Report of the Auditor General Part IV – 2012 – on Accounts of Public Authorities and Statutory Bodies and Government Owned Companies

Mentions of people and company names in this document

It is not suggested or implied that simply because a person, company or other entity is mentioned in the documents in the database that they have broken the law or otherwise acted improperly. Read our full disclaimer

Document content

-

Report of the Auditor-General – 2012 on the Accounts of Public Authorities and Statutory Bodies established under the Act of Parliament and Government Owned Companies established under the Companies Act

Part IV

? Public Bodies and their Subsidiaries ? National Government Owned Companies ? National Government Shareholdings in Other Companies ? Projects

Phone: (+675) 3012200 Fax: (+675) 325 2872 Email: agopng@ago.gov.pg Website: www.ago.gov.pg

21 October, 2013

The Honourable Theodore Zurenuoc, MP The Speaker of National Parliament Parliament House WAIGANI National Capital District

Dear Sir,

In accordance with the provisions of Section 214 of the Constitution of the Independent State of Papua New Guinea, I forward herewith a copy of my report signed on 21 October, 2013 upon the inspection and audit of the financial statements of the Public Bodies and their subsidiaries and National Government owned companies for tabling in the National Parliament. This Report (Part IV) also contains information on companies in which the Government does not hold majority interest. Section E of this Part of the Report contains information on the status of certain entities which have ceased operations and those entities audits of which have been in arrears.

Yours sincerely,

-

Page 2 of 307

-

PHILIP NAUGA Auditor-General

Level 6 PO Box 423 TISA Investment Haus WAIGANI, NCD Kumul Avenue, NCD Papua New Guinea

REPORT OF THE AUDITOR-GENERAL – 2012 PART IV TABLE OF CONTENTS

PARA SUBJECT PAGE NO. NO.

General V A. Foreword V B. Authority to Audit V C. Audit of Public Bodies VII D. Appointment and use of Authorised Auditors VII E. Executive Summary VIII Attachments A – E XVI SECTION A PUBLIC BODIES AND THEIR SUBSIDIARIES PARA SUBJECT PAGE NO. NO. 1. Foreword 1 2. Bank of Papua New Guinea 3 3. Border Development Authority 5 4. Civil Aviation Safety Authority of Papua New Guinea 10 5. Cocoa Board of Papua New Guinea and its Subsidiaries 11 5A. Cocoa Stabilization Fund 14 6. Cocoa Coconut Institute Limited of Papua New Guinea 16 7. Coffee Industry Corporation Limited and its Subsidiaries 22 7A. Coffee Industry Fund 29 7B. Patana No. 61 Limited 31 8. Government Printing Office 34 9. Immigration and Citizenship Service Authority 37 10 Independence Fellowship Trust 40 11. Independent Consumer and Competition Commission 41 12 Independent Public Business Corporation and its Subsidiaries 43 12A. Aquarius No. 21 Limited 55 12B. General Business Trust 56 12C. PNG Dams Limited 62 12D. Port Moresby Private Hospital Limited 66 13. Industrial Centres Development Corporation 67 14. Investment Promotion Authority 70 -i-

-

Page 3 of 307

-

15. Kokonas Indastri Koporesen and its Subsidiaries 72 15A. Papua New Guinea Coconut Extension Fund 73 15B. Papua New Guinea Coconut Research Fund 74 16. Legal Training Institute 75 17. Mineral Resources Authority 83 18. Motu Koitabu Council and its Subsidiary 85 18A. Tabudubu Limited 86 19. National Agriculture Quarantine and Inspection Authority 87 20. National Agriculture Research Institute 90 21. National AIDS Council Secretariat 92 22. National Broadcasting Corporation 94 23. National Capital District Commission and its Subsidiaries 98 23A. National Capital District Botanical Enterprises Limited 104 23B. Port Moresby City Development Enterprises Limited 105 24. National Cultural Commission 106 25. National Economic and Fiscal Commission 107 26. National Fisheries Authority 109 27. National Gaming Control Board 112 28. National Housing Corporation 117 29. National Maritime Safety Authority 118 30. National Museum and Art Gallery 121 31. National Narcotics Bureau 122 32. National Research Institute 123 33. National Road Safety Council 125 34. National Roads Authority 127 35. National Training Council 130 36. National Volunteer Service 131 37. National Youth Commission 132 38. Oil Palm Industry Corporation 134 39. Ombudsman Commission of Papua New Guinea 138 40. Pacific Games (2015) Authority 139 41. Papua New Guinea Forest Authority 140 42. Papua New Guinea Institute of Medical Research 145 43. Papua New Guinea Institute of Public Administration 146 44. Papua New Guinea Maritime College 147 45. Papua New Guinea National Institute of Standards and Industrial Technology 150 46. Papua New Guinea Radio Communications & Telecommunications Technical Authority (PANGTEL) 151 47. Papua New Guinea Sports Foundation 155 48. Papua New Guinea University of Technology and its Subsidiary 157 48A. Unitech Development and Consultancy Company Limited 161 49. Parliamentary Members’ Retirement Benefits Fund 165 50. PNG Waterboard 166 51. Public Curator of Papua New Guinea 167 52. Security Industries Authority 168 53. Small Business Development Corporation 169 54. Tourism Promotion Authority 170 55. University of Goroka and its Subsidiary 172 55A. Unigor Consultancy Limited 174 56. University of Natural Resources and Environment 179 57. University of Papua New Guinea and its Subsidiary 182

-

Page 4 of 307

-

57A. Unisave Limited 221 57B. Univentures Limited 222 SECTION B – NATIONAL GOVERNMENT OWNED COMPANIES PARA SUBJECT PAGE NO. NO. 58. Foreword 225 59. Air Niugini Limited 227 60 Livestock Development Corporation Limited 230 61. Mineral Resources Development Company Limited 234 62. Motor Vehicles Insurance Limited 241 63. National Airports Corporation Limited and its Subsidiaries 244 63A. Airport City Development Limited 249 63B. PNG Air Services Limited 250 64. National Petroleum Company of PNG (Kroton) Limited 252 65. NCD Water and Sewerage Limited (Eda Ranu) 253 66. Papua New Guinea Ports Corporation Limited 255 67. PNG Power Limited 258 68. Post PNG Limited 274 69. Telikom PNG Limited and its Subsidiaries 277 69A. Kalang Advertising Limited 280 69B. PNG Directories Limited 282 SECTION C – NATIONAL GOVERNMENT SHAREHOLDINGS IN OTHER COMPANIES PARA SUBJECT PAGE NO. NO. 70. Foreword 285 71. Bougainville Copper Limited 287 72. CTP (PNG) Limited 289 73. Gogol Reforestation Company Limited 290 74. Ok Tedi Mining Limited 291 75. Pacific Forum Line Limited 292 76. PNG Sustainable Development Program Limited 293 SECTION D – PROJECTS PARA SUBJECT PAGE NO. NO. 77. Foreword 297 78. Civil Aviation Development Investment Program (CADIP) 299 79. Lae Port Development Project 300 80. National Capital District Commission Urban Youth Employment Project 302 81. Port Moresby Sewerage System Upgrading Project (POMSSUP) 303 82. Productive Partnership in Agriculture Project 304 SECTION E – PROBLEM AUDITS PARA SUBJECT PAGE NO. NO. 83. Foreword 309 83.1 Exclusion of Entities from Future Reports 309 84. Audits in Arrears 310 84.1 General 310 84.2 Responsibility for preparation of Financial Statements 310 84.3 Legislative Requirements 311 84.4 Current Year Audits (2012 Audits) 311 84.5 Status of Current Year Audits 313 84.6 Audits in Arrears (2011 and prior years) 315 84.7 Long Outstanding Financial Statements 318 84.8 Status of Audits as at 30 June 2013 321 Acknowledgements 323

-

Page 5 of 307

-

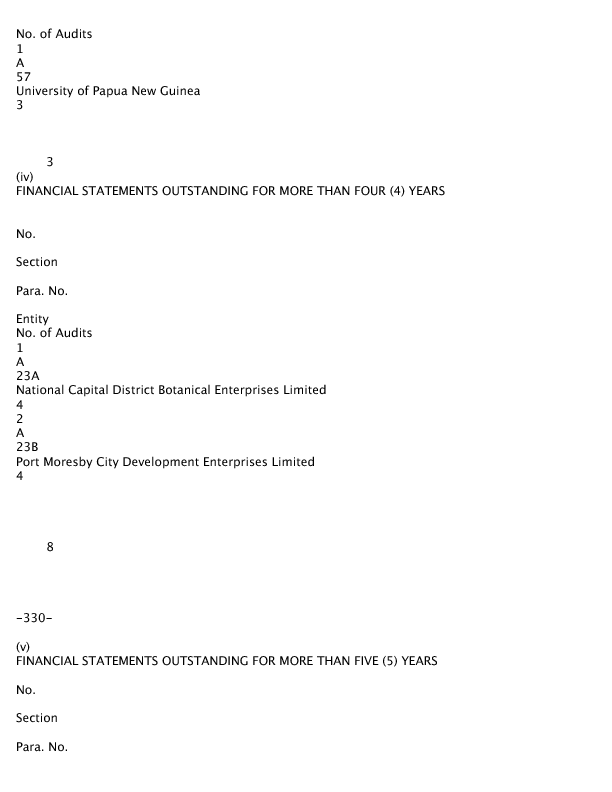

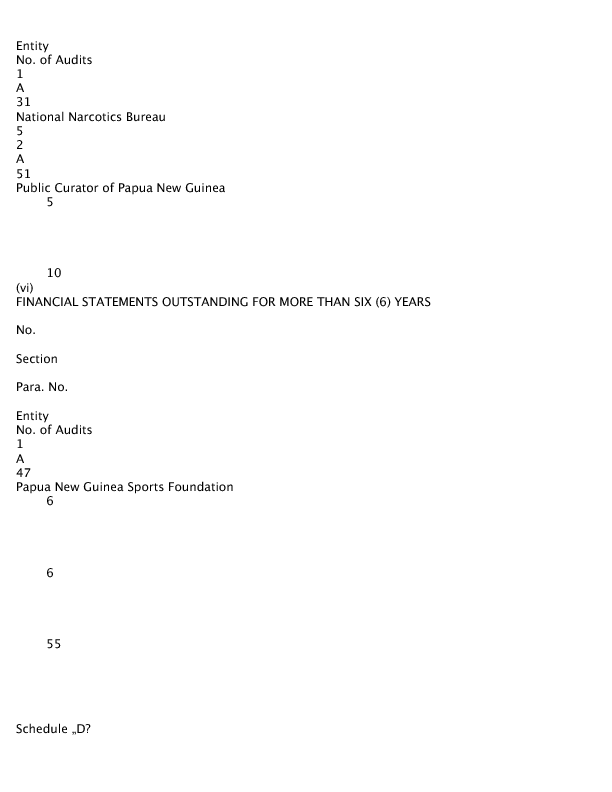

Schedule A – Current Year Audits 325 Schedule B – Status of Audits in Arrears 328 Schedule C – Long Outstanding Financial Statements 330 Schedule D – Non-Operational Entities and Others 332 Schedule E – Prior year Audits completed during 2012/2013 333 Schedule F – Status of Audits during the year 2012/2013 336

GENERAL

A. FOREWORD

My Annual Report to the National Parliament for the 2012 financial year is presented in four Parts. Part I deals with the Public Accounts of Papua New Guinea. Part II deals with National Government Departments and the Provincial Treasury Offices, whilst Part III deals with the audit of the Provincial Governments and Local-Level Governments.

Part IV (this Part) of my Report deals with Public Bodies and their Subsidiaries, Government Owned Companies and National Government?s shareholdings in Other Companies. This Report is divided into five sections. Section A deals with Public Bodies and their subsidiaries, Section B deals with National Government owned companies, Section C deals with Companies in which the National Government has shareholdings and Section D deals with Projects implemented by the Entities. Section E is an additional section which provides details of entities that have ceased operating and those other entities the audits of which have been in arrears due to non-submission of financial statements.

The audit findings contained in Sections A, B and D of this Report have been reported to the management of the respective entities and to the responsible Ministers.

B. AUTHORITY TO AUDIT

B.1 Constitution

Under Section 214(2) of the Constitution of the Independent State of Papua New Guinea, I am required to inspect and audit all bodies set up by Acts of the Parliament, or by Executive or Administrative Act of the National Executive for governmental or official purposes unless other provisions are made by law in respect of their inspection and audit.

I am also empowered under Section 214(3), if I consider it proper to do so, to inspect and audit and report to the Parliament on any accounts, finances or property of a body, insofar as they relate to, or consist of, or are derived from public moneys or property of Papua New Guinea.

B.2 Audit Act

By virtue of Section 214(4) of the Constitution, the Audit Act, 1989, which became effective from 1 May, 1989, provides more details of my functions under sub-sections (1), (2) and (3) of the Constitution. The Audit Act that was derived from the Constitution elaborates the functions and the duties of the Auditor-General. This Act was amended in 1995, and the relevant provisions of the amended Act are explained below.

-

Page 6 of 307

-

B.3 Auditing and Reporting Requirements

In Section 8, sub-sections 2 and 4 of the Act were amended to include provisions governing the auditing and the reporting requirements of public bodies including government owned companies incorporated under the Companies Act, 1997.

B.4 Matters of Significant Importance

Under Section 8(2) of the Act, I am required to inspect and audit the accounts and records of financial transactions and the records relating to the assets and liabilities of these public bodies and their subsidiaries, and to report to the Minister vested with the responsibility for the public body and the Minister in charge of Finance any irregularities found during the inspection and audit.

B.5 Audit Opinion on Financial Statements

Section 8(4) of the Act requires me to audit the financial statements of the public bodies and to report an opinion to the aforementioned Ministers on:

(i) whether the financial statements are based on proper accounts and records; (ii) whether the financial statements are in agreement with those accounts and records; and (iii) whether they show fairly the financial operations for the period which they cover and the state of affairs at the end of that period.

B.6 Public Finances (Management) Act, 1995

The submission of the financial statements of the public bodies for audit is required under Section 63(4) of the Public Finances (Management) Act, 1995.

The section requires each public body to prepare and furnish to its Minister before 30 June each year, a report on its operations for the year ended on 31 December preceding, together with financial statements in respect of that year duly audited by me.

The Minister is then required to table the report on the operations and the financial statements, together with my report on the financial statements, at the first meeting of the Parliament after receiving them.

B.7 Companies Act, 1997

I am required to audit National Government owned companies and subsidiary companies under the provisions of the Companies Act, 1997.

Though these companies are registered under the Companies Act, my responsibility to audit them is by virtue of Sections 48 and 63 of the Public Finances (Management) Act and Section 3 of the Audit Act.

C. AUDIT OF PUBLIC BODIES

C.1 Scope of Audit

-

Page 7 of 307

-

The full scope of my audit responsibility in respect of Public Bodies covers the Statutory Bodies and their subsidiaries, National Government owned companies and their subsidiaries, and the companies in which the government has minority interest.

C.2 Audit Objectives

Under the Companies Act, I am required to ascertain whether proper accounting records have been kept; whether the financial statements comply with generally accepted accounting practice; and whether those financial statements give a true and fair view of the matters to which they relate. The Act also requires the auditor to report the instances of non-compliance with these requirements. More details on the audit responsibilities under the Companies Act are provided in paragraph 58 of this Report which covers the National Government owned companies.

C.3 Reporting Framework

My audits are conducted in accordance with relevant Auditing Standards to provide reasonable assurance that the financial statements are free of material misstatements. The audit procedures include examination, on a test basis, of evidence supporting the amounts and other disclosures in the financial statements, evaluation of accounting policies and significant accounting estimates, and ensuring that the financial statements are presented fairly and in accordance with International Accounting Standards and the Statutory requirements.

D. APPOINTMENT AND USE OF AUTHORISED AUDITORS

Section 8(5) of the Audit Act, 1989 (as amended), empowers me to employ registered company auditors to assist me in undertaking my constitutional duties, where such assistance is required.

During the period covered in the Report, I engaged a number of registered company auditors to perform audits of numerous Statutory Bodies and National Government owned companies.

2012 AUDITOR-GENERAL?S REPORT – PART IV

E. EXECUTIVE SUMMARY

E.1 Report Coverage

This Report covers the audit reports issued by my Office on the audits of Public Bodies and their Subsidiaries, Government Owned Companies, Project audits and National Government?s shareholdings in Other Companies during the period July 2012 to June 2013 (2012/2013 Audit Cycle). The Report covers the audits of these entities? financial statements for a number of years, not just 2012.

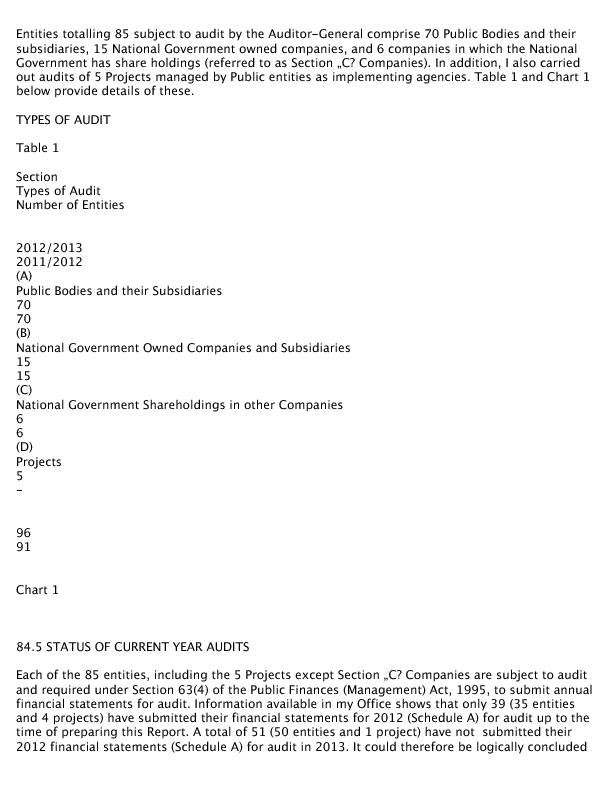

In 2012 there were 85 public entities subject to audit by my Office, consisting of 70 Public Bodies and their Subsidiaries and 15 National Government Owned Companies. In addition, I have also carried out audits on 5 Projects managed by Public entities as implementing agencies.

I am also responsible for reporting on the audits of 6 Companies, in which the National Government has a minority shareholding, that are audited by the private sector. These are reported under Section C of this Report.

