2005 the Public Accounts Committee directed the Office

of the Auditor General to conduct a Special Audit of the Office of the

Public Curator.3.5. The Public Accounts Committee requested the Public Curator give full

and complete assistance to the Auditor General in the performance of that

Audit.3.6. The Office of the Auditor General considered this request to be of interest

to the general public and directed that, in accordance with Section 8 (2) of

the Audit Act, the investigation be undertaken in accordance with the

Terms of Reference given by the Committee. These Terms of Reference

are recorded in Para. 15.9 of this Report.3.7. The Office of the Public Curator complied adequately with the request, but

failed to produce many documents and records to the Auditor General3.8. The Office of the Auditor General complied with the request and produced

a detailed Special Audit Report.3.9. An Auditor General’s Report on the Special Audit Investigation of the

Office of the Public Curator was completed and delivered to the Public

Accounts Committee on the 1st November 2005. A copy of that Report is

contained in Volume 2 of this Report.3.10. A copy of the Audit Investigation Report was delivered to the office of the

Public Curator for perusal and response. The Public Curator delivered a

Response to the Special Audit Investigation Report on the 28th day of

November 2005. That Response is also contained in Volume 2 of this

Report.3.11. The Public Accounts Committee has given careful consideration to both

the Report of the Auditor General and the Response from the Public

Curator4. LIST OF ABBREVIATIONS

Anvil Anvil Project Services Ltd.

CSTB Central Supply and Tenders Board

Jaco Jaco Business Consultants Ltd.

PF (M) A Public Finances (Management) Act

12

-

Page 13 of 104

-

PAC Public Accounts Committee

The Committee The Public Accounts Committee

The Constitution The Constitution of the Independent State of Papua

New GuineaThe National Court The National Court of Justice of Papua New Guinea

The Public Curator The Office of the Public Curator

Agent or Agents means an Agent of the Public Curator appointed by

the Public Curator or the Attorney General.5. THE INQUIRY

COMPOSITION OF THE COMMITTEE

5.1. The Public Accounts Committee which sat and made Inquiry into the

Department of Lands and Physical Planning was constituted as follows:13th April 2005:

1. Hon. John Hickey MP – Chairman

2. Hon Michael Maskal MP – Member.

3. Hon Tony Aimo MP – Member

4. Hon. Dr. Bob Danaya MP – Member

5. Hon. Sasa Zibe MP – Member

6. Hon Ekis Ropenau MP – Member

28th November 2005:

1. Hon. John Hickey, MP – Chairman

2. Hon. James Togel, MP – Member

3. Hon. Michael Mas Kal, MP – Member

4. Hon. Dr. Bob Danaya, MP – Member

13

-

Page 14 of 104

-

5. Hon. Dr. Allan Marat, MP – Member

1st March 2006:

1. Hon. John Hickey, MP – Chairman

2. Hon. Chris Haiveta, MP – Deputy Chairman

3. Hon. John Vulupindi, MP – Member

4. Hon. Sasa Zibe, MP – Member

5. Hon. Michael Mas Kal, MP – Member

6. Hon. Dr. Bob Danaya, MP – Member

7. Hon. Malcolm Smith Kela, MP – Member

5.2. Also present at the Inquiry were Officers of the Public Accounts

Committee, Officers of the Auditor General’s office, Officers of the

Department of Finance and the following Officers of the Public Curator:1. Mr Paul Wagun – Public Curator

2. Mr Theodore Bukikun, Regional Public Curator (Southern Region)

3. Mr Vuatha Leva – Regional Public Curator (Highlands Region)

5.3. The Chairman, Deputy Chairman and Members of the Committee were

properly and lawfully appointed and empowered to sit as a Public

Accounts Committee.6. LITIGATION

6.1. The Auditor General’s Report on the Special Audit Investigation of the

Office of the Public Curator contained certain findings against Contractors

and/or Agents retained by the office of the Public Curator.6.2. One of those Consultants was RAMS Business Consultants – a company

apparently owned and operated by a Rex Paki.6.3. On the 25th day of November 2005, Rex Paki and RAMS Business

Consultants obtained an ex parte Restraining Order from the National

Court of Justice.14

-

Page 15 of 104

-

6.4. That Order purported to restrain the Public Accounts Committee from

considering any part of the Report of the Auditor General into the Office

of the Public Curator which dealt with either RAMS Business Consultants

or its principal, Mr Rex Paki, upon the basis that neither party had any

opportunity to be heard in answer to the Report.6.5. Before this action was commenced, the Committee had extended the

opportunity to respond or appear to give evidence to Mr. Paki and RAMS.6.6. Attempted service of the Order was made on 28th day of November 2005.

That purported service breached Section 14 of the Parliamentary Powers

and Privileges Act 1964. That Section states:Section 14 SERVING OF PROCESS WITHIN THE PRECINCTS

(1) A person who, on a day in respect of which this Section applies,

and within the precincts of the Parliament –a) Serves, tenders for service or executes any Writ,

Summons, Warrant, Order or other process issued by or

with the Authority of any Court or otherwise in

accordance with any law; orb) …

is guilty of an offence;

Penalty: A fine not exceeding K400.00 or imprisonment for a term not

exceeding 6 months.(2) This Section applies in respect of –

a) …

b) A day fixed by a Committee of the Parliament to be a day on

which the Committee will sit.”6.7. The Committee has referred the Process Server to the Office of the

Speaker of the Parliament for prosecution in accordance with Section 39

of the Parliamentary Powers and Privileges Act 1964.6.8. On the 13th December 2005, the National Court of Justice refused to

continue or remake the Restraining Order. Her Honour Davani J. said;15

-

Page 16 of 104

-

“The Plaintiffs make no appearance. There is no restraining order in

place. The PAC should not be hindered from carrying out its lawful

activities and should do so”.6.9. The Public Accounts Committee continued with the Inquiry into the

Office of the Public Curator and concluded the Inquiry on the 1st March

2006.6.10. Neither RAMS nor Mr. Paki made any submission to the Committee.

7. JURISDICTION AND PURPOSE OF THE INQUIRY

INTRODUCTION

7.1. The Public Accounts Committee received a large number of very serious

allegations of misconduct leveled against the Office of the Public Curator

and its staff. Those reports and complaints extended over many years.7.2. The Committee considered that the Office of the Public Curator fulfills a

unique and highly important role in Papua New Guinea society.7.3. The Public Curator is a Trustee who is responsible for the administration

and finalization of the assets of, inter alia, deceased Estates and Estates of

persons under disability.7.4. By mid 2003 the Auditor General had provided reports and audits to the

Minister of Justice and Attorney General concerning the financial

statements of the Public Curator’s Office.7.5. This Report was tabled in Parliament and it was immediately evident that

the Auditor General was unable to determine the accuracy of virtually any

information recorded in the financial statements due to the chaotic state of

the Office of the Public Curator.7.6. The Auditor General identified significant failures in those financial

accounts, serious financial and administration problems and wide

mismanagement at all levels within the Office of the Public Curator, over

a long period of time.7.7. These conclusions were not new. The Committee notes that, in 1999, the