-

Page 8 of 307

-

E.2 Consistency in audit findings over a number of years

The Report?s findings are consistent with those in my previous years? reports that have highlighted my concerns over the number of entities that do not submit current year financial statements for audit, and the poor state of the financial management structure in most public entities whose statements are subject to my audit and inspection.

E.3 Submission of current year Financial Statements

Section 63(4) of the Public Finances (Management) Act, 1995 requires a „… public body to prepare and furnish to its Minister before 30 June each year, a performance and management report of its operations for the year ended 31 December preceding, together with financial statements to enable the Minister to present such report and statements to the Parliament …? Before submitting the financial statements to the Minister, Section 63(4) requires a public body to submit the financial statements to the Auditor-General and for the Auditor-General to report to the Minister in accordance with Part II of the Audit Act, 1989 (as amended).

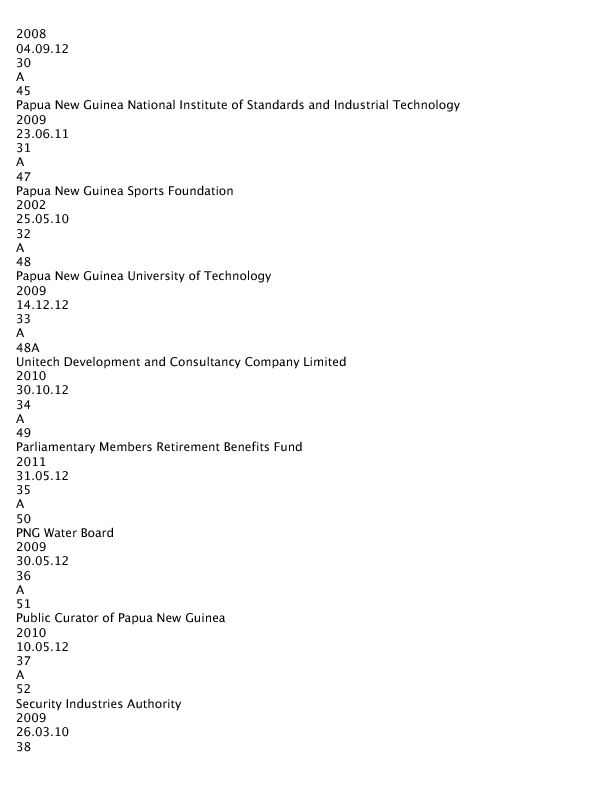

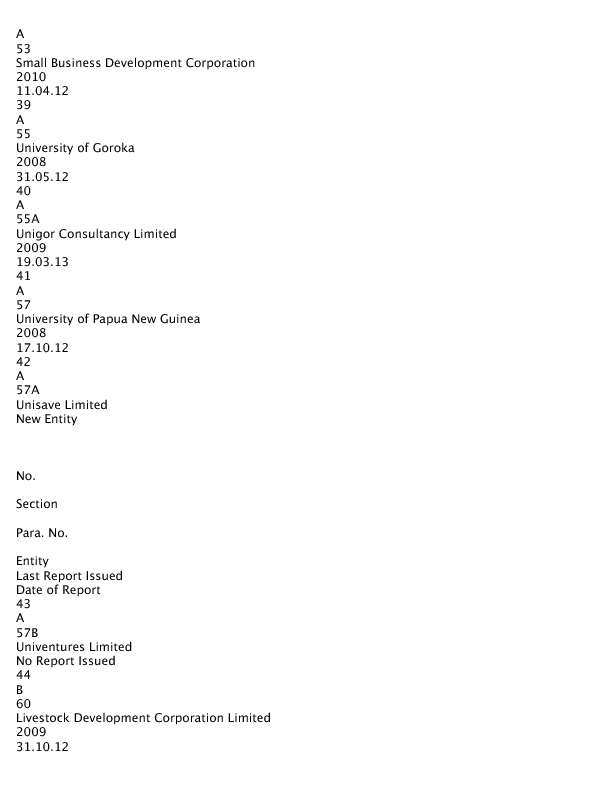

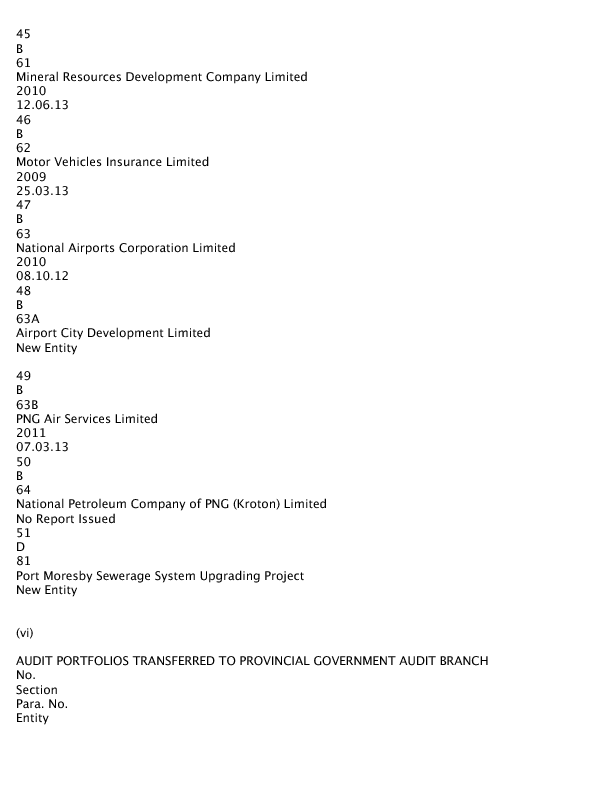

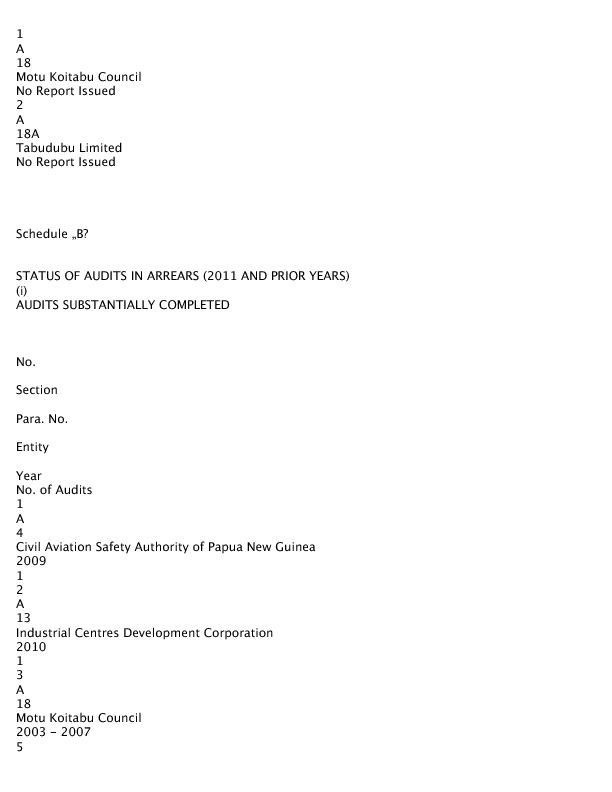

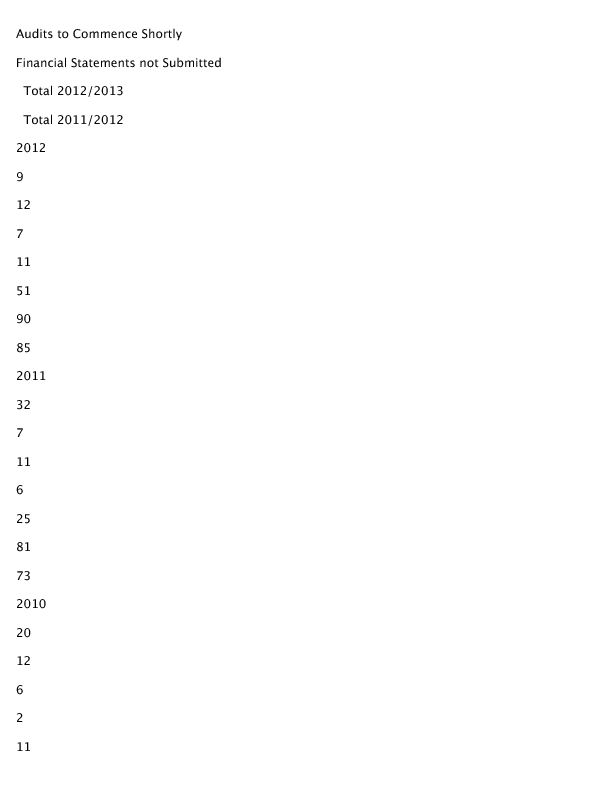

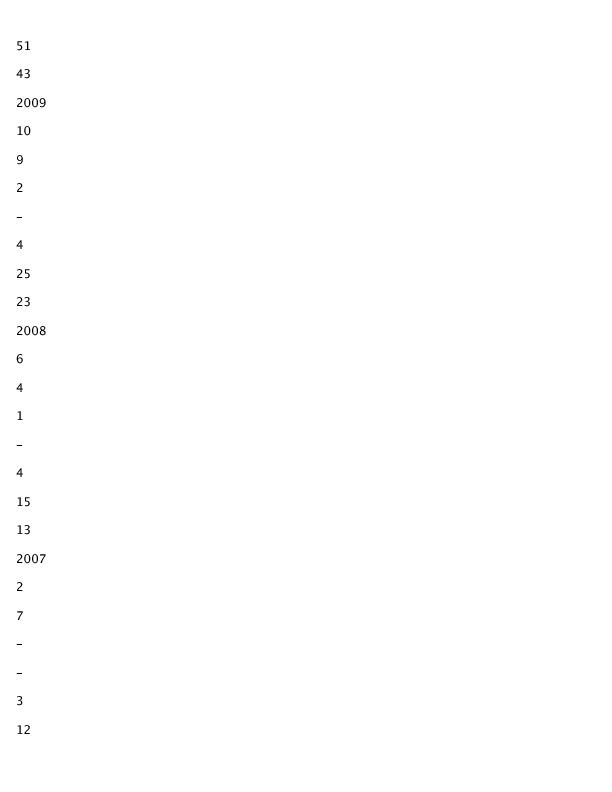

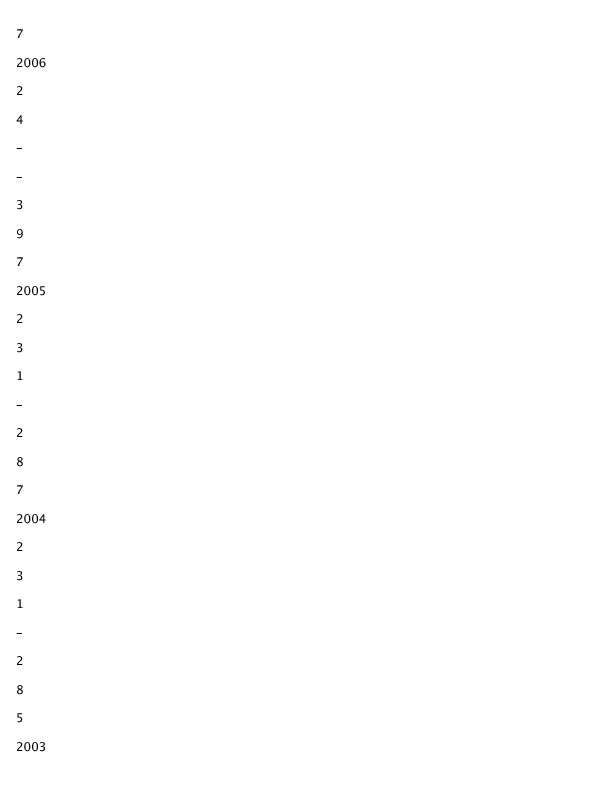

Despite these legislative requirements, 51 entities had not submitted their 2012 financial statements to be audited and overall some 55 financial statements for 2011 and prior years had not been submitted for audit (Refer Table 1).

The details of the audits in arrears and those entities whose financial statements have been outstanding for a number of years are shown in Attachment „B?.

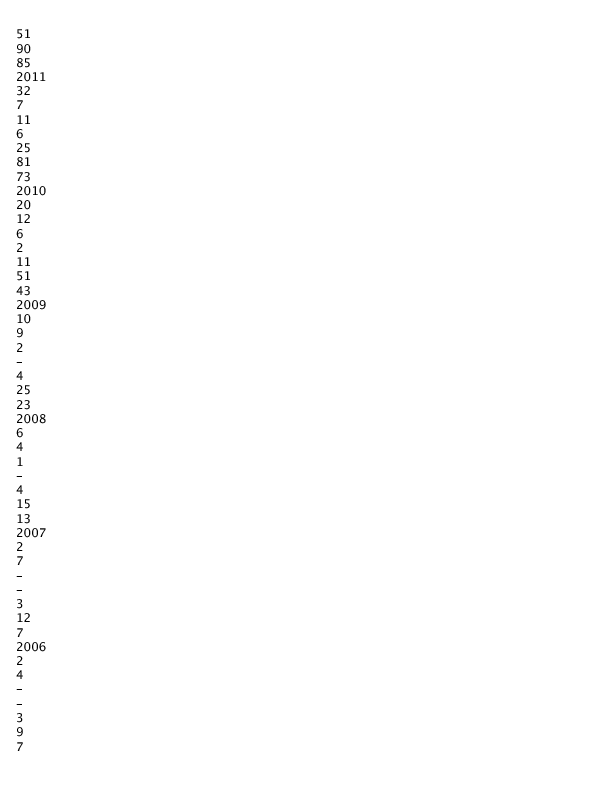

Table 1

STATUS OF AUDITS DURING THE YEAR 2012 (END OF 2012/2013 CYCLE)

Year

Audits Completed

Audits Substantially Completed

Audits in Progress

Audits to Commence Shortly Financial Statements not Submitted

Total 2012/2013

Total 2011/2012 2012 9 12 7 11

-

Page 9 of 307

-

51 90 85 2011 32 7 11 6 25 81 73 2010 20 12 6 2 11 51 43 2009 10 9 2 – 4 25 23 2008 6 4 1 – 4 15 13 2007 2 7 – – 3 12 7 2006 2 4 – – 3 9 7

-

Page 10 of 307

-

2005 2 3 1 – 2 8 7 2004 2 3 1 – 2 8 5 2003 – 3 1 – 1 5 – Total 85 64 30 19 106 304 263

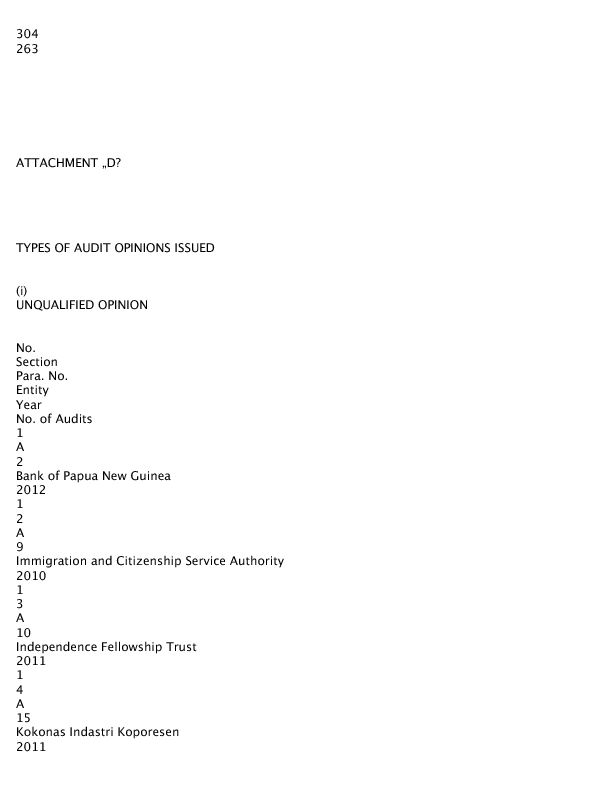

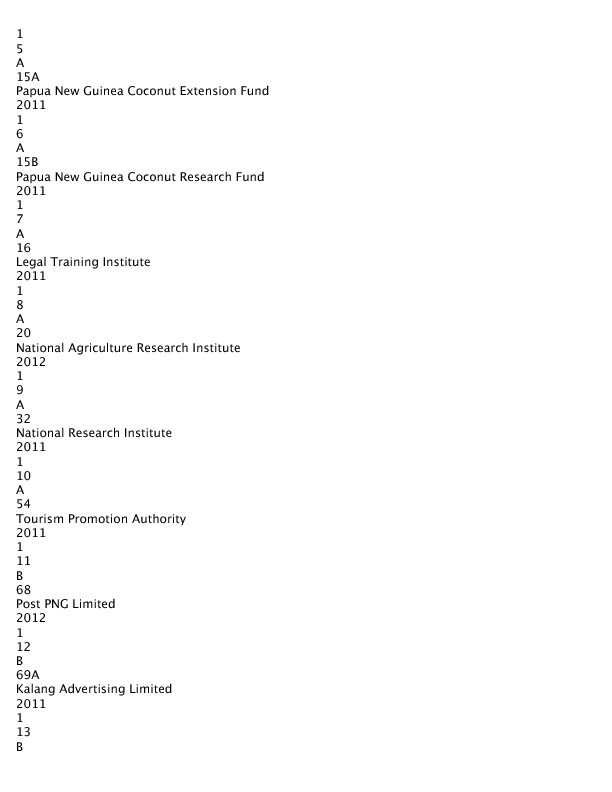

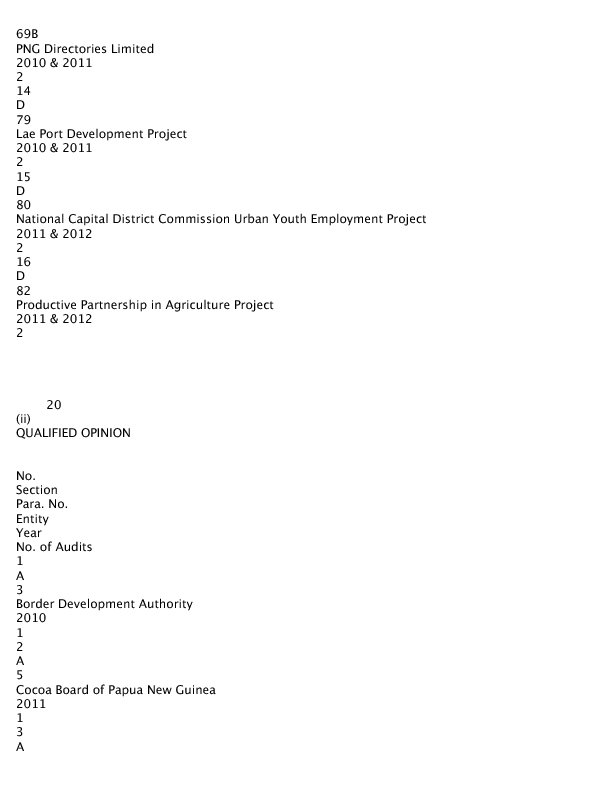

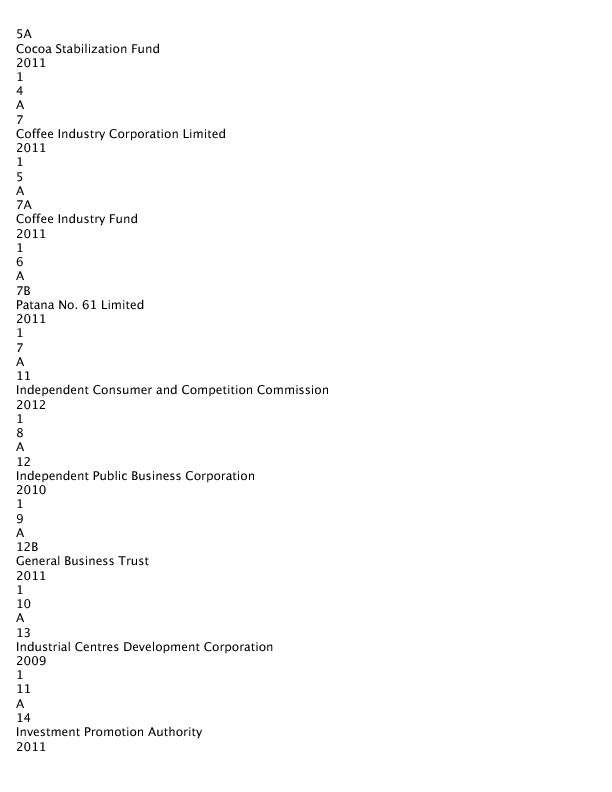

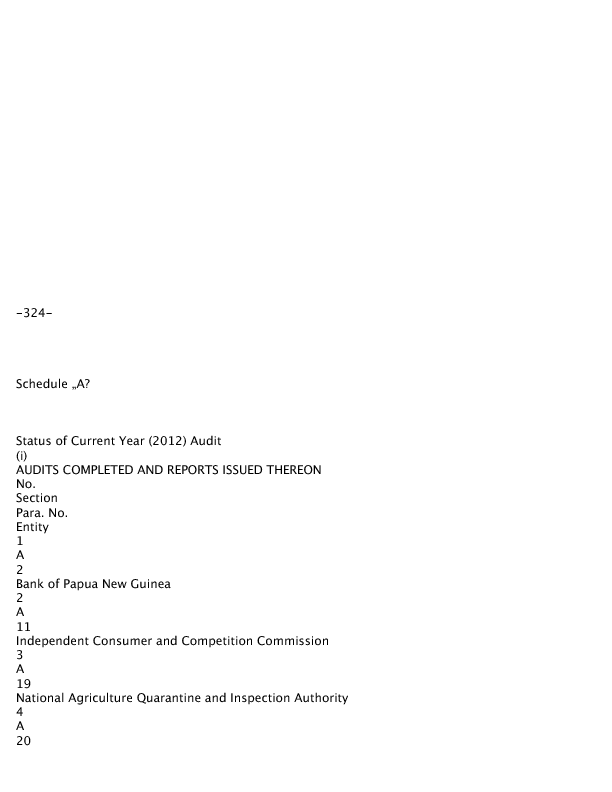

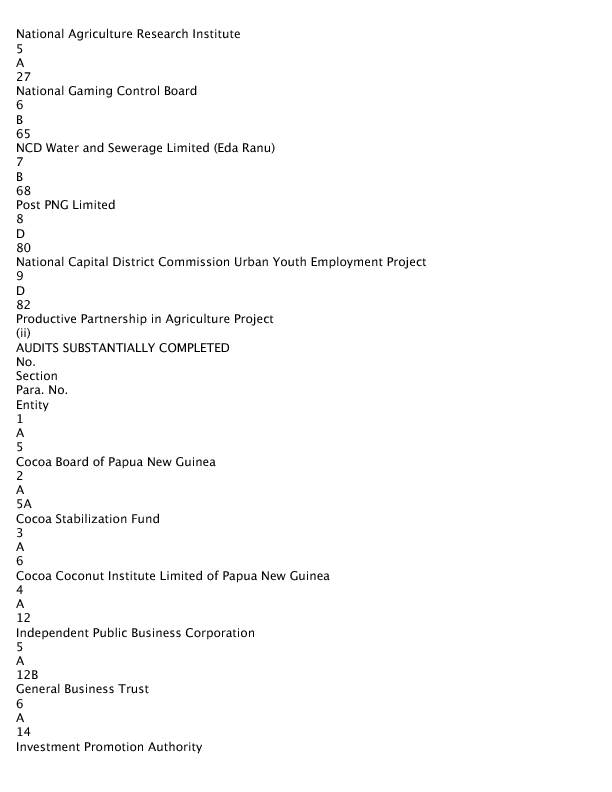

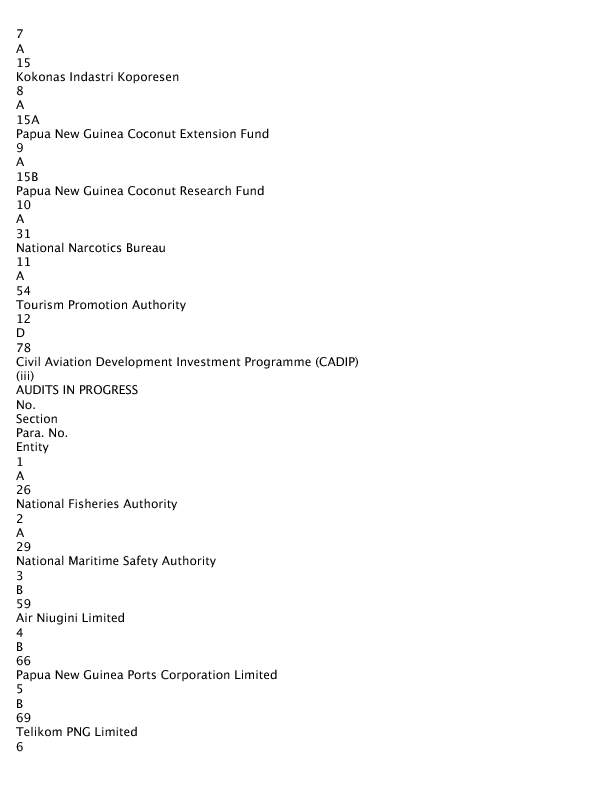

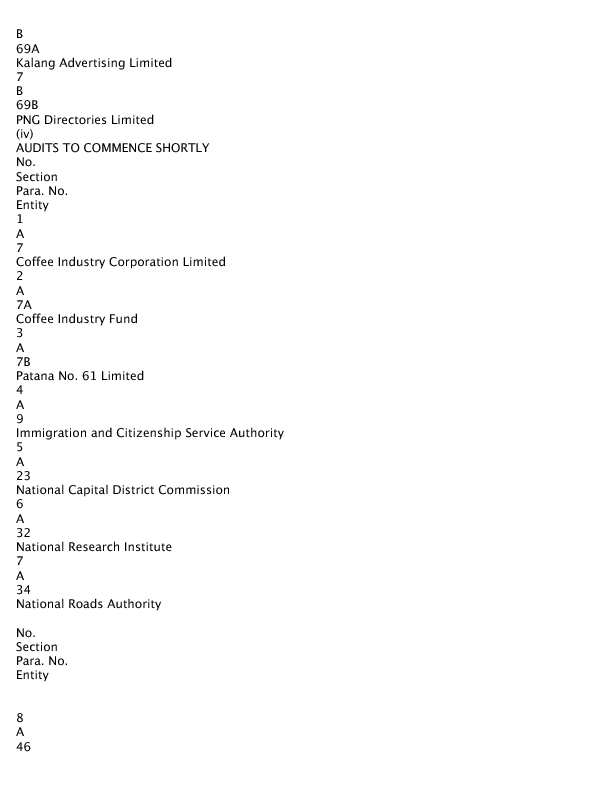

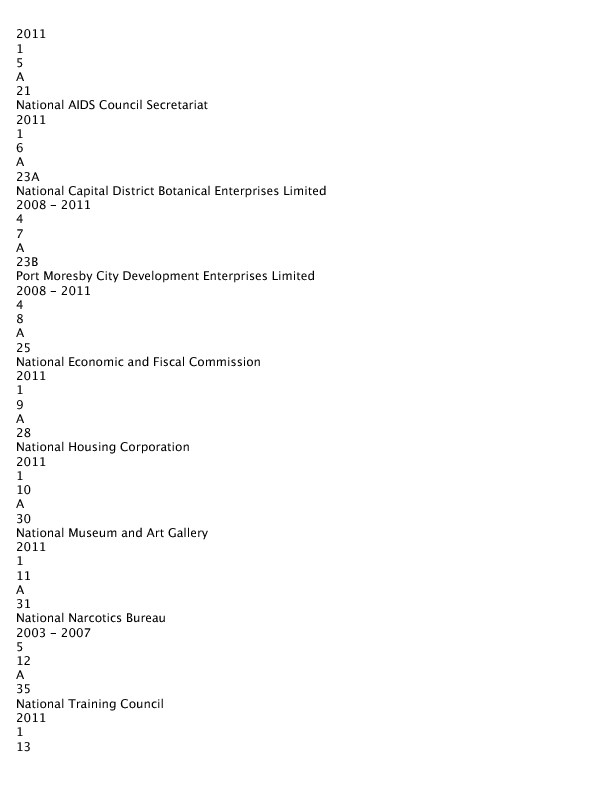

Table 1 also shows that 179 audits were completed, substantially completed or still in progress as at 30 June, 2013. The details are graphically depicted in Attachment „C?, which also included the arrears of prior years. Table 1 also shows that of the 85 audits completed, only 9 were for the current year (2012), with 19 current year audits substantially completed or were in progress. A further 11 audits were to commence shortly. Graphical description of status of current year (2012) audits (excluding arrears) is given in Attachment „A?. The list of entities is at Schedule „A? (i), (ii), (iii) and (iv).

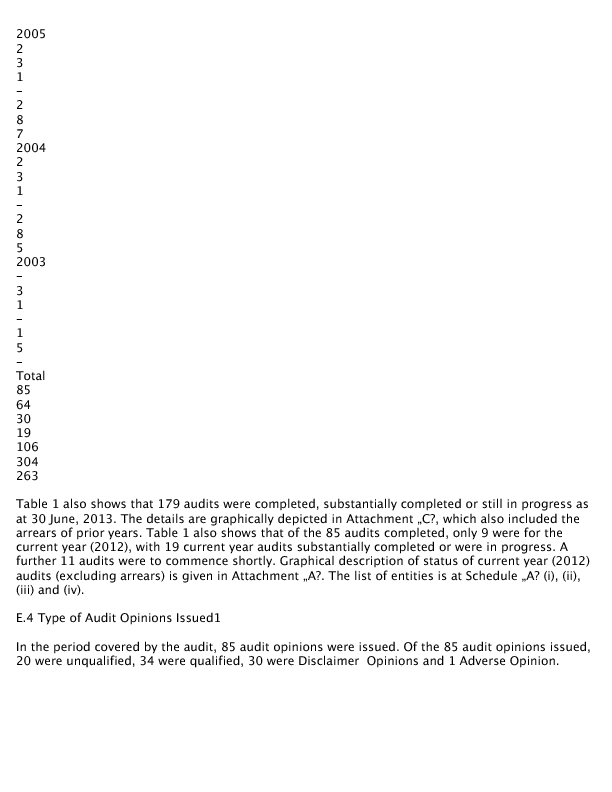

E.4 Type of Audit Opinions Issued1

In the period covered by the audit, 85 audit opinions were issued. Of the 85 audit opinions issued, 20 were unqualified, 34 were qualified, 30 were Disclaimer Opinions and 1 Adverse Opinion.

-

Page 11 of 307

-

1 The types of audit opinions are: Unqualified Opinion – A Company’s financial statements are presented fairly, in all material respects in conformity with generally accepted accounting principles. Qualified Opinion – The financial statements “except for” certain issues fairly present the financial position and operating results of the firm. The except for opinion relates to inability of the auditor to obtain sufficient objective and verifiable evidence in support of business transactions of the Company being audited. Disclaimer Opinion – When insufficient competent evidential matter exists to form an audit opinion due to scope limitation or uncertainties. Adverse Opinion – The Company’s financial statements do not present fairly the financial position, results of operations, or changes in financial position or are not in conformity with generally accepted accounting principles.

Of the 20 unqualified opinions issued, 15 related to prior years and only 5 were for 2012 as follows:

(i) Bank of Papua New Guinea; (ii) Post (PNG) Limited; (iii) Productive Partnership in Agriculture Project; (iv) National Agriculture Research Institute; and (v) NCDC Urban Youth Employment Project.

Four of the qualified opinions related to 2012 and others were for prior years. The high numbers of Disclaimer Audit Opinions issued are reflection of the poor state of accounting record keeping in a number of public bodies.

The list of entities and the type of audit opinions issued during the period July 2012 to June 2013 are provided in Attachment „D?.

E.5 Key Findings

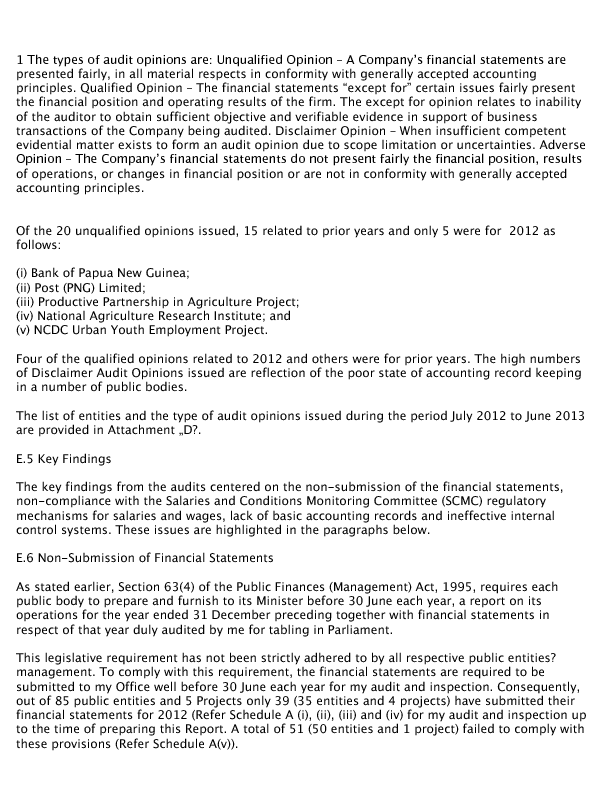

The key findings from the audits centered on the non-submission of the financial statements, non-compliance with the Salaries and Conditions Monitoring Committee (SCMC) regulatory mechanisms for salaries and wages, lack of basic accounting records and ineffective internal control systems. These issues are highlighted in the paragraphs below.

E.6 Non-Submission of Financial Statements

As stated earlier, Section 63(4) of the Public Finances (Management) Act, 1995, requires each public body to prepare and furnish to its Minister before 30 June each year, a report on its operations for the year ended 31 December preceding together with financial statements in respect of that year duly audited by me for tabling in Parliament.

This legislative requirement has not been strictly adhered to by all respective public entities? management. To comply with this requirement, the financial statements are required to be submitted to my Office well before 30 June each year for my audit and inspection. Consequently, out of 85 public entities and 5 Projects only 39 (35 entities and 4 projects) have submitted their financial statements for 2012 (Refer Schedule A (i), (ii), (iii) and (iv) for my audit and inspection up to the time of preparing this Report. A total of 51 (50 entities and 1 project) failed to comply with these provisions (Refer Schedule A(v)).

-

Page 12 of 307

-

The non-compliance of the public entities mentioned above has resulted in:

(i) My Office not being able to report adequately on the accountability of the use of public resources in a timely manner;

(ii) A build up of audits in arrears; and

(iii) The non-tabling of Annual Reports on performance and management by public entities in the Parliament.

Responsibility for Submission of Financial Statements

An entity?s management is responsible for preparing and presenting financial statements for my audit and inspection. It is also the responsibility of management to ensure that an adequate and effective internal control system is maintained to ensure that complete and accurate financial statements are produced on a timely basis.

My Office recommends

(iv) A vigorous enforcement of the provisions of Section 63 of the Public Finances (Management) Act; and

(v) A legislative requirement to make the renewal of contracts of Chief Executive Officers subject to submission of financial statements and prudent financial management.

These recommendations are to help achieve financial management accountability and good governance in the public sector.