Auditor General was unable to provide any opinion as to the reliability of

financial statements and the 1999 Audit Report identified significant

shortcomings in record-keeping and control within the Office of the Public

Curator.16

-

Page 17 of 104

-

7.8. That the Government has failed to address these findings in the last five

years is unacceptable.7.9. As a result of these complaints and Reports, the Public Accounts

Committee resolved to request a Special Audit Investigation into the

Public Curator of Papua New Guinea, from the Office of the Auditor

General.7.10. The Public Accounts Committee received the Special Audit Report and

was so concerned at the findings, that the Committee deemed this Inquiry

into the Office of the Public Curator to be a matter of National interest

pursuant to Section 17 of the Permanent Parliamentary Committees Act

and commenced a two-day Inquiry into the state of that Office.7.11. At the conclusion of the Inquiry, the Committee resolved to report to the

National Parliament its Findings, Resolutions, Recommendations and

Referrals.7.12. At all times, the Committee has taken great care to enable all witnesses to

make full and complete representations and answers to any matter before

the Committee – in particular those matters about which the Committee

may make adverse findings against individuals or companies.7.13. The Committee received and considered submissions from JACO Ltd.,

L.J. Hooker Ltd. And Anvil (PNG) Project Services These documents are

presented in Volume 2 of this Report.7.14. The Public Accounts Committee has given careful consideration to all

responses and to all evidence given before the Committee.7.15. All evidence was taken on oath and full and due Inquiry was made of all

relevant State Agencies where the Committee considered those Inquiries

to be necessary.JURISDICTION

THE CONSTITUTION OF THE INDEPENDENT STATE OF PAPUA

NEW GUINEA7.16. The Committee finds its jurisdiction firstly, pursuant to Section 216 of the

Constitution of the Independent State of Papua New Guinea. That

Section reads:“216. Functions of the Committee

17

-

Page 18 of 104

-

(1) The primary function of the Public Accounts Committee is, in

accordance with an Act of the Parliament, to examine and report

to the Parliament on the public accounts of Papua New Guinea

and on the control of and on transaction with or concerning, the

public monies and property of Papua New Guinea”.(2) Sub-section (1) extends to any accounts, finances and property that

are subject to inspection and audit by the Auditor General under

Section 214 (2) … and to report by the Auditor General under that

Sub-section or Section 214 (3)…”.7.17. The Committee has taken care to restrict its Inquiry to an examination of

the control of and transactions with or concerning the public monies and

property of Papua New Guinea by the Office of the Public Curator and its

Officers.7.18. Whilst considering the relevant provisions of the Constitution, the

Committee has had regard to the Final Report of the Constitutional

Planning Committee 1974 and been guided by or applied the stated

intentions of that Committee wherever necessary.7.19. Whilst engaged in the Inquiry the Committee was guided by two

definitions contained in the Constitution, which are directly relevant to

Section 216 of the Constitution. They are:“Public Accounts of Papua New Guinea” includes all accounts, books

and records of, or in the custody, possession or control of, the National

Executive or of a public officer relating to public property or public

moneys of Papua New Guinea;”and

“Public moneys of Papua New Guinea” includes moneys held in trust by

the National Executive or a public officer in his capacity as such,

whether or not they are so held for particular persons;”THE PUBLIC FINANCES (MANAGEMENT) ACT 1995

7.20. The Public Accounts Committee also finds its jurisdiction to inquire into

the Office of the Public Curator in Section 86 of the Public Finance

(Management) Act 1995. That Section empowers the Committee to

examine accounts and receipts of collection and expenditure of the Public

Account and each statement or Report of the Auditor General presented to

the Parliament.18

-

Page 19 of 104

-

7.21. The Office of the Public Curator receives, spends, and is accountable for

public monies.7.22. The Committee has considered both accounts and receipts of public

monies as they have been made available by the Office of the Public

Curator and such Reports of the Auditor General as may have been

presented to Parliament.7.23. The Committee has further considered reports of the Auditor General

which have not yet been presented to the Parliament, on the basis that that

evidence was tendered by the Auditor General for the consideration of the

Committee and on the basis that such material is within the power of the

Committee to consider.7.24. Power to refer matters for investigation and possible prosecution is

granted to the Committee by Section 86A of the Public Finances

(Management) Act.PERMANENT PARLIAMENTARY COMMITTEES ACT 1994:

7.25. The Committee found further jurisdiction for the Inquiry in Section 17 of

the Permanent Parliamentary Committees Act.7.26. That Section provides that the Public Accounts Committee can consider

any matter of national importance, on its own initiative. The Committee,

as we have stated, considers the Office of the Public Curator to be such a

matter.PURPOSE OF THE INQUIRY

7.27. The Public Accounts Committee conducted this Inquiry to establish the

standard to which and the competence and honesty with which the Office

of the Public Curator has fulfilled its role as the Trustee of Estates – and

therefore its statutory position as the State appointed, funded and

accountable Trustee.7.28. The Public Accounts Committee conducted this Inquiry to establish

whether the Public Curator, in all its operations, complied with all lawful

requirements and, if not, to make recommendations for change.7.29. The Public Accounts Committee conducted this Inquiry to establish the

exact state of Estates managed by the Office of the Public Curator and the

liability of the State (if any) for failings within the Office of the Public

Curator.8. THE AUTHORITY TO REPORT

19

-

Page 20 of 104

-

8.1 The Public Accounts Committee finds authority to make this Report in

Section 17 of the Permanent Parliamentary Committees Act and Section

86 (1) (c) and (d) (i), (ii), (iii) and (iv) and (f) of the Public Finances

(Management) Act 1995.9. THE AUTHORITY TO REFER

9.1. Where satisfied that there is a prima facie case that a person may not have

complied with the provisions of the Constitution of the Independent State

of Papua New Guinea and / or the Public Finances (Management) Act

1995 in connection with the control and transaction with and concerning

the accounts of a public body or the public moneys and the property of

Papua New Guinea, it may make referrals of that person to the Office of

the Public Prosecutor in accordance with Section 86A of the Public

Finances (Management) Act.9.2. The Public Accounts Committee is not a true investigatory body capable

of investigating and/or prosecuting persons for breaches of the law. The

Committee is required to refer such matters to the appropriate authorities

and may make such recommendations as it thinks fit in relation to any

referral made pursuant to Section 86A of the Public Finances

(Management) Act 1995.9.3. The Committee is also empowered to refer for prosecution, any witness

who fails to comply with a Notice to Produce any document, paper or

book and / or any person who fails to comply with a Summons issued and

served by the Committee. See Section 23 Permanent Parliamentary

Committees Act.9.4. The Public Accounts Committee refers past and present Public Curators,

past and present Attorneys General and staff of the Office of the Public

Curator for investigation of the alleged failures to carry out their duties

and subsequent prosecution, should the investigating authorities adopt that

course.9.5. Those referrals were made after anxious consideration of the evidence and

explanations given by the Public Curator and other witnesses. These

parties were invited to make any response or show any reason why they

should not be referred, but have made no or no adequate response to the

Committee in this regard.9.6. The Committee knows that to make Referrals, particularly of senior Public