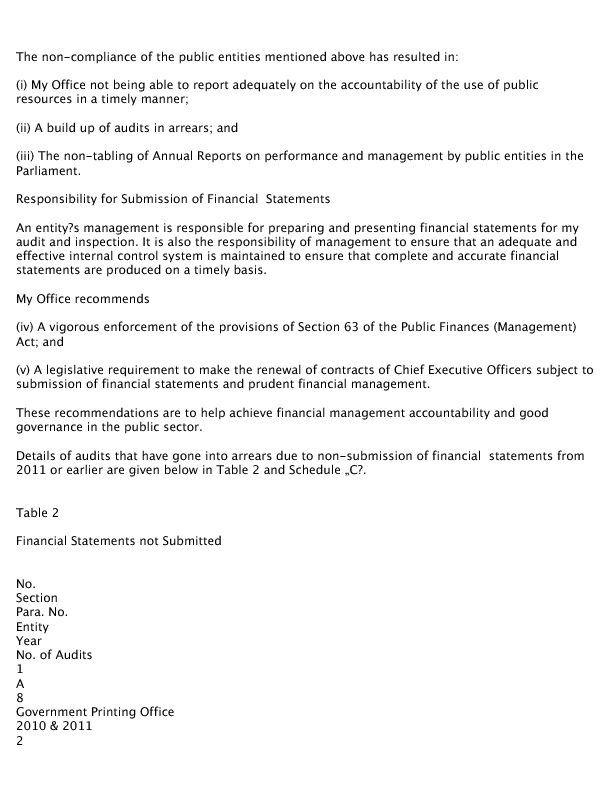

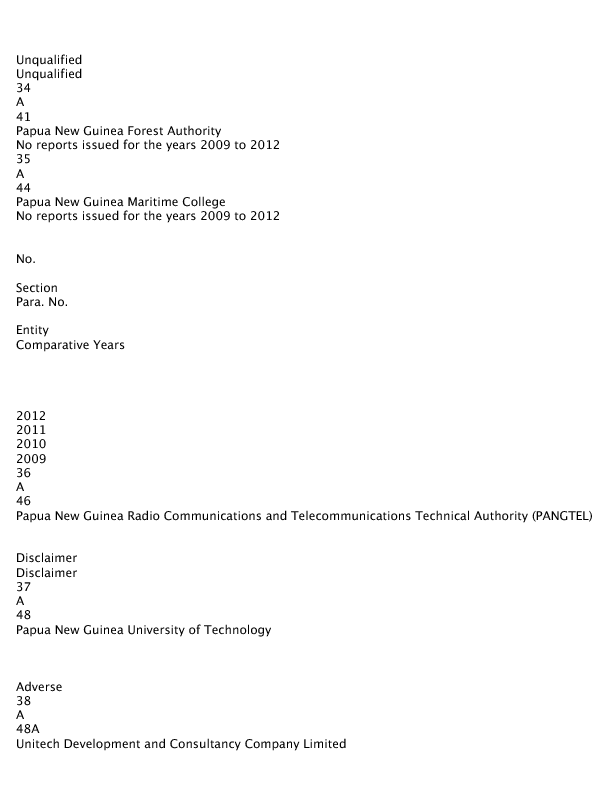

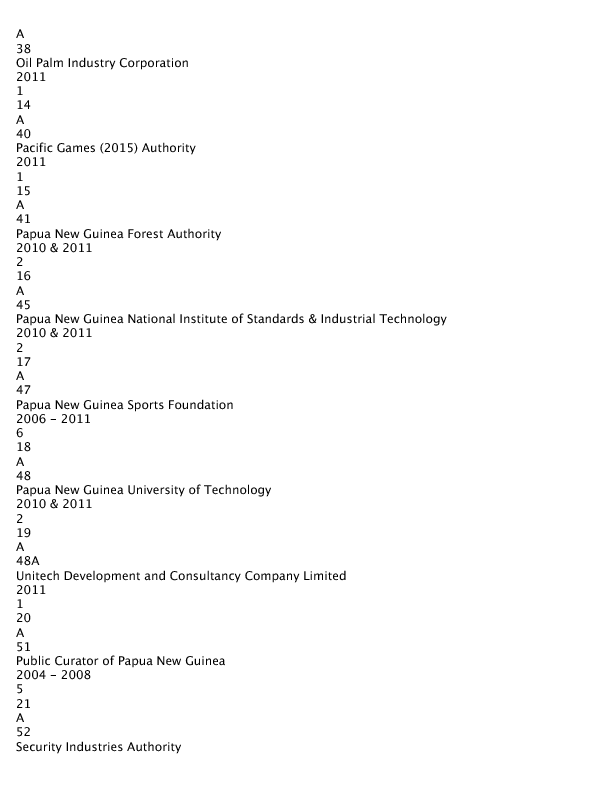

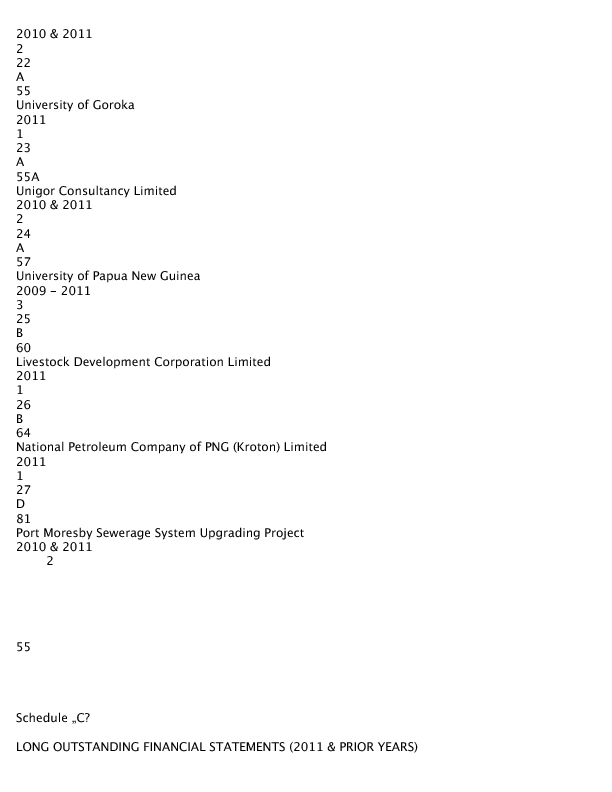

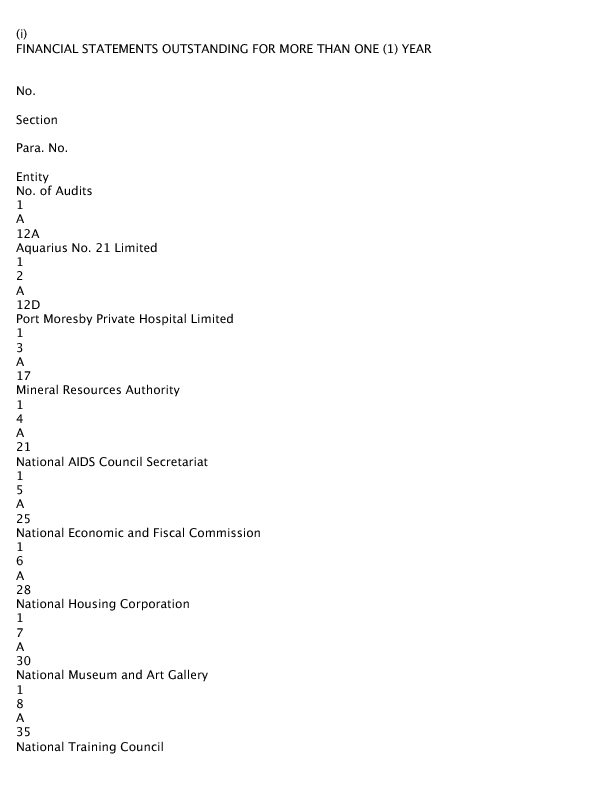

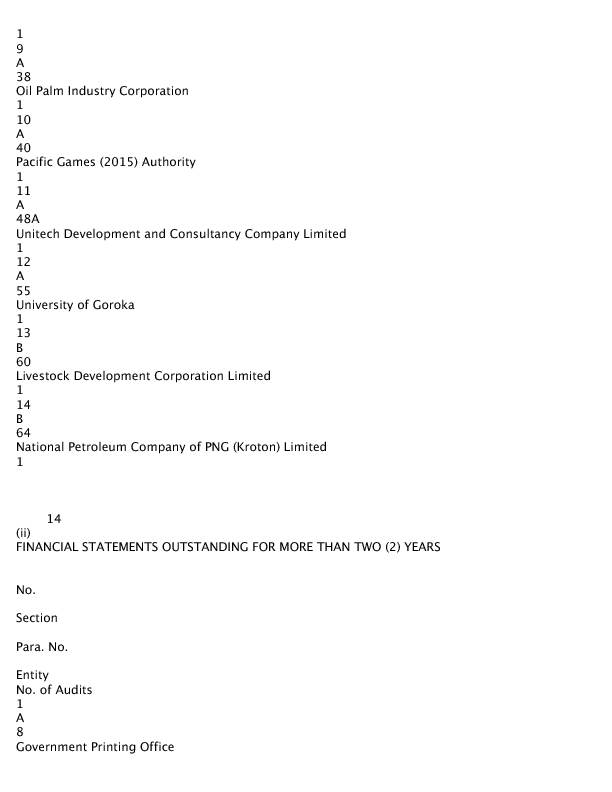

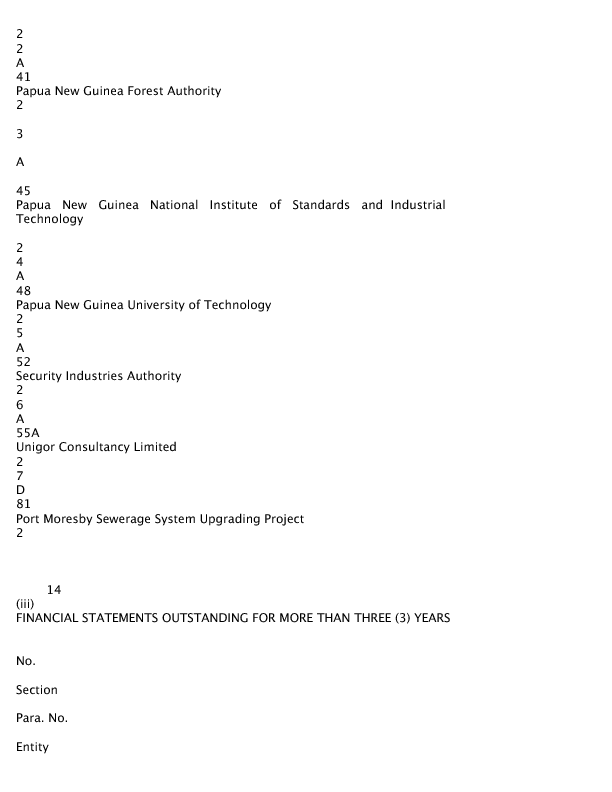

Details of audits that have gone into arrears due to non-submission of financial statements from 2011 or earlier are given below in Table 2 and Schedule „C?.

Table 2

Financial Statements not Submitted

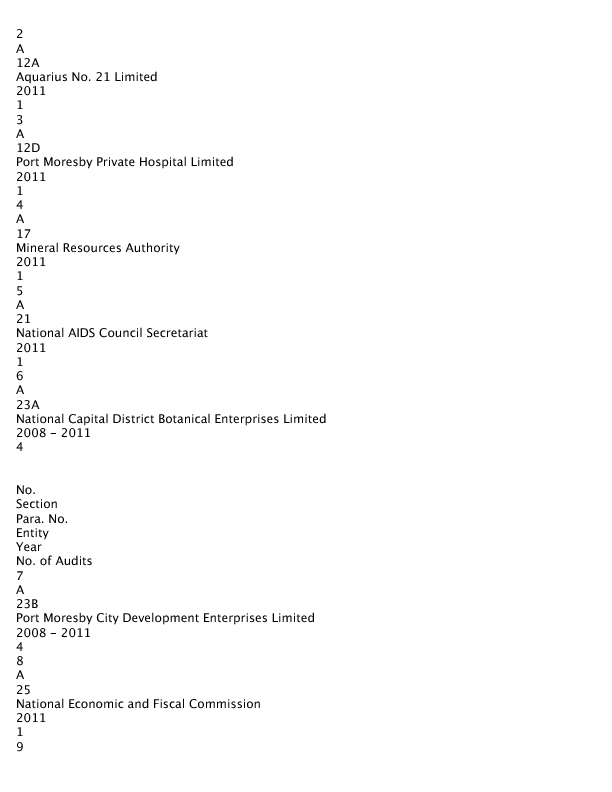

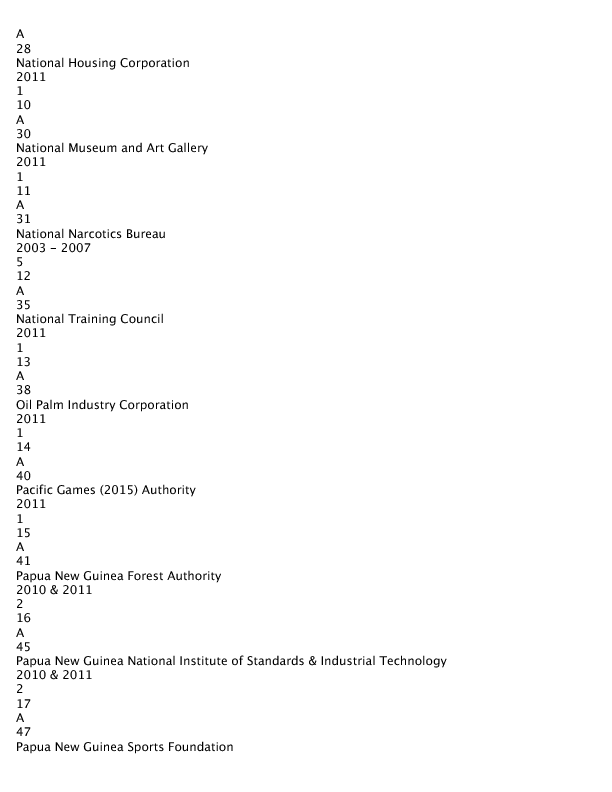

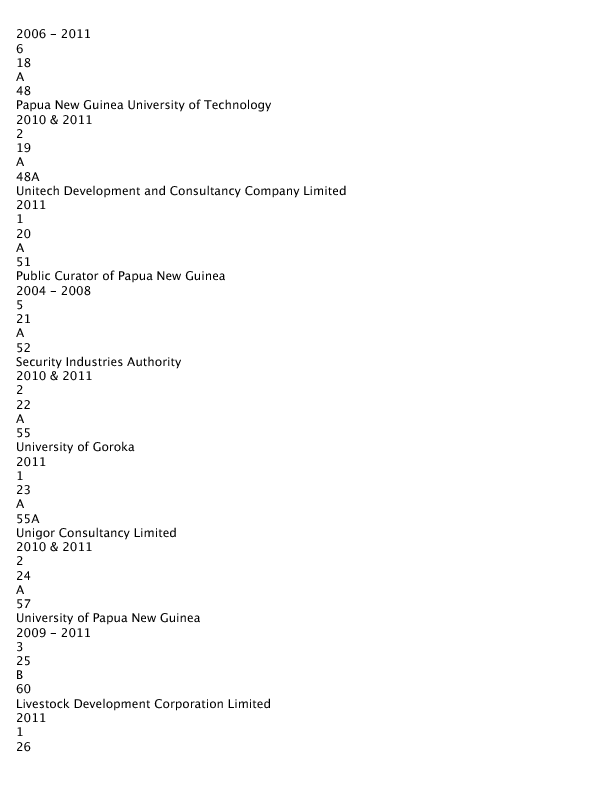

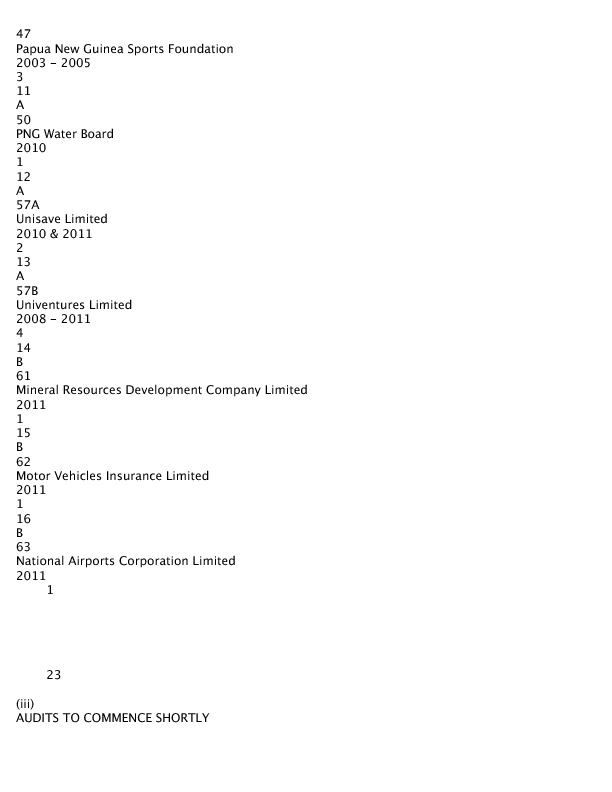

No. Section Para. No. Entity Year No. of Audits 1 A 8 Government Printing Office 2010 & 2011 2

-

Page 13 of 307

-

2 A 12A Aquarius No. 21 Limited 2011 1 3 A 12D Port Moresby Private Hospital Limited 2011 1 4 A 17 Mineral Resources Authority 2011 1 5 A 21 National AIDS Council Secretariat 2011 1 6 A 23A National Capital District Botanical Enterprises Limited 2008 – 2011 4

No. Section Para. No. Entity Year No. of Audits 7 A 23B Port Moresby City Development Enterprises Limited 2008 – 2011 4 8 A 25 National Economic and Fiscal Commission 2011 1 9

-

Page 14 of 307

-

A 28 National Housing Corporation 2011 1 10 A 30 National Museum and Art Gallery 2011 1 11 A 31 National Narcotics Bureau 2003 – 2007 5 12 A 35 National Training Council 2011 1 13 A 38 Oil Palm Industry Corporation 2011 1 14 A 40 Pacific Games (2015) Authority 2011 1 15 A 41 Papua New Guinea Forest Authority 2010 & 2011 2 16 A 45 Papua New Guinea National Institute of Standards & Industrial Technology 2010 & 2011 2 17 A 47 Papua New Guinea Sports Foundation

-

Page 15 of 307

-

2006 – 2011 6 18 A 48 Papua New Guinea University of Technology 2010 & 2011 2 19 A 48A Unitech Development and Consultancy Company Limited 2011 1 20 A 51 Public Curator of Papua New Guinea 2004 – 2008 5 21 A 52 Security Industries Authority 2010 & 2011 2 22 A 55 University of Goroka 2011 1 23 A 55A Unigor Consultancy Limited 2010 & 2011 2 24 A 57 University of Papua New Guinea 2009 – 2011 3 25 B 60 Livestock Development Corporation Limited 2011 1 26

-

Page 16 of 307

-

B 64 National Petroleum Company of PNG (Kroton) Limited 2011 1 27 D 81 Port Moresby Sewerage System Upgrading Project 2010 & 2011 2

Arrears Reduction Strategies

During the last Audit Cycle, I have taken steps as in the past to remind various entities of their responsibilities to submit the financial statements on a timely basis. These steps include but are not limited to the following:

(i) Forwarding reminder letters to entities on a regular basis until the submission of the financial statements.

(ii) Copies of these reminder letters were forwarded to the Public Accounts Committee and to the Secretary for Finance for their necessary action.

(iii) My officers have visited various entities and had meeting with the Chief Executive Officers regarding non-submission of the financial statements and drew their attention to the responsibility under the Public Finances (Management) Act and resultant breach of the Public Finances (Management) Act.

E.7 Non-Compliance of the Salaries and Conditions Monitoring Committee Act, 1988

The SCMC was established as the regulatory mechanism for salaries and wages in the public sector. Sadly, some public bodies do not comply with the provisions of this Act because of legislative changes in their constituent Acts. As a result, these bodies pay salaries and allowances without any monitoring from this Committee. Consequently, they have contravened Section (3) of the Salaries and Conditions Monitoring Committee Act, (SCMC) 1988 which stipulates:

“(1) The provisions of this Act apply notwithstanding anything in any other law relating to the determination of salaries and conditions or employment of employees of a public authority; and (2) Where by or under any law, power is given to a public authority, to determine or vary the salaries and conditions of employment of employees of the public authority, that power shall be exercised subject to this Act.”

E.8 Non-compliance with the Audit Act, 1989

Some entities owned by the State have amended their enabling Acts to exclude my Office from performing the audit of those entities and appointed their own auditors in contrary to the Audit Act. The following state owned entities have appointed their own Auditors.

(i) Petromin Limited

-

Page 17 of 307

-

(ii) National Development Bank Limited

E.9 Lack of Basic Accounting Records and Inadequate Control Systems

As reported in previous years, I noted serious deficiencies in accounting and record keeping and maintenance of internal controls during the course of audits. These deficiencies, which contributed to the limitation on the scope of my audit procedures, included:

(i) bank reconciliation statements not being prepared in a timely way or not being prepared at all; (ii) transactions not having supporting documentation; (iii) fixed asset registers not being properly kept or maintained; (iv) no consistent and proper valuation of assets; (v) physical asset stock-takes not being carried out; (vi) property being acquired or disposed of without proper procedures being followed; (vii) failure to comply with International Financial Reporting Standards in the preparation of the financial statements; (viii) travel and other allowances not being fully acquitted;

(ix) Internal Revenue Commission (IRC) regulations on payment of taxes not being followed; (x) entities paying housing allowances and Boards members allowances without tax but allowing officers to pay the tax; (xi) accounting, administrative and procedural manuals not being available; (xii) public servants serving on Statutory Boards receiving Board allowances contrary to regulations; (xiii) ineffective internal audit functions; and (xiv) ineffective budget controls.

The above factors contributed to the limitations on the scope of my audits which resulted in issuance of Disclaimer Audit Opinions in respect of many of the reports issued during the year, as shown in Attachment „D?.

E.10 Poor Financial Management

Over a number of years, I have expressed my concern about public bodies? poor accounting records, weaknesses in internal controls and management information systems, and non- compliance with legislative requirements and International Financial Reporting Standards.

I also consider that a large number of Chief Executive Officers do not pay sufficient attention to financial management in their entities. In my view, the concept of effective, prudent and efficient financial management is yet to be absorbed by many Chief Executive Officers.

E.11 Recommendations for Improvement

Consistent with comments in previous years? Reports, I will report to the Parliament in future that proper accounting records and adequate internal control systems must exist in all public entities subject to my audit. For that to be achieved, I believe that Chief Executive Officers are required to exercises proper leadership that provides an environment where there is:

(i) Timely submission of financial statements; (ii) Improved record keeping and documentation;

-

Page 18 of 307

-

(iii) Maintenance and provision of quality information; (iv) Effective implementation of internal control systems; and (v) Entity financial management that is carried out by qualified and experienced accountants.

E.12 Improvement Strategies

In my view, for improvement to occur:

(i) Chief Executive Officers must employ well trained accounting staff to manage the financial affairs of the organisation;

(ii) Chief Executive Officers must understand the value of and how to implement a strong governance framework and their performance assessed against implementation of the framework;

(iii) Parliament must increase its reviews of the management of public entities and provide Chief Executive Officers with the incentives to improve their management structures; and

(iv) Department of Finance must exercise its discretion to invoke Section 63(8) of the Public Finances (Management) Act, 1995 (as amended) by withholding funds for those entities that have not submitted their financial statements until the financial statements are submitted and/or completion of the audit.

E.13 Structure of the Report

This Report is structured as follows:

Section A – Public Bodies and Their Subsidiaries; Section B – National Government Owned Companies; Section C – National Government Shareholdings in Other Companies; Section D – Projects; and Section E – Problem Audits.

ATTACHMENT „A?

STATUS OF CURRENT YEAR AUDITS 2012

No. Status of Current Year Audits Number of Entities

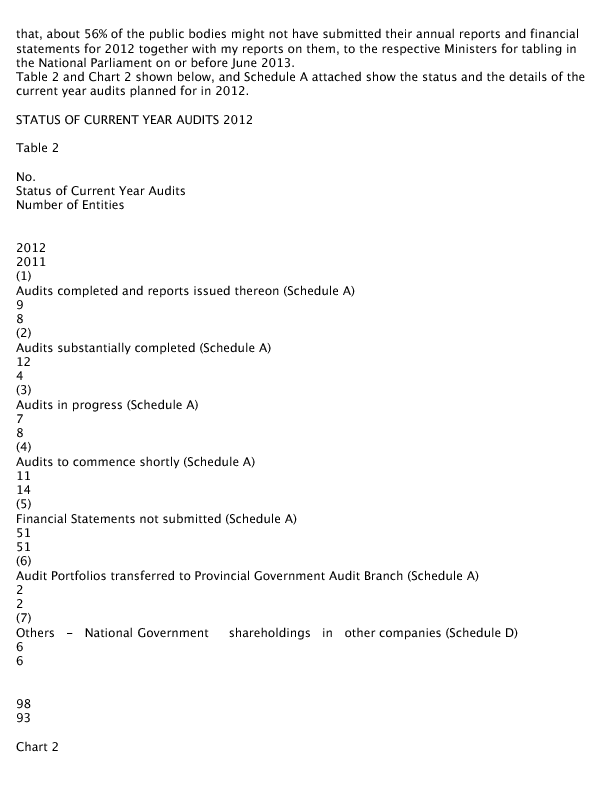

2012 2011 (1) Audits completed and reports issued thereon (Schedule A) 9 8 (2) Audits substantially completed (Schedule A) 12

-

Page 19 of 307

-

4 (3) Audits in progress (Schedule A) 7 8 (4) Audits to commence shortly (Schedule A) 11 14 (5) Financial Statements not submitted (Schedule A) 51 51 (6) Audit Portfolios transferred to Provincial Government Audit Branch (Schedule A)

2

2 (7) Others – National Government shareholdings in other companies (Schedule D) 6 6

98 93

Please refer to Pages 325 to 336 for Schedules A to F.

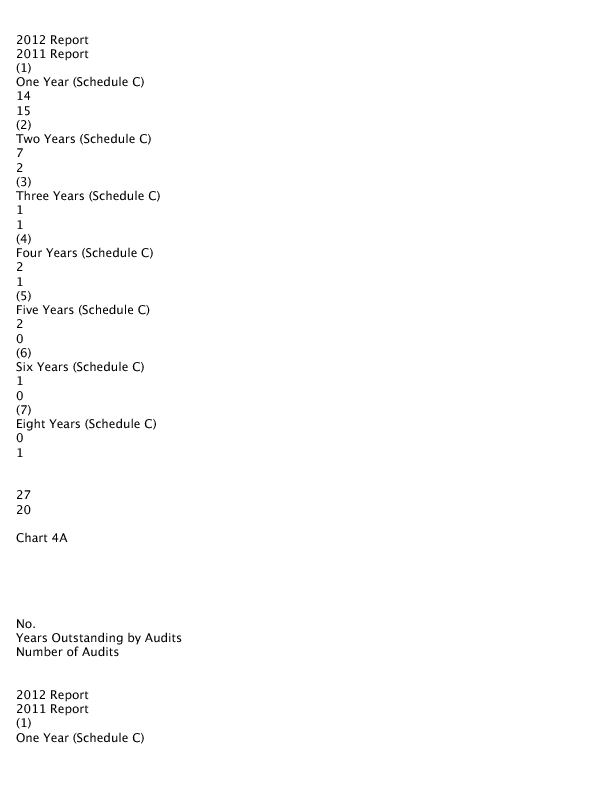

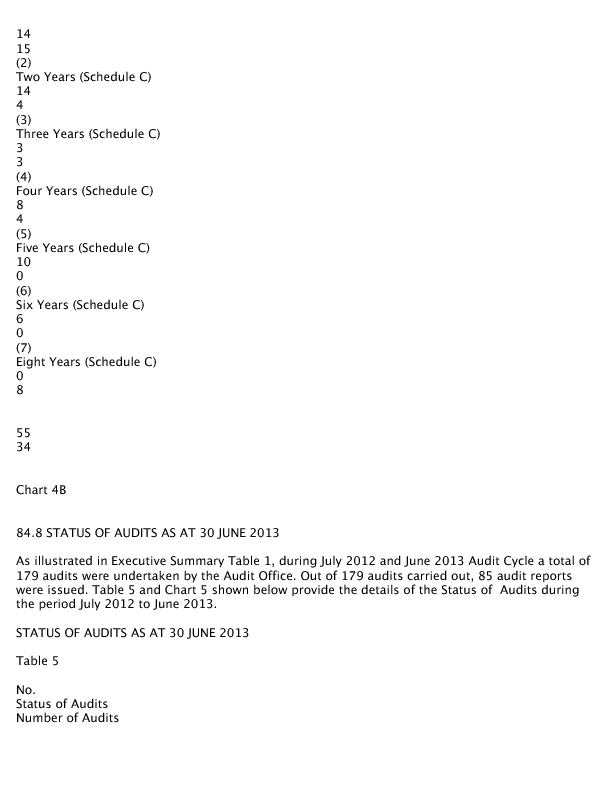

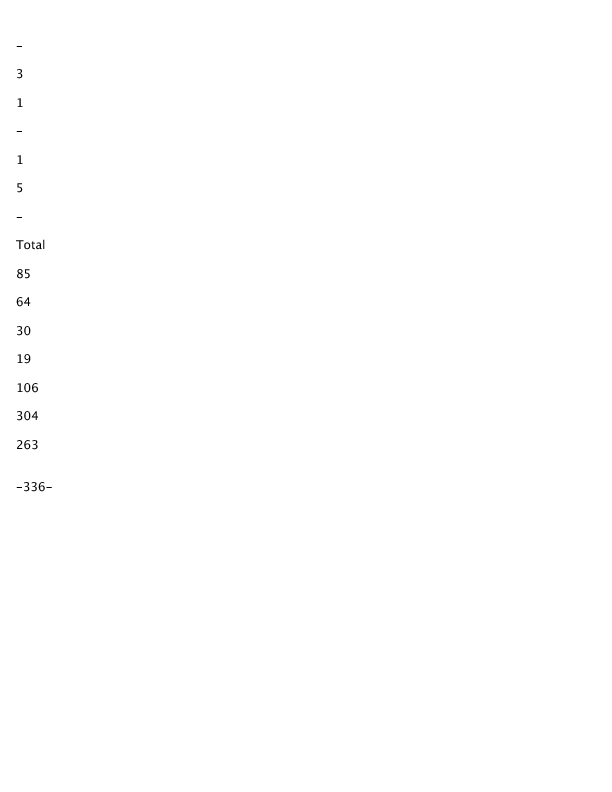

ATTACHMENT „B? STATUS OF AUDITS IN ARREARS BY NUMBER OF AUDITS (2011 AND PRIOR YEARS)

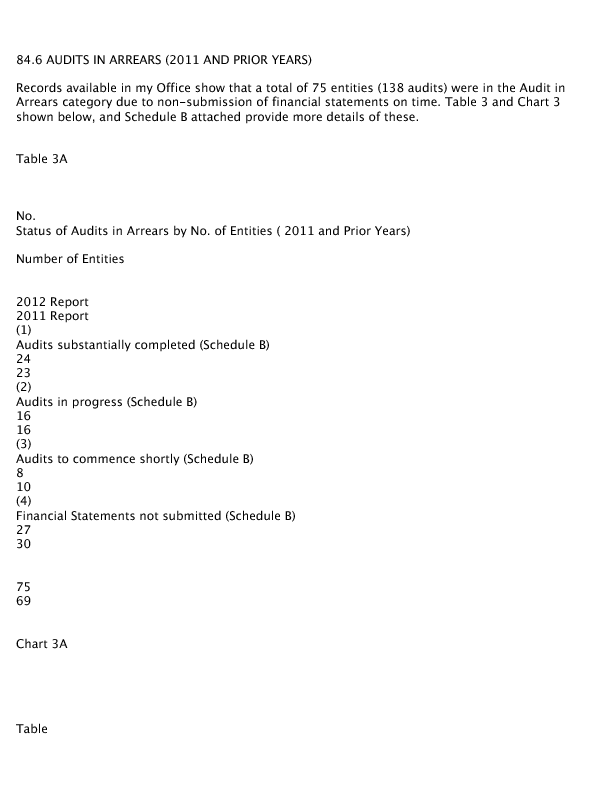

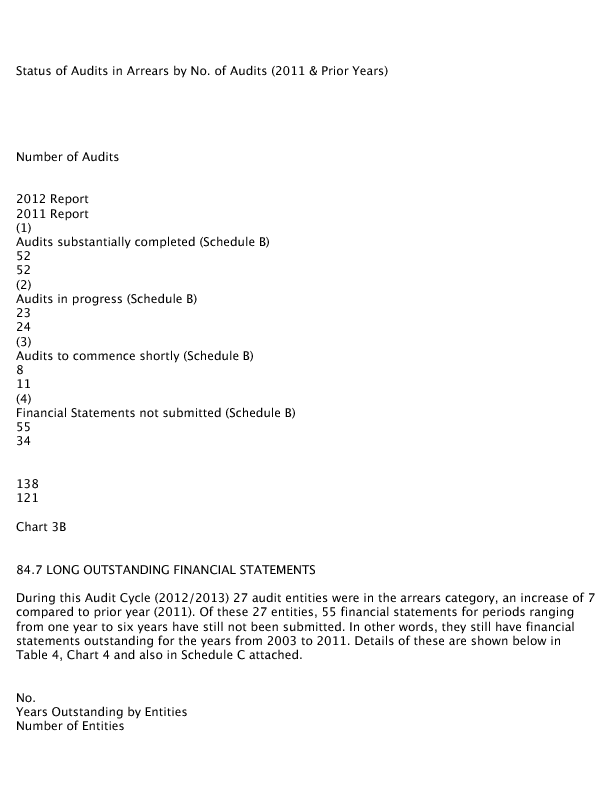

No. Status of Audits in Arrears by No. of Audits (2011 & Prior Years)

Number of Audits

2012 Report 2011 Report (1) Audits substantially completed (Schedule B) 52 52 (2) Audits in progress (Schedule B)

-

Page 20 of 307

-

23 24 (3) Audits to commence shortly (Schedule B) 8 11 (4) Financial Statements not submitted (Schedule B) 55 34

138 121

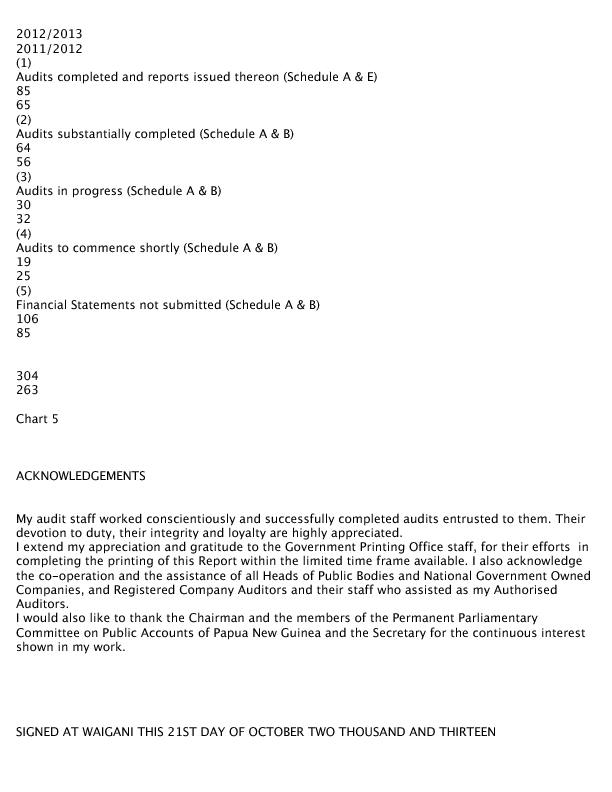

ATTACHMENT „C? STATUS OF AUDITS AS AT 30 JUNE 2013

No. Status of Audits Number of Audits

2012/2013 2011/2012 (1) Audits completed and reports issued thereon (Schedule A & E) 85 65 (2) Audits substantially completed (Schedule A & B) 64 56 (3) Audits in progress (Schedule A & B) 30 32 (4) Audits to commence shortly (Schedule A & B) 19 25 (5) Financial Statements not submitted (Schedule A & B) 106 85

-

Page 21 of 307

-

304 263

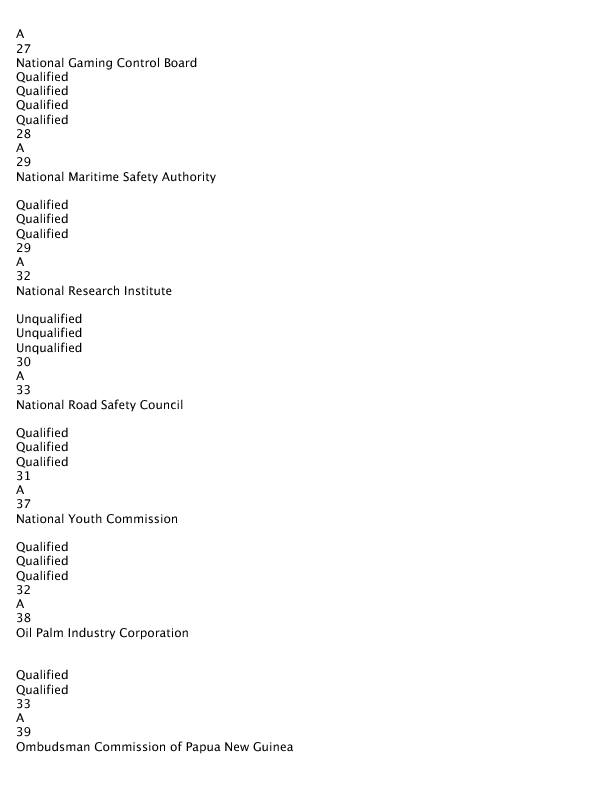

ATTACHMENT „D?