Servants is a very serious matter which may adversely reflect on the

individual concerned. These Referrals are not made lightly but only after

careful consideration and unanimous resolution of the Committee.20

-

Page 21 of 104

-

10. METHOD OF INQUIRY

10.1. The Inquiry by the Public Accounts Committee into the Public Curator

was a public hearing at which sworn evidence was taken from a small

number of witnesses. A list of witnesses is contained in Schedule 1 to this

Report.10.2. The Public Accounts Committee received a large number of documents

and reports. Those documents are listed in Schedule 3 of this Report and

are contained in Volume 2 of this Report.11. RELEVANT STATUTES

11.1. The Committee was required to consider the following Statutes during the

course of the Inquiry:PUBLIC FINANCES (MANAGEMENT) ACT 1995.

11.2. The Public Finances (Management) Act prescribes the method and

standard of the administration of and accounting for public monies, public

properties and assets by State entities in Papua New Guinea.11.3. Further, the Act imposes certain obligations on Public Servants for

collection of State revenue and controls the expenditure of State or public

monies.11.4. Relevant sections of the Act which were considered by the Public

Accounts Committee during the course of the inquiry into the Office of the

Public Curator are:(i) Section 5 – Responsibilities of Heads of Department

This Section prescribes the duties, powers and obligations of a Head

of Department.(ii) Section 3 – Responsibilities of the Minister

This Section prescribes the obligations and duties of relevant

Ministers of State.(iii) Part x – The Public Accounts Committee

This Part empowers and imposes functions and obligations on the

Public Account Committee. In particular, the Committee was

required to consider Section 86 (A) – power to refer officers of the21

-

Page 22 of 104

-

Public Curator to the Office of the Public Prosecutor for

investigation and possible prosecution relating to breaches of the

Public Finances (Management) Act 1995 and/or the Constitution.(iv) Part xi – Surcharge

This Section prescribes personal liability for certain public servants

who fail in their obligations to collect and protect certain public

monies.(v) Section 112 – Offences

This Section prescribes disciplinary action which may be taken

against certain public servants or accountable officers who fail to

comply with the terms of the Public Finances (Management) Ac

1995.FINANCIAL INSTRUCTIONS

11.5. Section 117 of the Public Finances (Management) Act 1995 enables

the promulgation of certain Financial Instructions which establish

detailed procedures for the handling, collection, expenditure, disposal of

and accounting for public monies, property and stores.11.6. The Public Accounts Committee had regard to these Financial

Instructions when considering the performance of the Office of the

Public Curator and its relevant responsible officers.11.7. In particular, the Committee had regard to:

Part 6 Division 1 Para. 2.1 – ACCOUNTABLE OFFICERS.

“…..the Departmental Head is liable under the doctrine of personal

accountability to make good any sum which the Public Accounts

Committee recommends should be “disallowed””.ORGANIC LAW ON THE DUTIES AND RESPONSIBILITIES OF

LEADERSHIP11.8. The Public Accounts Committee has had regard to this Organic Law in the

course of the Inquiry into the Office of the Public Curator. Certain

referrals and resolutions were considered within the terms of this Organic

Law and are more fully developed (infra).AUDIT ACT

22

-

Page 23 of 104

-

11.9. The Audit Act establishes and empowers the office of the Auditor General

to carry out its work of overseeing and supervising the handling of public

monies, stores and property by all arms of the National Government. The

Public Accounts Committee had regard to the terms of this Act during the

course of the inquiry into the Office of the Public Curator.11.10. The Committee received considerable assistance from the Office of the

Auditor General in the course of this Inquiry.PERMANENT PARLIAMENTARY COMMITTEES ACT 1994

11.11. The Committee has had regard to Section 17 of the Permanent

Parliamentary Committees Act 1994 during the course of the Inquiry into

the Office of the Public Curator.PARLIAMENTARY POWERS AND PRIVILEGES ACT 1964

11.12. The Parliamentary Powers and Privileges Act 1964 sets forth those

privileges and powers extending to Members of Parliament, Committees

of Parliament and Officers or Parliamentary Staff.11.13. In the course of this Inquiry, the Committee had cause to examine and

apply Sections 14 and 39 of that Act.` PUBLIC CURATOR ACT 1951

11.14. The Public Accounts Committee had given detailed consideration to the

Public Curator Act 1951. This Act establishes and empowers the Public

Curator in all its aspects of operation.11.15. The Public Accounts Committee had particular reference to Parts II, III, V

and VI of this Act.WILLS AND PROBATE ADMINISTRATION ACT 1966

11.16. The Public Accounts Committee had general regard to the terms of this

Act – as it deals with the Administration of deceased estates by the Public

Curator both intestate and testate.INSOLVENCY ACT 1951

11.17. The Committee had regard to the Insolvency Act 1951 where that Act

enables the Public Curator to act as a Trustee for Wills, Deeds of Trust

and other Trust Investments or to act as Executor, Distributor and

Administrator of deceased estates or Insolvent Estates.23

-

Page 24 of 104

-

PUBLIC HEALTH ACT Ch. 226

11.18. The Public Accounts Committee had regard to the terms of the Public

Health Act insofar as that Act appoints the Public Curator to act as trustee

or Manager of properties or affairs of persons certified insane, infirm, or

incapable of managing their own affairs.11.19. It is against this statutory background that the Public Accounts Committee

conducted this Inquiry.12. FISCAL RESPONSIBILITIES OF THE GOVERNMENT

12.1. The Government of Papua New Guinea is obliged to adequately fund and

resource the Office of the Public Curator.12.2. The Office of the Public Curator is accountable to the Office of the

Attorney General and this Committee concludes that the Office of the

Attorney General is responsible for ensuring adequate and proper funding

and resourcing of the Office of the Public Curator.12.3. This Committee finds that the Office of the Public Curator has been very

considerably under-financed and under-resourced for many years.12.4. The Committee finds that this failure by Government has and will result in

very significant exposure of the State to liability for mismanagement,

incompetence and corrupt conduct within the Office of the Public Curator.12.5. The Committee also finds that the Government owes a further obligation

to adequately and properly oversight and control the Office of the Public

Curator. Both the Department of Justice, the Attorney General and the

State have completely failed to fulfil this obligation.12.6. The Committee makes certain findings and Referrals in this regard, later in

this Report.13. RESPONSIBILITES OF THE AUDITOR GENERAL

13.1. The Auditor General is a Constitutional Office Holder and the duties and

responsibilities of that Officer are contained in the Audit Act 1989.13.2. The standard of the Reports of the Auditor General into the Office of the

Public Curator are found by this Committee to be both competent,

detailed and correct.