TYPES OF AUDIT OPINIONS ISSUED

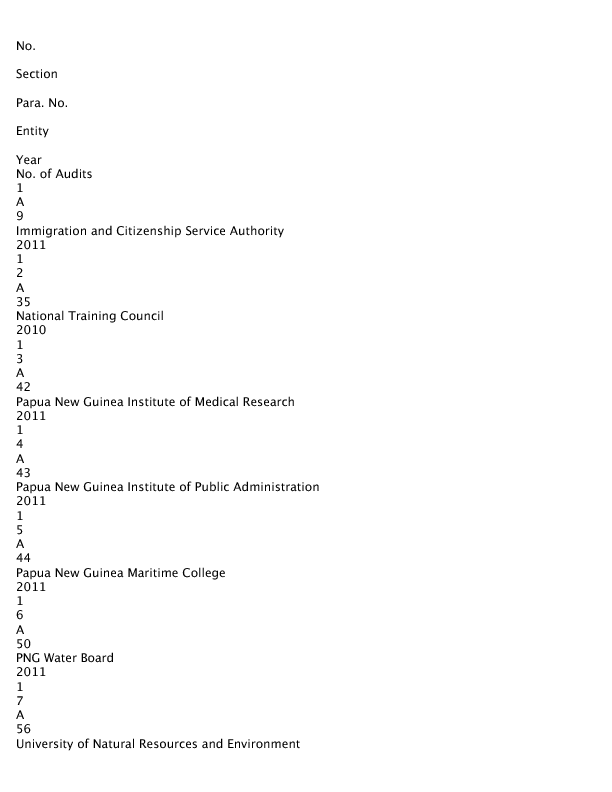

(i) UNQUALIFIED OPINION

No. Section Para. No. Entity Year No. of Audits 1 A 2 Bank of Papua New Guinea 2012 1 2 A 9 Immigration and Citizenship Service Authority 2010 1 3 A 10 Independence Fellowship Trust 2011 1 4 A 15 Kokonas Indastri Koporesen 2011

-

Page 22 of 307

-

1 5 A 15A Papua New Guinea Coconut Extension Fund 2011 1 6 A 15B Papua New Guinea Coconut Research Fund 2011 1 7 A 16 Legal Training Institute 2011 1 8 A 20 National Agriculture Research Institute 2012 1 9 A 32 National Research Institute 2011 1 10 A 54 Tourism Promotion Authority 2011 1 11 B 68 Post PNG Limited 2012 1 12 B 69A Kalang Advertising Limited 2011 1 13 B

-

Page 23 of 307

-

69B PNG Directories Limited 2010 & 2011 2 14 D 79 Lae Port Development Project 2010 & 2011 2 15 D 80 National Capital District Commission Urban Youth Employment Project 2011 & 2012 2 16 D 82 Productive Partnership in Agriculture Project 2011 & 2012 2

20 (ii) QUALIFIED OPINION

No. Section Para. No. Entity Year No. of Audits 1 A 3 Border Development Authority 2010 1 2 A 5 Cocoa Board of Papua New Guinea 2011 1 3 A

-

Page 24 of 307

-

5A Cocoa Stabilization Fund 2011 1 4 A 7 Coffee Industry Corporation Limited 2011 1 5 A 7A Coffee Industry Fund 2011 1 6 A 7B Patana No. 61 Limited 2011 1 7 A 11 Independent Consumer and Competition Commission 2012 1 8 A 12 Independent Public Business Corporation 2010 1 9 A 12B General Business Trust 2011 1 10 A 13 Industrial Centres Development Corporation 2009 1 11 A 14 Investment Promotion Authority 2011

-

Page 25 of 307

-

1 12 A 19 National Agriculture Quarantine and Inspection Authority 2012 1 13 A 26 National Fisheries Authority 2010 & 2011 2 14 A 27 National Gaming Control Board 2012 1 15 A 29 National Maritime Safety Authority 2010 & 2011 2 16 A 33 National Road Safety Council 2010 & 2011 2 17 A 37 National Youth Commission 2011 1 18 A 38 Oil Palm Industry Corporation 2009 & 2010 2 19 A 44 Papua New Guinea Maritime College 2008 1 20 A

-

Page 26 of 307

-

56 University of Natural Resources and Environment 2010 1 21 B 59 Air Niugini Limited 2011 1 22 B 61 Mineral Resources Development Company Limited 2010 1 23 B 62 Motor Vehicles Insurance Limited 2009 1

No.

Section

Para. No.

Entity

Year

No. of Audits 24 B 63 National Airports Corporation Limited 2010 1 25 B 63B PNG Air Services Limited 2011 1 26 B 65 NCD Water and Sewerage Limited (Eda Ranu)

-

Page 27 of 307

-

2011 & 2012 2 27 B 66 Papua New Guinea Ports Corporation Limited 2011 1 28 B 69 Telikom PNG Limited 2011 1 29 B 69A Kalang Advertising Limited 2010 1

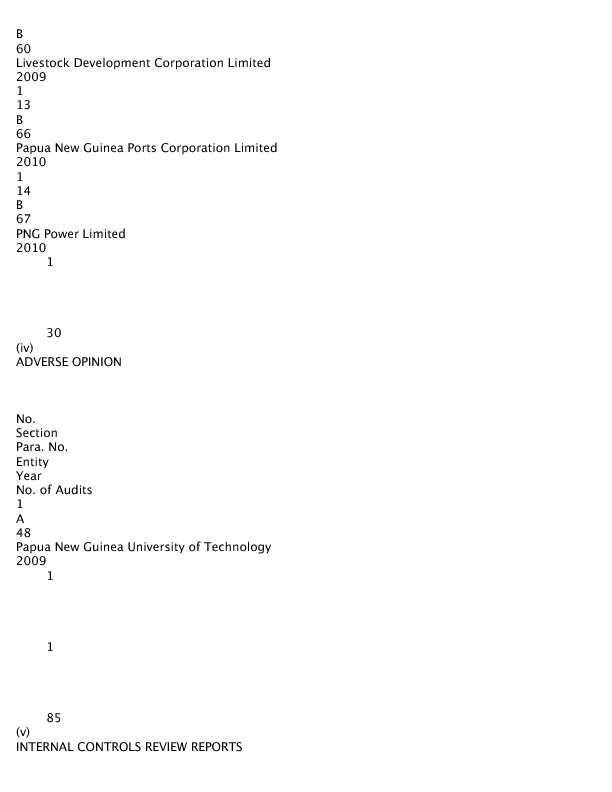

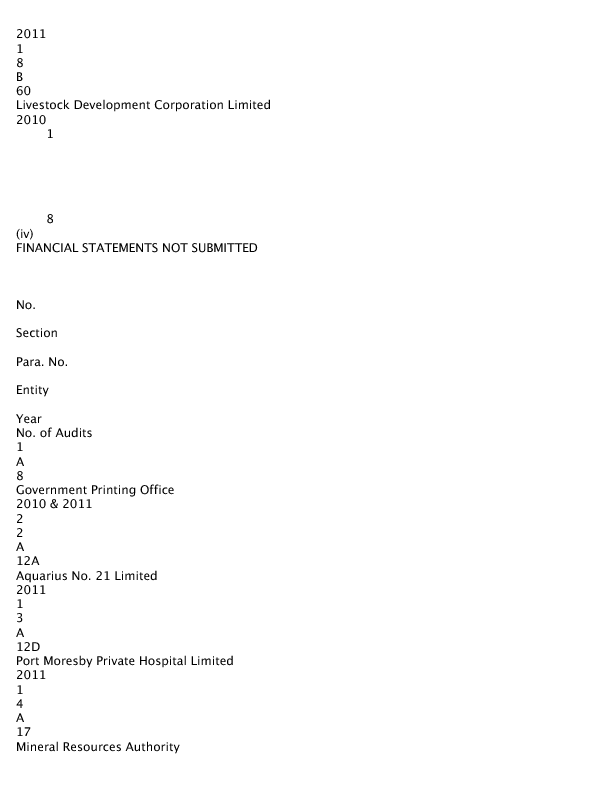

34 (iii) DISCLAIMED OPINION

No. Section Para. No. Entity Year No. of Audits 1 A 6 Cocoa Coconut Institute Limited of Papua New Guinea 2008 – 2011 4 2 A 8 Government Printing Office 2009 1 3 A 12 Independent Public Business Corporation

-

Page 28 of 307

-

2011 1 4 A 12C PNG Dams Limited 2004 – 2011 8 5 A 22 National Broadcasting Corporation 2010 & 2011 2 6 A 23 National Capital District Commission 2009 1 7 A 41 Papua New Guinea Forest Authority 2008 1 8 A 46 Papua New Guinea Radio Communications and Telecommunications Technical Authority (PANGTEL) 2010 1 9 A 48A Unitech Development and Consultancy Company Limited 2010 1 10 A 55A Unigor Consultancy Limited 2004 – 2009 6 11 A 57 University of Papua New Guinea 2008 1 12

-

Page 29 of 307

-

B 60 Livestock Development Corporation Limited 2009 1 13 B 66 Papua New Guinea Ports Corporation Limited 2010 1 14 B 67 PNG Power Limited 2010 1

30 (iv) ADVERSE OPINION

No. Section Para. No. Entity Year No. of Audits 1 A 48 Papua New Guinea University of Technology 2009 1

1

85 (v) INTERNAL CONTROLS REVIEW REPORTS

-

Page 30 of 307

-

No. Section Para. No. Entity Year No. of Audits 1 A 57 University of Papua New Guinea 2007 – June 2010 1

1

86

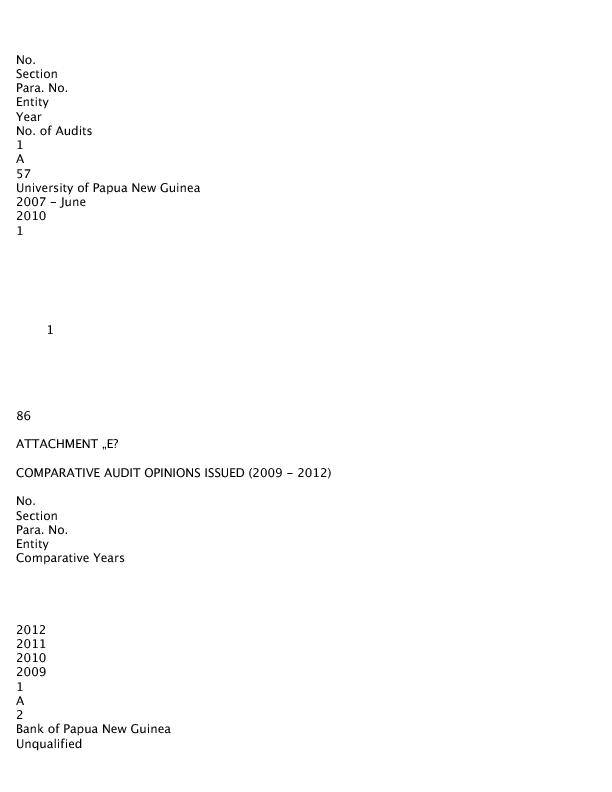

ATTACHMENT „E?

COMPARATIVE AUDIT OPINIONS ISSUED (2009 – 2012)

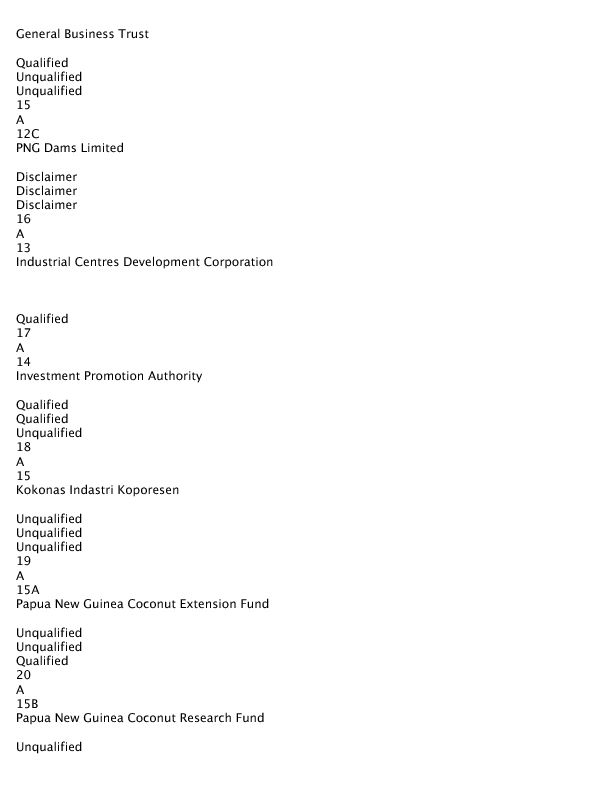

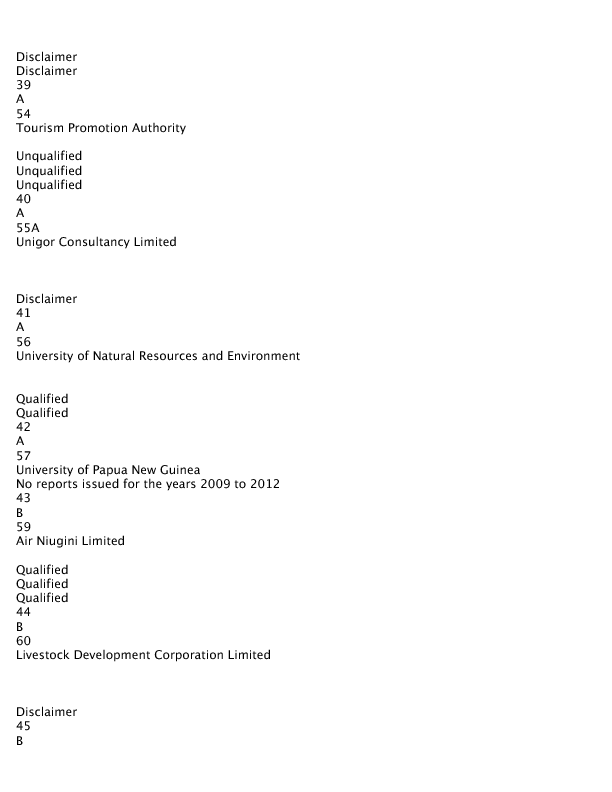

No. Section Para. No. Entity Comparative Years

2012 2011 2010 2009 1 A 2 Bank of Papua New Guinea Unqualified

-

Page 31 of 307

-

Unqualified Unqualified Unqualified 2 A 3 Border Development Authority

Qualified Unqualified 3 A 5 Cocoa Board of Papua New Guinea

Qualified Qualified Qualified 4 A 5A Cocoa Stabilization Fund

Qualified Qualified Qualified 5 A 6 Cocoa Coconut Institute Limited of Papua New Guinea

Disclaimer Disclaimer Disclaimer 6 A 7 Coffee Industry Corporation Limited

Qualified Qualified Qualified 7 A 7A Coffee Industry Fund

Qualified Qualified Qualified

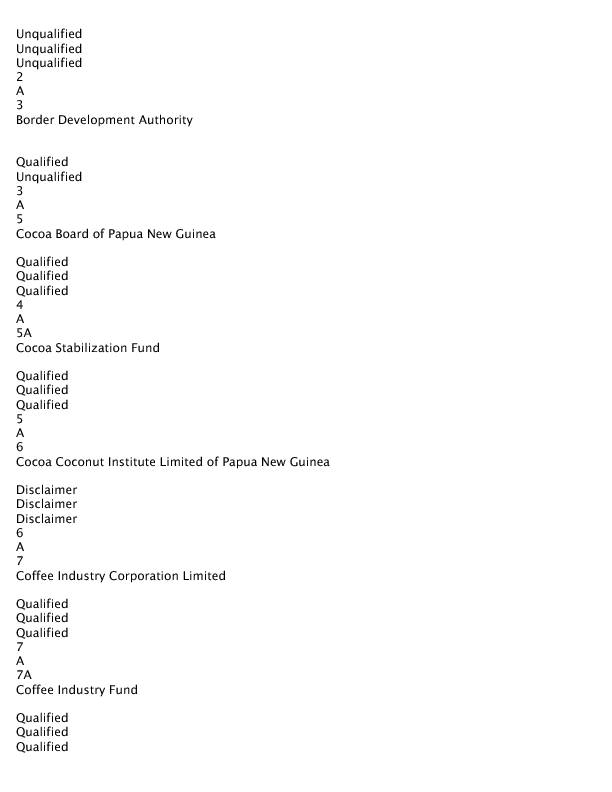

-

Page 32 of 307

-

8 A 7B Patana No. 61 Limited

Qualified Qualified Qualified 9 A 8 Government Printing Office

Disclaimer 10 A 9 Immigration and Citizenship Service Authority

Unqualified New 11 A 10 Independence Fellowship Trust

Unqualified Unqualified Disclaimer 12 A 11 Independent Consumer and Competition Commission Qualified Unqualified Unqualified Unqualified 13 A 12 Independent Public Business Corporation

Disclaimer Qualified Qualified 14 A 12B

-

Page 33 of 307

-

General Business Trust

Qualified Unqualified Unqualified 15 A 12C PNG Dams Limited

Disclaimer Disclaimer Disclaimer 16 A 13 Industrial Centres Development Corporation

Qualified 17 A 14 Investment Promotion Authority

Qualified Qualified Unqualified 18 A 15 Kokonas Indastri Koporesen

Unqualified Unqualified Unqualified 19 A 15A Papua New Guinea Coconut Extension Fund

Unqualified Unqualified Qualified 20 A 15B Papua New Guinea Coconut Research Fund