.

13.3. The Committee fully understands the severe staffing constraints attending

the Office of the Auditor General and will make recommendations in24

-

Page 25 of 104

-

respect of the funding and resourcing of that Office by the Government of

Papua New Guinea, to enable it to carry out its statutory duty in a

competent and timely manner.14. OFFICE OF THE PUBLIC CURATOR – FUNCTIONS AND POWERS

14.1. The Office of the Public Curator is established and operated under the

Public Curator Act 1951 (“the Act”). The major functions of the Public

Curator are:• Administration of deceased Estates both intestate and testate under

the Wills and Probate Administration Act 1966.• To act as agent or attorney for Estates.

• Act as Trustee under the Insolvency Act 1951 for Wills, Deeds of

Trust and other Trust Investments, and as an Executor, Distributor

and Administrator of deceased Estates;• Act as trustee for minors properties;

• Act as Official Trustee to administer Estates adjudged insolvent by

the National Court in accordance with the Insolvency Act 1951; and• Act as Trustee or Manager for the management of properties of

persons certified insane, infirm or incapable of managing their own

affairs under the Public Health Act 1973.14.2. The Public Curator’s office is located in Port Moresby with regional

offices in Rabaul, Lae and Mt Hagen.14.3. The Public Curator acts as Trustee and accepts all the onerous

responsibilities of a Trustee administering money and property of

deceased persons for the benefit of named and identified beneficiaries.14.4. The Public Curator also stands in a fiduciary relationship to the Estate and

its beneficiaries, with all the duties and obligations attending such a

relationship.14.5. The Committee finds that the Public Curator owes very strict obligations

to carry out the work of a Trustee in a lawful and efficient manner.14.6. The Committee considers that the position of Public Curator requires the

appointment of a person with highly specialized training, experience and

qualifications.25

-

Page 26 of 104

-

14.7. Moreover, that position and all staff positions within the Office of the

Public Curator require high standards of probity, accountability, analysis

and judgement by persons who hold those offices.14.8. This Committee finds that those attributes have been lacking for many

years.14.9. In order to carry out these obligations the Office of the Public Curator

requires sufficient trained and competent staff or trained and efficient and

honest contractors that possess the appropriate skills and experience to

undertake these responsibilities.14.10. This Committee finds that these skills and experience have been lacking

for many years.14.11. The skills required are legal, financial, accounting/management,

investment and property management, office support, public management

and capacity to deal quickly and honestly with property entrusted to the

Office.14.12. The Committee finds that the Public Curator also owes a moral and ethical

responsibility to beneficiaries and that the person holding the Office of

Public Curator must be trained and experienced in carrying out this highly

specialised statutory role, but has failed to meet those obligations.14.13. The Public Curator has the power to appoint Agents to carry out certain

functions – see Section 4 Public Curator Act.14.14. This Committee considers that the position of Agent, contractor or

consultant of the Public Curator requires the appointment of persons of

high repute, honesty and competence.14.15. This Committee concludes that those attributes were lacking in the

majority of Agents so appointed.14.16. The Committee finds that Consultants, contractors and agents to the Public

Curator were unlawfully appointed and were often incompetent or

ineffective.14.17. In order to carry out his statutory role in an efficient manner, the Public

Curator should be free of inter-meddling by any person.14.18. This Committee finds that there is evidence of considerable interference in

the management and financial operation of the Public Curator’s Office by

the Department of Justice and Attorney General. This Committee makes

findings concerning that interference later in this Report.26

-

Page 27 of 104

-

14.19. Equally, this Committee finds that when the Attorney General should have

intervened in the operations of the Public Curator – he did not, to the

detriment of the Office, the State and beneficiaries.14.20. The Committee finds that the Office of the Public Curator has, for many

years, failed to carry out its function in anything like a competent manner.14.21. Criminal dealings, fraud, forgery, incompetence and non-accountability

have resulted in gross mismanagement of a huge number of Estates which

may result in a significant liability to the State for those failures.15. INQUIRY BY AND REPORT OF THE AUDITOR GENERAL

15.1. On the 13th June 2003 the Auditor General reported to the Minister of

Justice and Attorney General on the financial statements of the Public

Curator’s Office for the year ending 31st December 2000. This report was

tabled in the Parliament.15.2. In that report the Auditor General found that

“financial statements were prepared from incomplete and insufficient

records resulting in the limitation of scope of my audit work. As a

result, it was impractical to extend my audit procedures sufficiently to

determine the accuracy of the information recorded in the financial

statements”.15.3. The Auditor General identified and described serious failures in the

financial accounts and raised matters which, prima facie, suggested a

failure of the Trustee to act in a proper and lawful manner.15.4. More significantly, the report identified serious financial and

administrative mismanagement over a long period.15.5. In 1999 the Auditor General undertook an audit of the financial statements

for the period ending 31st December 1991 and in October 1999, provided a

qualified audit opinion on these financial statements.15.6. The Auditor General could not then form an opinion as to whether the

financial statements were based on proper accounts and records or whether

the financial statements showed fairly the state of affairs of the Public

Curator’s office as at the 31st December 1991.That audit reported:-

• Incomplete reporting

27

-

Page 28 of 104

-

• Accounting records either non existent or not made available

• Inability to verify bank balance and cash books which could not be

reconciled.• A Register of Assets belonging to Estates had not been maintained.

• Inadequate accounting for investments.

• Inadequate management of investments.

• Estate and trust accounts that had been static for up to 20 years when

the Public Curators Act 1951 require these to be remitted to the

Consolidated Revenue Fund• The Estate records had not been reconciled.

• Fees and Commissions charged on Estates had not been paid into

Consolidated Revenue on a regular basis.15.7. On the 13th April 2005 the Parliamentary Public Accounts Committee

commenced an inquiry into the office of the Public Curator.15.8. The Public Accounts Committee resolved to request the Auditor General

to carry out a Special Audit Investigation of the office of the Public

Curator of Papua New Guinea.15.9. The Public Accounts Committee set the following Terms of Reference for

the Auditor General:1. To review the Public Curators Act to ascertain compliance by the

Public Curator’s office in terms of administration of Estates.2. To review compliance with the Act in terms of investment and

distribution of deceased Estates.3. In reviewing compliance with (1) and (2), ascertain the legitimacy

and appropriateness of specific decisions and actions concerning the

administration of deceased Estates.4. Establish whether proper accounts and records were maintained by

the Public Curator’s office in accordance with the Public Curators

Act and other relevant legislation including an investigation into

bank accounts, Estate accounts and records, office accounts and

returns.28

-

Page 29 of 104

-

5. Establish lapses in the system and ascertain reasons for such lapses.

6. Establish whether any misappropriation, theft or fraud might have

occurred as a result of any weakness in the system, particularly

during the time of the previous management and also under the

current management.7. Review engagement of Consultants and ascertain whether proper

procedures were followed for such engagement and also examine the

scope of work and reports prepared by the Consultants and examine

whether Certificates of Compliance were in place8. Review the Insolvency Act and the Companies Act to see whether

the Public Curator has complied with those Acts9. Review the internal control procedures in place to establish their

adequacy and effectiveness.10. Review the audit report issued under Section 8 (2) of the Audit Act

for the year ended at 31st December 2000 to establish whether any

misappropriation, theft or fraud might have occurred during the

period under audit.11. Establish whether the current management has taken necessary

action to improve control systems covering audit qualifications

issued on the 13th June 2003.12. Based on the qualifications in the Auditor General’s Report for the

year 2000, investigate fully and provide the necessary documentary

evidence in addition to the information that has been collected to

support the Audit qualifications.15.10. The Auditor General reports that the scope of the audit was handicapped

by failures within the Public Curator’s Office. These failures are:• Lack of audit trail;

• The Public Curator’s Office has no proper accounting system in

place. The Financial Statements were prepared by the Auditor by

relying only on insufficient manual cash book without proper

distribution of accounts. In addition, the Office did not maintain any

General Ledger and any General Journal. Subsidiary books such as

staff advances and various creditors lists were not kept.29

-

Page 30 of 104

-

• The Committee finds this is a fundamental breach of the

requirements of the Public Finances Management (Act) and the

Financial Instructions.• The Public Curator does not maintain proper books of accounts. The

Financial Statements were prepared from incomplete and insufficient

records resulting in the limitation of scope of the audit. The audit

was unable to determine the accuracy of the information recorded in

the financial statements.• Again, the Committee finds that this is a fundamental breach of the

Public Finances (Management) Act and Financial Instructions.• There is no reliable system of control over the Estate ledger

accounting on which the Auditor could rely for the purpose of the

audit. In particular, the Auditor was not able to satisfy himself as to

the accuracy of the bank reconciliation or completeness of the Public

Curator’s books, was unable to obtain sufficient audit evidence

concerning the accuracy and completeness of opening balances of

assets and liabilities in the Estate ledger.16. FINDINGS OF THE AUDITOR GENERAL

16.1. The Auditor General reports the following conclusions:

• That, in 2001, an independent Consultant commissioned by the

Public Curator produced a strategy for addressing the problems of

that Office and a future plan. The Auditor General finds little

evidence that those strategies/recommendations have been acted on.• The Office of the Public Curator has, for many years, acted in an ad

hoc manner with no obvious direction or plan. That situation

continues to the present day.• There are significant problems with staff numbers, skills and

qualification, financial and other resources, additional appropriation,

facilities, procedures and manual and computer systems required to

support the operations of the Office of the Public Curator.• Limited evidence of any action to address staff numbers, skills and

qualifications, financial and other resources, additional

appropriation, facilities, procedures and manual and computer

systems required to enable the Public Curator to competently carry

out his statutory duty.30

-

Page 31 of 104

-

• The Public Curator has failed to establish policies and practices

essential for the effective operation of the Public Curator’s Office,

including the establishment of control structures;• A failure to secure sufficient and appropriate resources for the Public

Curator’s Office to operate effectively;• A failure to manage the activities of Agents resulting in significant

and unlawful losses to Estates;• A failure to finalise Estates in a timely manner;

• A failure to maintain proper accounting records and documentation

relating to the financial matters and the management of Estates;• A failure to provide any proper accounting for its operation since

1991 or provide satisfactory financial reports;• A failure to maintain proper accounting records relating to the

operations of the Public Curator’s Office;• A failure to fully and accurately identify and value the extent of

Estates;• A failure to manage and maintain assets, including properties, that

make up Estates;• A failure to manage and effectively account for investments;

• A failure to remit commissions received to the Consolidated

Revenue Fund as required by the Public Curators Act 1951 and of

Section 211(2) Constitution;• A failure to remit monies to the Consolidated Revenue Fund relating

to Estate investment and property not resolved within a period of six

years as required by Section 17 of the Public Curators Act 1951;• A failure to protect the assets of Estates and as a result significant

amounts of money and assets held in trust have been lost through

poor management and fraud;• A failure to manage large Consultancies effectively, and as a result of

this mismanagement, has not received any benefits from significant

expenditures;31

-

Page 32 of 104

-

• A failure to take action to recover monies lost or to act against

individuals or organizations responsible; and• A failure to provide any level of effective customer service to

beneficiaries, responding only to Court actions and threats by

beneficiaries;• That the Public Curator has failed to discharge his responsibilities as a

Trustee and this failure extends to assets of the Estates, money, plant

and properties.• That a significant amount of Trust money has been lost through fraud

or has been spent and cannot be accounted for – this results from

inadequate financial management and/or illegal expenditure on

operating costs of the Public Curator’s Office.16.2. More specifically, the Auditor General finds that the Public Curator has

charged Commissions far in excess of that allowed by the Public Curator

Regulations and cannot reconcile the Commissions removed from Estate

monies, to individual Estates.16.3. Further, monies collected as Commissions have been used to offset the

running and operational cost of the Public Curator’s Office rather than

being remitted to the Consolidated Revenue Fund.16.4. This appalling litany of conclusions is compounded by a finding that over

K 2.5 Million provided by the Government specifically to meet shortfalls

in the Estate Trust Account caused by the inappropriate use of trust

monies by the Public Curator’s Office, has not been used for this purpose

but has been employed to discharge operating debts of the Public

Curator’s Office16.5. This blatant misuse of the allocated public funds requires urgent referral

and investigation by the relevant investigatory Agencies.16.6. The Auditor General concludes that the Department of Finance has an

obligation regarding the review and monitoring of Trust Accounts.

However, clearly, in the case of the Public Curator’s Office, the

Department of Finance has completely failed to meet those obligations.16.7. On the 13th June 2000 Mr Nouairi, the Acting Public Curator, reported

that:“At the moment, the Office is under strength in manpower. It lacks

basic skills and administrative knowledge in administering matters

that fall under the Public Curator’s responsibilities.32

-

Page 33 of 104

-

………………………..