Unqualified

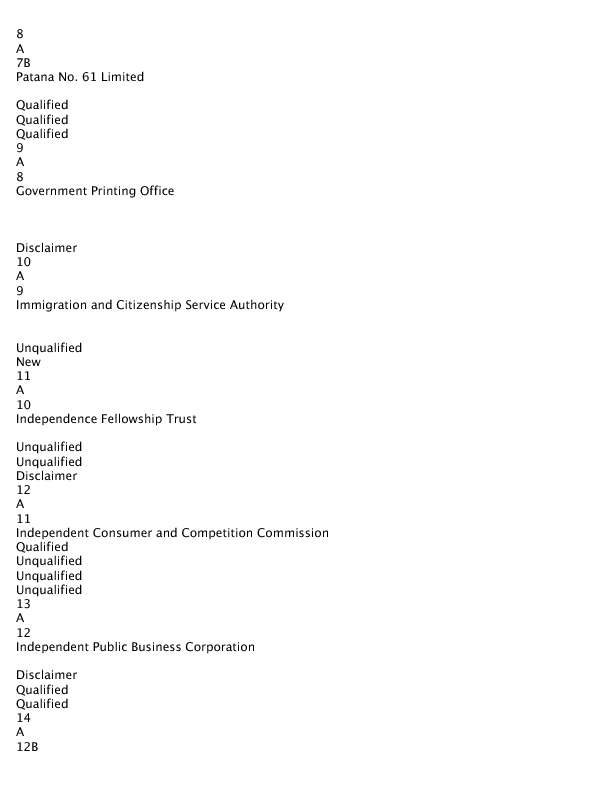

-

Page 34 of 307

-

Unqualified Qualified 21 A 16 Legal Training Institute

Unqualified Unqualified Unqualified 22 A 19 National Agriculture Quarantine and Inspection Authority Qualified Qualified Qualified Qualified 23 A 20 National Agriculture Research Institute Unqualified Unqualified Unqualified Unqualified 24 A 22 National Broadcasting Corporation

Disclaimer Disclaimer Disclaimer 25 A 23 National Capital District Commission

Disclaimer 26 A 26 National Fisheries Authority

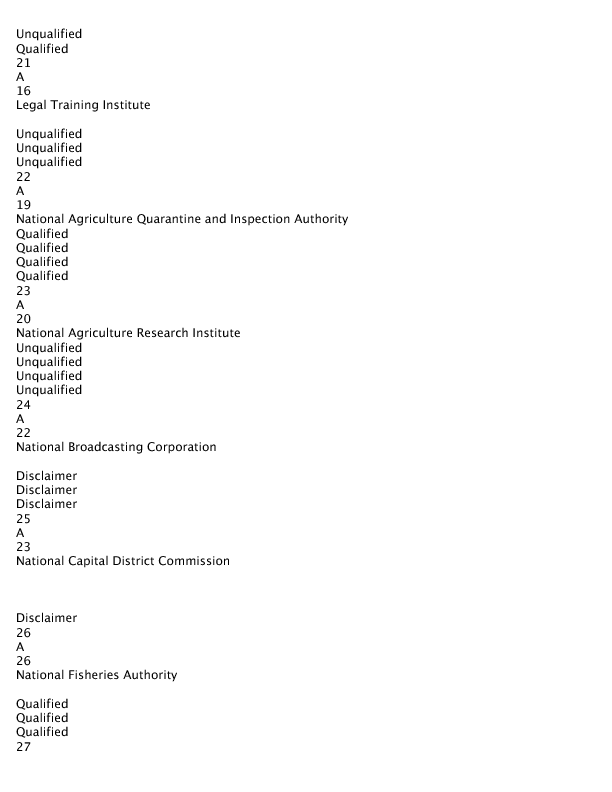

Qualified Qualified Qualified 27

-

Page 35 of 307

-

A 27 National Gaming Control Board Qualified Qualified Qualified Qualified 28 A 29 National Maritime Safety Authority

Qualified Qualified Qualified 29 A 32 National Research Institute

Unqualified Unqualified Unqualified 30 A 33 National Road Safety Council

Qualified Qualified Qualified 31 A 37 National Youth Commission

Qualified Qualified Qualified 32 A 38 Oil Palm Industry Corporation

Qualified Qualified 33 A 39 Ombudsman Commission of Papua New Guinea

-

Page 36 of 307

-

Unqualified Unqualified 34 A 41 Papua New Guinea Forest Authority No reports issued for the years 2009 to 2012 35 A 44 Papua New Guinea Maritime College No reports issued for the years 2009 to 2012

No.

Section Para. No.

Entity Comparative Years

2012 2011 2010 2009 36 A 46 Papua New Guinea Radio Communications and Telecommunications Technical Authority (PANGTEL)

Disclaimer Disclaimer 37 A 48 Papua New Guinea University of Technology

Adverse 38 A 48A Unitech Development and Consultancy Company Limited

-

Page 37 of 307

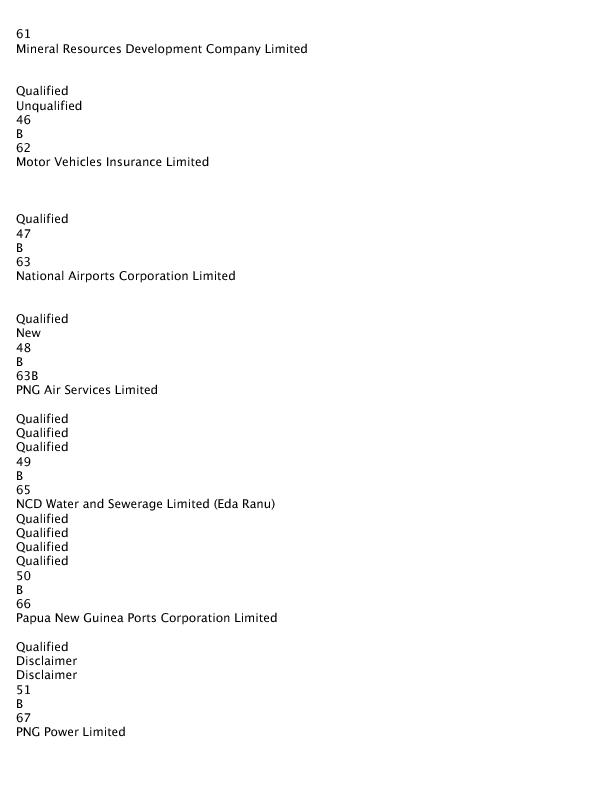

-

Disclaimer Disclaimer 39 A 54 Tourism Promotion Authority

Unqualified Unqualified Unqualified 40 A 55A Unigor Consultancy Limited

Disclaimer 41 A 56 University of Natural Resources and Environment

Qualified Qualified 42 A 57 University of Papua New Guinea No reports issued for the years 2009 to 2012 43 B 59 Air Niugini Limited

Qualified Qualified Qualified 44 B 60 Livestock Development Corporation Limited

Disclaimer 45 B

-

Page 38 of 307

-

61 Mineral Resources Development Company Limited

Qualified Unqualified 46 B 62 Motor Vehicles Insurance Limited

Qualified 47 B 63 National Airports Corporation Limited

Qualified New 48 B 63B PNG Air Services Limited

Qualified Qualified Qualified 49 B 65 NCD Water and Sewerage Limited (Eda Ranu) Qualified Qualified Qualified Qualified 50 B 66 Papua New Guinea Ports Corporation Limited

Qualified Disclaimer Disclaimer 51 B 67 PNG Power Limited

-

Page 39 of 307

-

Disclaimer Disclaimer 52 B 68 Post PNG Limited Unqualified Unqualified Unqualified Unqualified 53 B 69 Telikom PNG Limited

Qualified Unqualified Qualified 54 B 69A Kalang Advertising Limited

Unqualified Qualified Qualified 55 B 69B PNG Directories Limited

Unqualified Unqualified Unqualified 56 D 79 Lae Port Development Project

Unqualified Unqualified New 57 D 80 National Capital District Commission Urban Youth Employment Project Unqualified Unqualified Newly Created 58

-

Page 40 of 307

-

D 82 Productive Partnership in Agriculture Project Unqualified Unqualified Newly Created

xxii

SECTION A

PUBLIC BODIES AND THEIR SUBSIDIARIES

1. FOREWORD

-

Page 41 of 307

-

This Section of my Report deals with the audit of public bodies and their subsidiaries.

The auditing and reporting requirements of the public bodies and their subsidiaries are stipulated under Section 8 of the Audit Act, 1989 (as amended). My findings in that regard are detailed in paragraphs 2 to 57B of this part of my Report.

2. BANK OF PAPUA NEW GUINEA

2.1 INTRODUCTION

2.1.1 Legislation and Objectives of the Bank

The Bank of Papua New Guinea was established under the Central Banking Act (Chapter 138). This Act was in operation until 16 June, 2000 when it was repealed and replaced by the Central Banking Act, 2000. The main objectives of the Bank of Papua New Guinea as stipulated in the new Act are:

(a) to formulate and implement the monetary policy with a view to achieving and maintaining price stability; (b) to formulate financial regulation and prudential standards to ensure stability of the financial system in Papua New Guinea; (c) to promote an efficient national and international payments system; and

(d) subject to the above, to promote macro-economic stability and economic growth in Papua New Guinea. 2.1.2 Functions of the Bank

The primary functions of the Bank are to:

(a) issue currency;

(b) act as banker and agent of the Government;

(c) regulate banking, credit and other financial services as empowered by the Act or by any other law of the Independent State of Papua New Guinea;

(d) manage the gold, foreign exchange and other international reserves of Papua New Guinea;

(e) perform any function conferred on it by or under international agreement to which Papua New Guinea is a party;

(f) perform any other functions conferred on it by or under any other law of Papua New Guinea; and

(g) advise the Minister as soon as practicable where the Bank considers that a body regulated by the Central Bank is in financial difficulty.

Bank of Papua New Guinea

-

Page 42 of 307

-

2.1.3 Structural Reforms at the Bank

In addition to the Central Banking Act which was enacted in June 2000, three (3) other Acts were legislated in 2000 which gave enormous responsibilities to the Bank. These other Acts are: (a) The Banks and Financial Institutions Act, 2000; (b) The new Superannuation Act, 2000; and (c) The new Life Insurance Act, 2000.

Each of these Acts provides additional responsibilities to the Bank.

2.2 AUDIT OBSERVATIONS

2.2.1 Comments on Financial Statements

My report to the Ministers under Section 8(4) of the Audit Act, 1989 (as amended), on the financial statements of the Bank for the year ended 31 December, 2012 was issued on 24 June, 2013. The report did not contain any qualification. 2.2.2 Audit Observations Reported to the Ministers

My report to the Ministers under Section 8(2) of the Audit Act, 1989 (as amended), on the inspection and audit of the accounts and records of the Bank for the year ended 31 December, 2012 was issued on 24 June, 2013. The report contained the following matter:

Net Asset Deficiency – Going Concern

The Bank has a net capital deficiency as at 31 December, 2012 where the Bank?s total liabilities exceeded its total assets by K1.2 billion. The capital deficiency along with other matters set forth in Note 1(a) indicated the existence of a material uncertainty that may cast doubt about the Bank?s ability to continue as a going concern and therefore the Bank may be unable to realise its assets and discharge its liabilities in the normal cause of business.

The Bank has brought this matter to the attention of the Minister for Treasury and has submitted a letter dated 9 May, 2012 to the Minister requesting a promissory note for the net asset deficiency. At the time of issuing this report the promissory note was not provided to the Bank.

3. BORDER DEVELOPMENT AUTHORITY

3.1 INTRODUCTION

3.1.1 Legislation

The Border Development Authority was established under the Border Development Authority Act, 2008. This Act came into operation on 7 October, 2008. 3.1.2 The Objectives of the Authority

The objectives of the Authority are to manage and fund development activities in the Border Provinces of Papua New Guinea and to make provision for the functions and powers of the Authority and for related purposes.

-

Page 43 of 307

-

3.1.3 Functions of the Authority

The functions of the Authority generally are to consult with relevant agencies and to supervise and co-ordinate all development activities in each of the border provinces and, without prejudice to the generality of the foregoing, are:- (a) the co-ordination of the planning, and implementation of capital works, infrastructure and socio-economic programs in respect to:- (i) education, health care, road network, communication, transport system, electricity, water, sewerage and all activities relevant to the improvement of basic living standards in the border provinces; (ii) liaison with public bodies, non-government organisations and private enterprise in identifying and negotiating sources of funding for short to medium term activities; (iii) the co-ordination of the development of specifications for contracts for all capital and infrastructure works and the advertising, evaluation and awarding of such contracts; (iv) the supervision and monitoring of the implementation of all contracts relating to such capital and infrastructure works; (v) the transformation of border provinces into agro financial sector by developing their respective natural resources; and (vi) the promotion of investors both foreign and local into the border provinces and to encourage and facilitate international cross border and inter border trade. (b) the establishment of programs and regulatory framework for immigration including the monitoring of immigrants and immigrant activity along the border with respect to:-

(i) establishment of proper state of the art offices, and facilities for relevant government agencies including customs, immigration, quarantine, police, defence force such as security monitoring systems, communication, transport, electricity, water, sewerage, staff accommodation, computers and all other facilities that would be relevant to the administration of border activities; (ii) establishment of dialogue and co-operation with the respective cross border authority or government for the prevention of diseases, drug trafficking, human smuggling, money laundering and other illicit activities; and (iii) the development of long term activities for the establishment of infrastructure and other facilities. (c) such other functions as are likely to assist in the border administration activities.

3.2 AUDIT OBSERVATIONS AND RECOMMENDATIONS

3.2.1 Comments on Financial Statements

My report to the Ministers under Section 8 of the Audit Act, 1989 (as amended), on the financial statements of the Authority for the year ended 31 December, 2010 was issued on 21 February, 2013. The report contained a Qualified Opinion.

“BASIS FOR QUALIFIED OPINION

Other Income (PNG Maritime Transport Limited) – K1,482,562

I noted that PNG Maritime Transport Limited shipping income from passengers and freight collections were banked into BDA bank account without proper checking and verification. I also observed that most of the shipping income general ledger entries were passed based on bank

-

Page 44 of 307

-

statements and not from the receipt books. This indicates a serious control deficiency in relation to collection of revenue and banking of collected funds. Hence, I was unable to place reliance on controls surrounding the collection of receipts from passengers and freights and banking of collected receipts.

Missing Payment Vouchers – K120,714

My examination of payments revealed that on seventeen (17) instances payment vouchers and supporting documents of payments totaling K120,714 were missing. Hence, I was unable to confirm that controls surrounding the custody and filing of source documents are effective. In the absence of payment vouchers and supporting documents I was unable to validate the above payments.

Consultancy Payments – K122,513

My review of consultancy payments revealed that payments totaling K122,513 were made to two (2) consulting firms without properly signed consultancy agreements in place. In the absence of the proper consultancy agreements, I was unable to verify the consultancy payments as valid and correct payments.

QUALIFIED OPINION

In my opinion, except for the effects of the matters described in the Basis for Qualified Opinion paragraphs:

(a) the financial statements are based on proper accounts and records; and

(b) the financial statements are in agreement with those accounts and records and show fairly the state of affairs of the Authority as at 31 December, 2010 and the results of its financial operations for the year then ended.”

3.2.2 Audit Observations Reported to the Ministers

My report to the Ministers under Section 8(2) of the Audit Act, 1989 (as amended), on the inspection and audit of the accounts and records of the Authority for the year ended 31 December, 2010 was issued on 26 September, 2012. The report contained the following comments:

Bank Reconciliation and Payment vouchers

My review of the Authority?s bank reconciliations for Project Account # 1001559482 and Interest Income Account # 1001559487 revealed that reconciliations were not independently reviewed and approved by a responsible officer. As a result, there were unexplained reconciling items noted in their bank reconciliation statements. Further, I noted that payment vouchers were not properly and securely filed for retrieval for timely management reports and audit examination. Consequently, nineteen (19) payment vouchers and their supporting documents were not provided for audit verification.

I recommended management to install proper control measures by reviewing the bank

-

Page 45 of 307

-

reconciliation by a senior officer and to securely file all documentation for future reference.

Granting of Approval Limits

In my last report, I stated that the Minister for Finance and Treasury in 2008 had delegated to Border Development Authority Board the financial approval powers for transactions for acquisition of property and service over K500,000 to an upper limit of K10,000,000 superseding normal procurement procedures stipulated under the Public Finances (Management) Act. I emphasised that these higher approval limits up to K10 million was not consistent with the approval limits set by the Public Finances (Management) Act, 1995 (as amended). Further, I noted that still the excessive delegated financial powers had not been revoked to date. As such, in my view, these excessive financial powers should be reviewed by the Minister responsible.

Non-compliance of Procurement Procedures

Part VII, Section 39 of the Public Finances (Management) Act and Part 13 of the Financial Management Manual explains explicitly the procurement process for procuring goods and services at each threshold. Public tendering attracts attention from wide range of suppliers within Papua New Guinea and overseas. It eliminates goods and services that are of low standard and ensures those procured are of good quality and at a better price. I brought this non-compliance of the Public Finances (Management) Act to management in my last report when the Authority management did not call for public tendering by using international media when procuring seven (7) ships from Indonesia. The Authority also did not observe the procurement process while employing two (2) consultants for feasibility study in relation to the Corporate Plan and Border Development study.

Purchase of Ships

The Authority had entered into a Sales and Purchase Agreement (SPA) with a ship building company in Indonesia to acquire seven (7) ships. I noted that all seven (7) ships arrived in Papua New Guinea. Out of the seven (7) ships, I visited three (3) ships and had discussions with the crew of the ship and according to their view, two (2) of the three (3) ships I visited had to be filled with water to balance the centre of gravity of the ship. They further stated that the metals used to build the ships were of substandard material. Consequently, rust was forming quickly thus the Authority had to maintain the ships on a continuous basis.

PNG Maritime Limited

I noted that PNG Maritime Limited was registered under the Companies Act, 1997 to take charge of the operations of the seven (7) ships. It commenced operations in mid-2010 on an adhoc basis. The financial statements of the company for the period ended 31 December, 2010 was not provided for my review and audit.

Berthing Fees

My examination of the port charges revealed that huge sums of money were paid to PNG Ports Limited for berthing of ships at various ports around the country. The ships were operated on an

-

Page 46 of 307

-

adhoc basis without proper schedule and docked at a port until it was used for operations. As a result of this uncertainty, ships were docked for prolonged periods resulting in additional charges being imposed by PNG Ports Limited.

Breach of Functions

My examination of the Authority?s Act revealed that its functions and powers do not provide for the Authority to make donations to groups and individuals. I noted that since its establishment, the Authority had donated funds to individuals and groups for various reasons for which valid explanations were not provided by the Authority.

3.3 STATUS OF FINANCIAL STATEMENTS

At the time of preparing this Report, the inspection and audit of the accounts and records and examination of the financial statements of the Authority for the year ended 31 December, 2011was in progress. The financial statements for the year ended 31 December, 2012 had not been submitted for my inspection and audit.