Customer service is chaos (sic) and attending queries for the

customers is even embarrassing because the information required

either no existence (sic) or misplaced. Many estates have been in our

custody for ages without attempting to grant them the probate or

obtaining letters of administration for their releases.The Office is inundated with legal threats of unnecessary

procrastination of obtaining probates, and non responses to letters

from the clients since September last year.It should not be a surprise to anyone because the personnel are

insensitive to the public pressures or indifference (sic) to their

responsibilities. Given this background you can draw your own

conclusions of the problems the Public Curator has in attempting to

discharge his statutory responsibilities”.16.8. It is therefore clear that as early as 2000, at least some of the problems

were known to the Office of the Public Curator itself.16.9. The Acting Public Curator continued:

“… State of Administration of numbers of estates which I have

examined is very appalling … as they involved huge amounts of

overpayments. Due to lack of proper checks and balances, there are no

audit records and situational reports; it is possible that the estate records

may not be completely accurate.… Overpayments are attributed to a number of things. The officials are

incompetent in their duties which contributed to this mess. Records are

missing, cheques have been written without authority by subordinates

and no proper control of accounts and lack of audits for the last decade

has led to the demise of this office’s integrity”.16.10. The Auditor General concludes that the situation reported some five years

ago, still prevails.16.11. The Auditor General concludes that fraud and inappropriate use of Estate

monies to fund the operation of the Public Curator’s Office means that

there is a significant gap between Estate assets held by the Public

Curator’s Office and its liabilities to beneficiaries of deceased estates.16.12. The Auditor General continues:

33

-

Page 34 of 104

-

“Due to the deplorable state of the Public Curator’s Office financial

records, I am not able to accurately quantify this amount. I do know

that the Public Curator estimated the gap to be more than K9,000,000 in

its 2002 submission to the National Executive Council seeking financial

assistance.I am of the opinion that the situation has worsened over the last three

years. In addition the Public Curator cannot be assured that he has

identified all of the financial and non-financial assets including

properties, belonging to estates”.16.13. The Auditor General also concludes that systems, manual and

computerized, that support the operations of the Public Curator’s Office

are inadequate or do not operate effectively with even the most basic

controls absent.16.14. The Auditor General concludes that to accurately determine and finalise

the disbursement of Estate assets to beneficiaries, is impossible.17. RECOMMENDATIONS OF THE AUDITOR GENERAL

17.1. The Auditor General makes short and long term recommendations, which

have been considered by the Public Accounts Committee. These

recommendations are:General Recommendations:

1. The Minister of Justice and Attorney General must act immediately to

appoint someone with the appropriate background and capability to take

responsibility for reform of the Public Curator’s Office.2. The appointee should have experience in the operation and management of

similar public trustee organization and be empowered to make the many

and hard decisions required to move the Office of the Public Curator

forward.3. An immediate plan of action must be established. That Plan must set a

timetable for the process, recommend a structure and organization for the

Public Curator’s Office and specify the financial and manpower resources

required to deliver at least the various stages of the plan.4. In the medium term, the Minister for Justice and Attorney General need to

address both the short term and long term objectives for the Public

Curator’s Office.Short Term Recommendations

34

-

Page 35 of 104

-

1. It is necessary to obtain an understanding of the current financial and

operational problems that face the Public Curator’s Office. This should

include the identification, documentation and resolution of instances

where poor management practices and inappropriate behaviour, including

fraud, have resulted in financial loss and to initiate recovery action;2. Legal claims should be immediately pursued against parties for the

recovery of assets of the Public Curator’s Office or Estates that it manages

including and in particular legal action against Consultants and

Contractors that have failed to deliver contractual obligations and parties

that have drawn on Estate funds or have failed to remit proceeds to Estate

accounts;3. Arrangements for appropriate and on-going funding of the Office of the

Public Curator must be formalized immediately. That funding should be

arranged through the budget and appropriation;4. The State must immediately make up shortfalls in assets held in trust.

This is likely to be a very expensive exercise;5. The State must ensure appropriate and timely distribution of assets to

beneficiaries as a priority;6. The Public Curator and the State must ensure an understanding of the legal

and business responsibilities and needs of the Public Curator’s Office;7. It is necessary to identify specific staffing numbers and skills base

required to address the problems of the Public Curator’s Office. This will

need significant import of expertise through the engagement of

Consultants and Contractors.8. It is necessary to identify and establish policies, procedures and practices

to support the operation of an effective and efficient Public Curator’s

Office, including the effective management of and accounting for all the

assets of Estates.9. Immediately identify and implement systems to support the operation of

the Public Curator’s Office. This will include:Filing;

Document control;

Property/Asset Management;

35

-

Page 36 of 104

-

Financial Management;

Reporting and Customer Support;

Property Registers;

Separate Financial Records of individual Estates;

Records of the full extent of the assets of an Estate;

Identification of new Estates;

Management and administration of businesses;

Asset Registers of Plant and Equipment including motor vehicles;

Property Management system to ensure properties are controlled,

maintained and leased; andMortgage Registration and management.

10. Projects to obtain and analyse information relating to the responsibilities

of the Public Curator as Public Trustee must be instituted;11. Immediately initiate projects to ensure that systems contain and maintain

complete and accurate Estate, asset and financial information for all of the

Public Curator’s clients.12. Immediately establish processes for dealing effectively with clients of the

Office of the Public Curator;13. Propose changes to the legal framework set out in the Public Curator Act

and Public Curator Regulations.Longer Term Recommendations

17.2. After consolidation of the achievements in the short term, the State must:

1. Develop a Corporate Plan supported by Risk Assessment and

Policies and Business Plans for the Public Curator’s Office;2. Analyse, identify and legislate the legal form of the Office of the

Public Curator with attention to administrative autonomy of that

Office and clear definition of the roles of other Agencies – in

particular the Department of Justice and Attorney General;36

-

Page 37 of 104

-

3. Review longer term funding. Funding strategies will need to take

into account that it is unlikely the Public Curator’s Office can

achieve self funding in the medium term, if ever, and that there

would be the need for continued financial support from the State;4. Formalise structure and staffing establishment for the Public

Curator’s Office;5. Recruit staff and ensure effective on-going training and assessment

programs;6. Ensure a control environment over business operations including

management and financial controls;7. Analyse and update records of deceased Estates/accounts/clients and

develop networks with relevant private and public Agencies to

ensure continued maintenance of records and identification of

Estates.17.3. The Public Accounts Committee accepts the findings and

recommendations of the Auditor General but makes further findings,

recommendations and referrals in its own right. These are set forth at the

conclusion of this Report.18. RESPONSE BY THE PUBLIC CURATOR

18.1. The Office of the Auditor General invited the Public Curator to respond to

its Report and provided the opportunity for the Public Curator to

incorporate any response that it wished. The Public Curator declined to

formally respond until after the Report had been tabled in the Parliament.18.2. Eventually, the Public Curator did prepare and table a Response before the

Public Accounts Committee on the 28th November 2005. A copy of that

Response is contained in Volume 2 of this Report.18.3. The Public Accounts Committee gave careful consideration to the

Response from the Public Curator and summarises responses to individual

findings of the Auditor General (infra).19. SPECIFIC ALLEGATIONS AND FINDINGS BY THE PUBLIC

ACCOUNTS COMMITTEE:19.1. The Public Accounts Committee examined specific allegations and

findings contained in the Special Audit Investigation by the Office of the

Auditor General. The Committee now addresses each of those allegations,37

-

Page 38 of 104

-

the evidence, the response of the Public Curator thereto, and makes certain

findings, resolutions and referrals.19.2. These specific matters of Inquiry and findings in respect of them are:

20. PUBLIC CURATOR’S OFFICE STAFFING

AUDITOR GENERAL’S FINDINGS

20.1. The Auditor General found that the Public Curator has never had

sufficient persons with the necessary qualifications to ensure that the

Office of Public Curator was able to carry out its statutory duties.The lack

of expertise, training, experience and qualifications extends also to the

Public Curator himself and the Regional Public Curators.20.2. The Auditor General finds that this lack of staff and or adequately trained

personnel has resulted in a backlog of Estates in various stages of

resolution. All too often the Committee finds that many Estates were left

unattended or derelict. Few deceased Estates have been resolved in a

reasonable time period and there are many instances of Estates not

resolved after a decade or more.20.3. The Auditor General finds that the Public Curator’s office has no qualified

accountant, qualified property management staff to deal with 680

properties under the trusteeship of the Public Curator, no trained or

adequately trained search staff and no repository of skill or expertise in the

evaluation, letting, maintenance, sale, transfer and general management of

the Estate properties.20.4. Further, the Auditor General finds that the Public Curator has no

investment advice to ensure maximum return on investments of Estate

monies, no qualified legal staff, no independent internal audit function and

no or no sufficient office management staff including information

technology, contract management and filing staff to ensure that manual

and computer systems are installed, or work at all.20.5. The Auditor General finds that the current permanent staffing of the

Public Curator’s office is 10 persons only. These numbers are totally

inadequate to deal with approximately 19,600 Deceased Estates managed

by the Public Curator.Those 10 staff are:

• Public Curator (Waigani)

• Deputy Public Curator (Mt Hagen)

38

-

Page 39 of 104

-

• Four Regional Deputy Public Curators (Waigani, Boroko, Lae and

Rabaul).• Executive Secretary (Waigani)

• Three Office Assistants (Waigani, Boroko and Mt Hagen)

20.6. Eleven casual employees are retained by the Public Curator, but these staff

have inadequate training and qualifications to carry out their tasks.20.7. The Auditor General finds a problem with continuity of expertise within

the Office of the Public Curator. Most employees including casuals had

been employed by the Public Curator for less than four years and few were

with the office prior to 1999. Clearly the lack of expertise and

competence is contributed to by high staff turnover.20.8. The Auditor General concludes that the Public Curator’s Office is not

resourced with sufficient or appropriately skilled staff to meet its

obligations. As a result, it has been unable to identify all the properties

belonging to the deceased Estates or manage, maintain, dispose of or

transfer to beneficiaries the 680 properties which are currently identified.20.9. The Auditor General finds a total of 19,600 unresolved Estates dating back

over 15 years and the backlog is growing all the time.20.10. The Auditor General concludes that the Office of the Public Curator needs

immediate additional and properly qualified staff to manage its operations.

It also needs significant resources to re-establish any semblance of

competence in its operations.20.11. The Auditor General concludes that key positions in the Public Curator’s

Office including the Public Curator himself are held by Officers who do

not have the capabilities, experience and qualifications to hold their

positions.20.12. Further, although such expertise has been sought through Agencies and

Consultancies, the Public Curator is not in the position to control or direct

those Agents – due mainly to a lack of skilled staff to accomplish even this

role.RESPONSE OF THE PUBLIC CURATOR

20.13. The Public Curator tendered to the Public Accounts Committee a

document entitled “Public Curator’s Response on Special Audit39

-

Page 40 of 104

-

Investigation of the Office of the Public Curator” on the 28th November

2005.20.14. In respect of staffing of the Office of the Public Curator, that Response

states:“The Report on this is very accurate and facts pointed out are the core

fundamental reasons for the failure of the Office to deliver services as

should be expected in any jurisdiction with a vibrant justice system”.And later at Page 8:

“No organization can function without properly qualified and

capacitated manpower”.20.15. So far as the Committee can ascertain, the Public Curator agrees with the

conclusions of the Auditor General.20.16. On the 28th November 2005 the Public Accounts Committee questioned

the Public Curator on this issue. The sworn evidence was:“HON. JOHN HICKEY MP (Chairman) –

Is it true that the Public Curator’s Office does not have enough skilled

staff to fully perform the functions of the Office and to update its

records? Yes or noMR PAUL WAGUN (Public Curator) –

Mr. Chairman it is very true.

HON. JOHN HICKEY MP –

Is it true that estates totaling K19,600 remain unresolved and some

dating back to some 15 years? Yes or noMR PAUL WAGUN –

Mr Chairman that’s correct.

HON. JOHN HICKEY MP –

Is it true that the financial accounts and records of estates are not

updated or missing and large numbers of outstanding legal disputes

need to be settled? And there are large numbers of outstanding legal

disputes to be settled? Yes or No40

-

Page 41 of 104

-

MR PAUL WAGUN –

Mr Chairman that is very true and its getting more complicated every

day and every year”.20.17. The Committee accepts the conclusions of both the Auditor and the Public

Curator.FINDINGS OF THE PUBLIC ACCOUNTS COMMITTEE

20.18. The Committee find that the Public Curator’s Office is not now and has

not been for many years adequately staffed with sufficient or appropriately

skilled officers.20.19. As a result of this neglect the Office of the Public Curator has become

totally inadequate to the task of managing deceased Estates and the huge

backlog of unresolved Estates dating back 15 years is growing all the time.20.20. The financial records and accounts of the Estates are not up to date, are

missing or incomplete – as are records of Estate dealings.20.21. There are a large number of outstanding legal disputes. The Committee

notes that in early March 2006, a Judgment was given against the office of

the Public Curator for damages consequent upon a finding that the Public

Curator had acted negligently in the administration of a particular Estate.20.22. The Committee has been unable to ascertain the exact number of cases

which have been brought against the Public Curator.20.23. The Committee finds that the State may be open to significant liability as a

result of this chronic understaffing and failure to properly resource the

Office of the Public Curator with officers who understand and are trained

to carry out their work.20.24. The Committee finds that all key positions in the Public Curator’s Office

are filled by persons who do not have the background, qualifications,

training and experience required to hold the positions.20.25. The Committee makes recommendations in respect of the staffing

inadequacies later in this Report (infra).21. INTERNAL CONTROLS

REPORT OF THE AUDITOR GENERAL

41

-

Page 42 of 104

-

21.1. In order for the Office of the Public Curator to work effectively, the

organization requires effective internal control structures appropriate to its

highly specialized role and to ensure compliance with the Public Finance

(Management) Act 1995 and the Financial Instructions promulgated

thereunder.21.2. In order to establish appropriate controls, the senior management of the

Public Curator’s office needs to fully understand the unique and highly

specialized requirements of Estate management and consequent business

and financial risks which attend the position of a Trustee.21.3. Had this understanding been present in the past, policies and internal lines

of command and control could have been implemented and maintained.