4. CIVIL AVIATION SAFETY AUTHORITY OF PAPUA NEW GUINEA

4.1 INTRODUCTION

4.1.1 Legislation

The Civil Aviation Safety Authority of Papua New Guinea was established on 1 January, 2010 after the enactment of the Civil Aviation Act, 2000. 4.1.2 Functions of the Authority

The principal functions of the Authority are to: undertake activities that promote safety in civil aviation at a reasonable cost; ensure the provision of air traffic services, aeronautical communications services and aeronautical navigation services; ensure the provision of meteorological services and science; and to own, operate, manage and maintain airports.

4.2 STATUS OF FINANCIAL STATEMENTS

At the time of preparing this Report, field work associated with the inspection and audit of the accounts and records and the examination of the financial statements for the year ended 31 December, 2009 had been completed and the results were being evaluated.

The field work associated with the inspection and audit of the accounts and records and the examination of the financial statements of the Authority for the years ended 31 December, 2010 and 2011 were in progress.

The financial statements for the year ended 31 December, 2012 had not been submitted for my inspection and audit.

5. COCOA BOARD OF PAPUA NEW GUINEA

5.1 INTRODUCTION

5.1.1 Legislation

-

Page 47 of 307

-

The Cocoa Board of Papua New Guinea was established under the provisions of the Cocoa Act, 1981.

5.1.2 Functions of the Board

The principal functions of the Board are: to control and regulate the growing, processing, marketing and export of cocoa and cocoa beans and the equalisation and stock holding arrangements within the cocoa industry; to promote research and development programmes for the benefit of the cocoa industry; and to promote the consumption of Papua New Guinea cocoa beans and cocoa products.

5.1.3 Subsidiary

Cocoa Coconut Institute Limited of PNG (formerly PNG Cocoa and Coconut Research Institute) was amalgamated with PNG Cocoa and Coconut Extension Agency Limited in 2003. The Institute is owned equally by the Cocoa Board and the Kokonas Indastri Koporesen of Papua New Guinea. Comments in relation to the PNG Cocoa Coconut Institute Limited are contained in paragraph 6 of this Report (Part IV).

5.1.4 Projects and Stabilization Funds

The Board as a Trustee, administers the Cocoa Stabilization Fund as required under Part IV of the Cocoa Act, 1981. Comments in relation to this Fund are contained in paragraph 5A of this Report.

Further, the Board also administers the operation of a World Bank counter GoPNG funded project, the Productive Partnership in Agriculture Project in Cocoa. Comments in relation to this project are contained in paragraph 5B of this Report.

5.2 AUDIT OBSERVATIONS

5.2.1 Comments on Financial Statements

My reports to the Ministers under Section 8 of the Audit Act, 1989 (as amended), on the financial statements of the Board for the year ended 30 September, 2011 was issued on 14 March, 2013. The report contained a Qualified Opinion:

“BASIS FOR QUALIFIED OPINION

1. Cash at Bank

Cash at Bank was disclosed as K1,220,482 in the financial statements. Included in this account balance was the Board Main Operating Accounts balance of K585,447. However, the bank reconciliation statements from which the general ledger and the financial statements were derived from disclosed K868,980 as the closing reconciled account balance which resulted in a difference of K283,533 between the financial statements and the general ledger of the Board?s Main Operating Account. I was not provided a detailed reconciliation of the variance or supporting documents relating to the reconciliation of the difference in the account balance. Consequently, I am unable to confirm and verify the validity and the correctness of the Cash at Bank balance for the year ended 30 September, 2011.

-

Page 48 of 307

-

2. Going Concern

The Board has prepared its financial statements on a going concern basis. However, the National Court in its ruling of 19 March, 2010 awarded Agmark Pacific Limited K4,885,260 plus 8% interest and costs. This was subsequent to an earlier decision on 27 July, 2007 whereby an award of K6,292,441 was made against Cocoa Board. These rulings resulted from legal proceedings against Cocoa Board of Papua New Guinea allegedly for collections of Stabilisation Bounty illegally without the Minister?s approval. Further, should the appeal made in 2010 fail, the Board will not be able to pay the K4,885,260 within its current financial position unless an agreement is reached with Agmark Pacific Limited to pay the award over a period of time, or the State agrees to bail out the Board by paying the award, otherwise the Board may be considered as insolvent and may be placed under receivership.

QUALIFIED OPINION

In my opinion, except for the effects of the matters described in the Basis for Qualified Opinion paragraphs, the financial statements of Cocoa Board of Papua New Guinea for the year ended 30 September, 2011: (a) Give a true and fair view of the financial position and the results of its operations; and

(b) The financial statements have been prepared in accordance with generally accepted accounting practice.”

OTHER MATTERS

In accordance with the Audit Act, 1989 (as amended), I have a duty to report on other significant matters arising out of the financial statements to which the report relates. I draw attention to the following issues:

1. Employment Contracts

The Contract Officers? employment contracts expired in October, 2007. Due to the absence of a duly constituted Board, these contracts were not renewed. The contract officers were still performing the same duties and responsibilities at the same positions and were being paid the respective salaries, gratuities and entitlements including housing and gas allowances. However, as the former contracts had expired/lapsed, I was not able to confirm the correctness and the validity of those payments made during the year.

2. Stabilisation Loan/Advance

A deposit of K90,000 was made by a Sambam Agro Estate for the advances made to staff from the Stabilisation Fund for the purpose of land block purchase for cocoa development. I was informed by management that as the respective staff blocks are managed by the entity, Sambam Agro Estate, it had erroneously made repayments to the Board?s main operating bank account instead of the Stabilisation Fund?s bank account. During the year ended 30 September, 2011, the Board had not made repayments to the Fund.

3. Report under Public Finances (Management) Act, 1995

The Board is required to submit an annual report on performance and management and a quarterly

-

Page 49 of 307

-

report on all investment decisions, a detailed report on investments, performance and returns for each year and a five year investment plan (up-dated each year) setting out investment policies, strategies and administrative systems to be pursued and providing forecasts of investment flows and returns. However, I noted that the management did not submit its relevant reports as required under Section 63 (2) of the Public Finances (Management) Act, 1995 to the Minister for the year ended 30 September, 2011.”

5.3 STATUS OF FINANCIAL STATEMENTS

At the time of preparing this Report, the fieldwork associated with the inspection and audit of the accounts and records of the Board for the year ended 30 September, 2012 was substantially completed and the results were being evaluated.

5A. COCOA STABILISATION FUND

5A.1 INTRODUCTION

5A.1.1 Legislation

The Cocoa Stabilisation Fund was established under Section 18 of the Cocoa Act, 1981. The Fund is administered by the Cocoa Board of Papua New Guinea with the objective of establishing price stabilisation, price equalisation and stockholding arrangements within the cocoa industry.

5A.2 AUDIT OBSERVATIONS

5A.2.1 Comments on Financial Statements

My report to the Ministers under Section 8 of the Audit Act, 1989 (as amended), on the financial statements of the Fund for the year ended 30 September, 2011 was issued on 14 March, 2013. The report contained a Qualified Opinion.

“BASIS FOR QUALIFIED OPINION

1. I audited the Statement of Receipts and Payments of Cocoa Stabilisation Fund for the year ended 30 September, 2010 and issued a disclaimer of opinion on them. Consequently, I was unable to quantify the effects of any material misstatement on the opening balances that might have a bearing on the balances reported for the year ended 30 September, 2011. Therefore, I was unable to perform sufficient audit procedures to satisfy myself as to the accuracy or completeness of the opening balances that would have consequential effect on the Statement of Receipts and Payments for the year ended 30 September, 2011, and the comparative amounts presented.

2. In Note 2 to the financial statements Loans and Advances made to the Cocoa Board of Papua New Guinea were stated as K671,517. However, the audited financial statements of the Cocoa Board for the year ended 30 September, 2011 disclose the amount as K536,585 payable to the Stabilisation Fund. I was not provided the necessary explanations and the supporting documentation regarding the variance of K134,932 that was evident in the disclosure and as a result, I am unable to satisfy myself as to the accuracy or correctness of the account balance.

QUALIFIED OPINION

In my opinion, except for the effects of the matters described in the Basis for Qualified Opinion

-

Page 50 of 307

-

paragraphs, the financial statements of Cocoa Stabilisation Fund of Papua New Guinea for the year ended 30 September, 2011:

Cocoa Stabilisation Fund

(a) Give a true and fair view of the financial position and the results of its operations; and (b) The financial statements have been prepared in accordance with generally accepted accounting practice. OTHER MATTERS

In accordance with the Audit Act, 1989 (as amended), I have a duty to report on significant matters arising out of the financial statements to which the report relates. I draw attention to the following issues: Cocoa Board of PNG as Debtor

In Note 2 to the financial statements additional loans during the year were stated as K49,277. This was consequence of payments out of the Fund in relation to the Staff Savings and Loans Scheme. The monies were used to purchase blocks of land from land owners on behalf of the staff of the Board. I was informed by the management that these blocks of land were managed by Sambam Agro Estates and the repayments by the respective staff were erroneously paid into the Cocoa Board main operating bank account. These advances were outstanding since 2007 and remain as outstanding debtors as at 30 September, 2011. Further, the disbursement of these funds was without stipulated guidelines and policy for the application of these monies as the Fund?s activities were to be measured against its outputs in the industry. Contrary to this, I was earlier informed by the Board that, “the payments made from the Cocoa Stabilisation Fund were done after the National Executive Decision (NEC Decision No. 319/2006) to write off the outstanding Cocoa Industry Price Support Loan (K26.2 million) and abolish the Cocoa Stabilisation Fund and convert the K2.5 million as Grants Assistance to the Industry”.

5A.3 STATUS OF FINANCIAL STATEMENTS

At the time of preparing this Report, the field work associated with the inspection and audit of the accounts and records and the examination of the financial statements of the Fund for the year ended 30 September, 2012 had been completed and the results were being evaluated.

6. COCOA COCONUT INSTITUTE LIMITED OF PAPUA NEW GUINEA (FORMERLY PNG COCOA AND COCONUT RESEARCH COMPANY LIMITED)

6.1 INTRODUCTION

6.1.1 Legislation

Cocoa Coconut Institute Limited of PNG (formerly PNG Cocoa and Coconut Research Company Limited) was amalgamated with PNG Cocoa and Coconut Extension Agency Limited in 2003. The Company is owned equally between the PNG Cocoa Board and the Kokonas Indastri Koporesen of Papua New Guinea.

6.1.2 Functions of the Company

-

Page 51 of 307

-

The principal functions of the Company are: to conduct research into all aspects of Cocoa and Coconut growing and production and all aspects of the Cocoa and Coconut industries; to promote research and beneficial programs for these industries; to provide assistance to all persons and bodies engaged in any aspect of the Cocoa and Coconut industries; to produce planting materials for the Cocoa and Coconut industries; and to provide consultancy services.

6.2 AUDIT OBSERVATIONS AND RECOMMENDATIONS

6.2.1 Comments on Financial Statements

In accordance with the provisions of the Companies Act, 1997, my reports on the financial statements of the Company for the years ended 31 December, 2008, 2009, 2010 and 2011 were issued on two separate dates. The 2008 and 2009 reports were issued on 14 March, 2013 while the 2010 and 2011 reports were issued on 30 June, 2013. These reports contained similar qualifications, hence, only the 2011 audit report is reproduced as follows:

“BASIS FOR DISCLAIMER OPINION

Departure from Accounting Standards

In Note 1(c) to the financial statements, replanting and redevelopment costs for crops are capitalised and amortised over fifteen (15) years based on a prime cost method. However, the Institute had not specified its accounting treatment of the respective relevant costs or whether in compliance with the PNG Accounting Standards 03/04 which specifically cater for Plantations Accounting in PNG. As a result, I am unable to confirm and verify the referred accounting treatment or its application as stated in the notes to the financial statements for the year ended 31 December, 2011.

Fixed Assets – K7,267,486

The Institute did not maintain a proper, complete and accurate Fixed Assets Register to record the details and movements of assets under its custody and control. Further, the Institute did not conduct a valuation/board of survey for the assets under its custody since its inception after its amalgamation from PNG CCEA and PNG CCRI. Consequently, I was not able to physically inspect assets against the records and confirm the existence and occurrence of these assets. As a result, I am unable to conclude on the correctness of the measurement, existence, completeness and the ownership of the fixed assets disclosed as K7,267,486 for the year ended 31 December, 2011.

Debtors – K1,268,015

Debtors were stated as K1,268,015 in the financial statements. However, I was not provided the detailed listings and the schedules of the accounts for the year then ended. Consequently, I was unable to do subsequent testing for these accounts and as a result, I was unable to satisfy myself as to whether these transactions have occurred and the Institute is able to receive the money or resources from its debtors.

Inter Company Accounts – K719,808

-

Page 52 of 307

-

Inter Company Accounts was disclosed as K719,808 in the financial statements. I was not provided the schedules and supporting documents pertaining to the account balance. As a result, I am unable to confirm the completeness and accuracy of the Inter Company Accounts balance for the year ended 31 December, 2011.

Trade Creditors and Accruals – K4,909,421

Trade Creditors and Accruals were stated as K4,909,421 in the financial statements for the year ended 31 December, 2011. However, I was not provided the creditor?s aged listing for my review and verification for subsequent settlement of the accounts. In the absence of the Trade Creditors aged listing, I am unable to state whether the creditors actually existed and the subsequent settlement of those accounts.

Provisions – K949,089

Provisions were stated as K949,089 in the financial statements. Included in this account balance were provisions for Annual Leave, Leave Fares and Provisions for Long Service Leave amounting to K32,687, K50,306 and K866,095 respectively. However, the leave reports and schedules that were provided for my review disclosed; Annual Leave as K284,109, Leave Fares as K186,994 and Long Service Leave as K842,370. Consequently, an unreconciled difference of K411,835 was noted. As a result, I am unable to ascertain the accuracy and the completeness of the amount disclosed as Provisions in the financial statements for the year ended 31 December, 2011.

Grants – K11,244,198

Grants were disclosed as K11,244,198 in the financial statements. However, a un-reconciled difference of K771,827 was noted as the bank statement balance was K10,472,372. Further, I was not provided other documentary evidence to verify and confirm the validity and the correctness of this account balance. As a result, I am unable to verify and confirm the accuracy and completeness of the Grants balance for the year ended 31 December, 2011.

DISCLAIMER OF OPINION

Because of the significance of the matters described in the Basis for Disclaimer of Opinion, I have not been able to obtain sufficient appropriate audit evidence and accordingly, I am unable to express an opinion on the financial statements of the PNG Cocoa Coconut Institute Limited for the year ended 31 December, 2011.”

6.2.2 Audit Observations Reported to the Ministers

My reports to the Ministers under Section 8(2) of the Audit Act, 1989 (as amended), on the inspection and audit of the accounts and records of the Institute for the years ended 31 December, 2008, 2009, 2010 and 2011 were issued on two separate dates. The 2008 and 2009 reports were issued on 14 March, 2013 while the 2010 and 2011 were issued on 30 June, 2013. These reports contained similar observations, hence, only the 2011 observations are reproduced as follows:

OTHER MATTERS

In accordance with the Audit Act, 1989 (as amended), I have a duty to report on other significant

-

Page 53 of 307

-

matters arising out of the financial statements to which the report relates. I draw attention to the following issues:

1. Report under Public Finances (Management) Act, 1995

The Institute is required to submit an annual report on its performance and management and a quarterly report on all investment decisions, a detailed report on investments, performance and returns for each year and a five (5) year investment plan (updated each year) setting out investment policies, strategies and administrative systems to be pursued and providing forecasts of investment flows and returns. However, I noted that the management did not submit its relevant reports as required under Section 63 (2) of the Public Finances (Management) Act, 1995 to the Minister for the year ended 31 December, 2011.

2. IT Infrastructure

The Institute had a big investment in computers and its peripherals. However, I noted that the IT Section was not functioning as no IT professional was in charge. I recommended the Institute to employ a competent IT professional to compliment the needs of this important support function of the Institute?s activities.

3. Control over Fixed Assets

A proper fixed assets register was not maintained to record and monitor the location, custody, usage and condition of all assets controlled by the Institute and further, management had not undertaken any physical inspection of the assets. I noted that the Institute had not conducted a valuation of its fixed assets since its inception after its amalgamation from PNG CCEA and PNG CCRI. I also observed that some of the Institute?s houses and the administration buildings in Tavilo and Stewart Research Stations, lacked periodic and scheduled maintenance and as a result, the assets of the Institute have deteriorated to an extent where huge reinvestment of capital will be required to maintain and upgrade the respective buildings. As a result, I was not able to satisfy myself as to the existence, obsolescence, deterioration and control over the assets.

However, I was advised by management that under the current management, it is embarking on a program to roll out scheduled maintenances to rundown Institute properties, including houses.

4. Accounting Administration and Procedural Manual

The Institute did not have an up dated Accounting, Administration and Procedural Manual in place for the daily operations of the Institute. In the absence of the documentation in relation to systems and controls, I had no basis to measure the standard of operations in existence. Further, I was informed by management that the Accounting, Administration and Procedural Manual was expected to be completed in 2012, however, in 2012 the manual was not made available for my review.

5. Travel Advance Register

I observed that duty travels were not acquitted as the Institute did not maintain a travel advance register. The Institute did not comply with the Public Finances (Management) Act, 1995 and its Regulations where domestic travels should be acquitted within seven (7) days after return and

-

Page 54 of 307

-

fourteen (14) days for overseas travels. Consequently, I was not able to verify and confirm the correctness of the domestic and overseas travels amounting to K1,021,652 and K75,309 respectively for the year ended 31 December, 2011.

6. Accounting System (Attaché? Software)

I observed that staff responsible for data entry and administration had some knowledge of the system but were not conversant and competent with the operation and full integration and implementation of the accounting software. As a result, posting errors were common in the General Ledgers of the Attaché Accounting System.

7. Intellectual Property Rights

The Institute does not register and patent its knowledge and innovations with the Investments Promotion Authority. I informed management that, as a research institution, the protection of its knowledge and innovations are of paramount importance as they constitute the Institute?s intrinsic values and recommended for appropriate actions by the Institute.

8. Segregation of Duties – Cash at Bank

I noted that the Institute did not reconcile the bank account balances on a periodic basis and instill proper checks and balances for the bank accounts. Of the seventy seven (77) bank accounts and nine (9) petty cash floats maintained during the year ended 31 December, 2011, there were two (2) staff assigned to reconcile the bank accounts amongst other pressing Institute accounts duties. In most cases, the Institute did not appoint senior accountable officers to check the work of the two (2) accounts clerks as they were also writing and processing cheque payments.