This has not occurred.21.4. The very basic systems which are required are:

• Estate and Corporate file management, including a record of assets,

decisions and status;• Correspondence control;

• Financial management systems and accounting records for both

corporate operations and Estate accounts;• Register of assets for investments, cash and property, plant and

equipment.

.

.

21.5. The Auditor General’s Report at Paragraph 5.3 outlines the types of basic

controls which are required by the office of a Public Curator. The

Committee accepts the comments of the Auditor General in this regard.

Those basic controls are:• Accounting policies including;

• Dual signing of cheques;

• Receipt Registers;

• Separation of duties over approval to spend, certification of

payments and authorization of payments;• Reconciliations of cash at bank to payments/receipts and posting to

ledgers along with reviews of those reconciliations;42

-

Page 43 of 104

-

• Delegations over expenditure and other authorizations;

• Reconciliation of Registers of assets to Estates;

• Staff familiar with, and trained in, the processes and their individual

responsibilities including new starters and temporary/contract staff;• Secure storage for files;

• Accounting records, share certificates, passbooks, property titles and

accountable documents;• Monitoring and quality assurance processes to ensure that the control

environment is operating effectively;• Review and certification of all decisions on Estates;

• Control over access to manual and computer records;

• Review and quality assurance including internal audit.

21.6. The Systems which do exist had no effective controls, with an absence of

even the most basic financial and management controls required to:• Ensure completeness, accuracy and validity of records;

• Ensure security of assets;

• Ensure protection from corrupt and fraudulent behaviour by staff or

third parties.21.7. The Auditor General also finds corrupt systems incapable of providing

complete or accurate records. Therefore the Systems cannot be relied

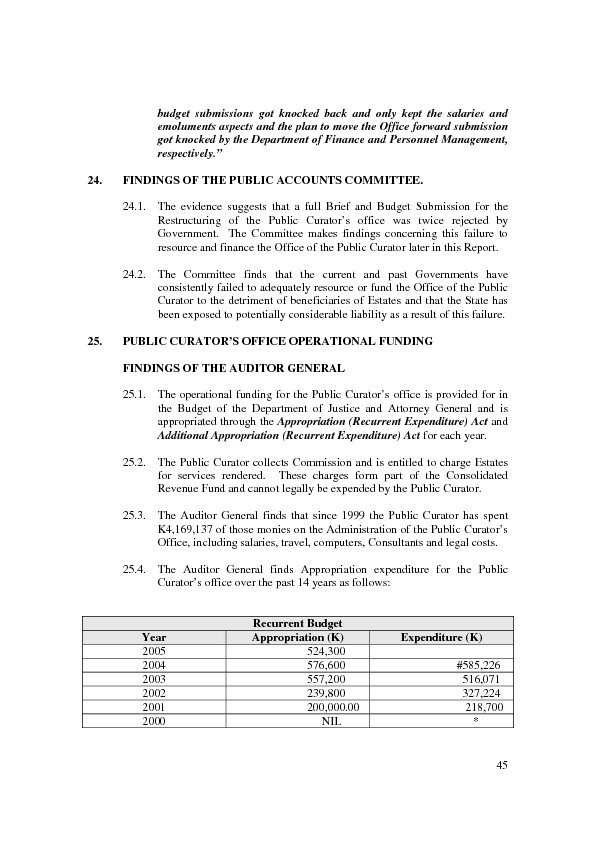

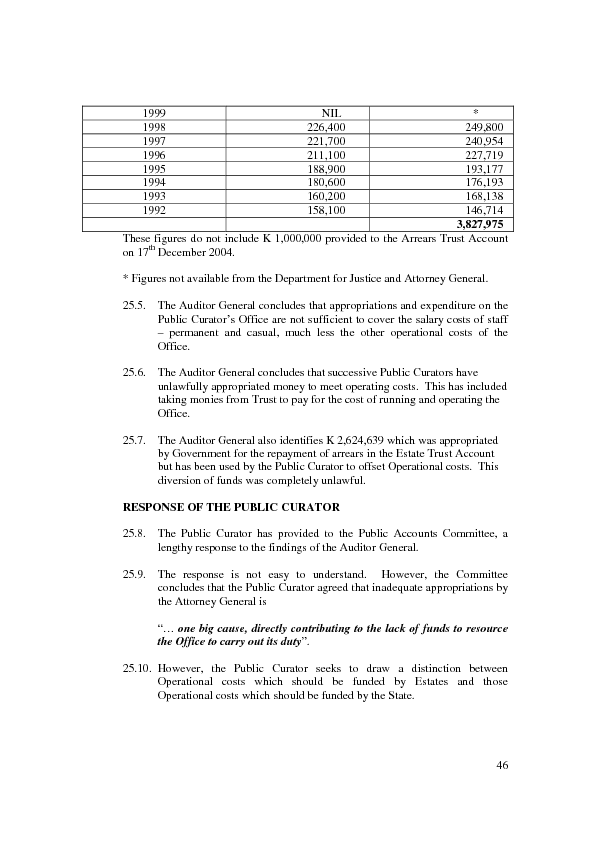

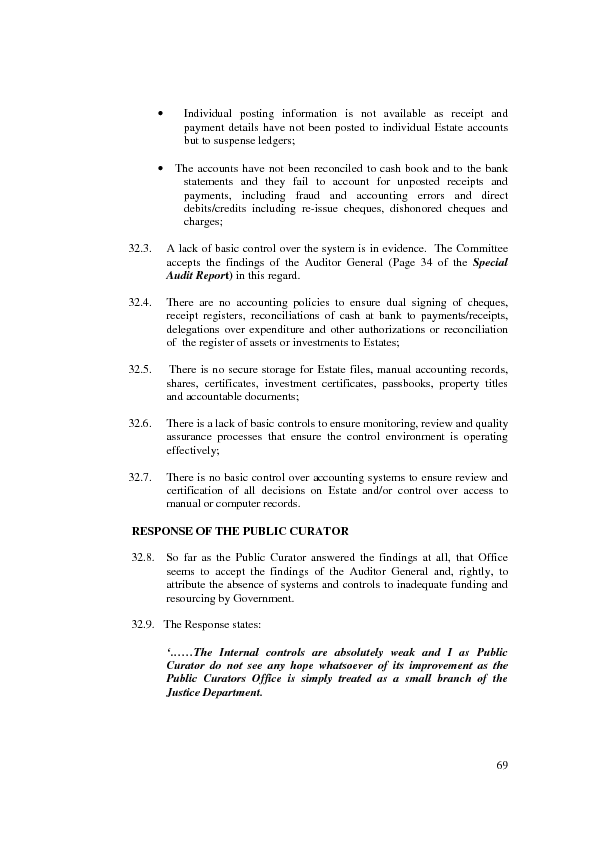

upon to effectively manage the financial and other assets that the Public