Report of the Commission of Inquiry into the Management of the Investment Corporation of PNG – Part 1

Mentions of people and company names in this document

It is not suggested or implied that simply because a person, company or other entity is mentioned in the documents in the database that they have broken the law or otherwise acted improperly. Read our full disclaimer

Document content

-

REPORT of the COMMISSION OF INQUIRY into THE MANAGEMENT of the INVESTMENT CORPORATION of PAPUA NEW GUINEA and THE INVESTMENT CORPORATION FUND OF PAPUA NEW GUINEA and all matters relating to the CONVERSION of the INVESTMENT CORPORATION FUND 0F PAPUA NEW GUINEA to PACIFIC BALANCED FUND.

Hon. Don Sawong, LLB, MBE Chairman 8: Chief Commissioner

28th MARCH 2007

Table of Contents Page

1 INTRODUCTION V1 1.0 THE INQUIRY vi 2.0 ACKNOWLEDGEMENTS vii

2 EXECUTIVE SUMMARY IX A. FOREWORD AND LIMITATION ix B. BACKGROUND x C. MANAGEMENT OF THE CORPORATION AND THE FUND BEFORE SEPARATION xii D. GOVERNMENT POLICY AND NATIONAL EXECUTIVE COUNCIL DECISIONS xv E. MANAGEMENT OF THE FUND AFTER SEPARATION xvii F. FINDINGS RECOMMENDATIONS xx

3 STRUCTURE OF THE CORPORATION AND THE FUND 1 3.1 The Corporation 1 3.1.1 Introduction 1

-

Page 2 of 72

-

3.1.2 Establishment of Corporation 2 3.1.3 Objectives of the Corporation 2 3.1.4 Functions of the Corporation 2 3.1.5 Scheme of the Legislation 4 3.1.6 The Board 4 3.1.7 Appointment to the Board of Directors 6 3.1.8 Powers of the Corporation 7 3.1.9 Officers and Service of the Corporation 8 3.1.10 Management structure 8 3.1 .1 1 Financial structure 9 3.1.12 Tender Procedures 9 3.1.13 Accounting Procedures 10 3.1.14 Tax Liabilities 11 3.1.15 State Guarantee 11 3.1.16 Power of Attorney 12 3.1.17 Returns 12 3.1.18 Investment Guidelines 12 3.1.19 Policies of the Corporation 13 3.1.20 Political Head of Corporation 14 3.2 Investment Corporation Fund of PNG Management Declaration 16 3.2.1 General Background 16 3.2.2 Establishment of the Fund 16 3.2.3 Manager of the Fund 16 3.2.4 Functions of the Manager 17 3.2.5 Powers of the Manager 17 3.2.6 Duties Responsibilities of the Manager 18 3.2.7 Rights of the Manager 19 3-2.8 Obligations of the Manager 19 3.2.9 Manager’s Undertakings 20 3.2.10 Meetings 20 i

3.2.11 Manager’s Indemnities 20 3.2.12 Register of Shareholders 20 3.2.13 Right of a Shareholder to sell his share 21 3.2.14 Liability of a Shareholder 21 3.2.15 Restriction on Transfer of Funds Property 21 3.2.16 Manager’s Successor in Title 21 3.2.17 Amendments to the Management Declaration 21 3.2.18 Termination of the Management Declaration 21 3.2.19 Death of a Shareholder 21 3.2.20 General Observations. 22

4 TERMS OF REFERENCE 1 – COMPLIANCE WITH ADMINISTRATIVE AND FINANCIAL MANAGEMENT PROCEDURES 23 4.1 TOR 1(a) Sale of Institutional assets and Investment Properties 23 4.2 TOR 1(b) Investment Guidelines 24 4.3 TOR 1(c) Imprudent, improper and illegal conduct 25 4.4 Terms of Reference 1(d) Contract of Employments and Payouts 25 4.4.1 Introduction 25

-

Page 3 of 72

-

4.4.2 Recruitment of Terminated and Retrenched staff 26 4.4.3 Employment Contracts 29 4.4.4 Staff Retrenchment Payouts 31 4.4.5 Summary of Findings Recommendations 39 4.5 Terms of Reference 1(e) Tender Procedures 41 4.5.1 Introduction 41 4.5.2 Legislative Framework for Tender Procedures 42 4.5.3 The Corporation?s Board and Management 46 4.5.4 Management under Wandi Yamuna 48 4.5.5 Management under John Ruimb 57 4.5.6 Y2K Upgrade 58 4.5.7 Engagement of Lawyers 64 4.5.8 Purchase and Disposal of Vehicles 65 4.5.9 Sale of Properties 71 4.5.10 Other Cases of Tender Procedures not followed 71 4.5.11 Summary of Findings in respect of Terms of Reference 1(e) 78 4.6 Sale of Properties 80 4.6.1 Introduction 80 4.6.2 Commercial Properties 81 4.6.3 Institutional Houses 106 4.6.4 Summary of findings and recommendations 108 4.7 Sale of Ilimo Poultry Products Limited 112 4.7.1 Introduction 1 12 4.7.2 Background on Ilimo Poultry Products Limited 113 4.7.3 Requirements of Companies Act 114 4.7.4 Board of directors of the Corporation, Ilimo & Toutu No. 37 115 4.7.5 Management of Ilimo Poultry Products Limited 118 4.7.6 Trading Results of Ilimo Poultry Products Limited 124 4.7.7 Loans obtained by Ilimo Poultry Products Limited 130 4.7.8 Attempted Sale of Ilimo 151 4.7.9 Liquidation of Ilimo 160 ii

4.7.10 Summary of findings and recommendations 161

4.8 Equity Investments of the Corporation and the Fund 165 4.8.1 Introduction 165 4.8.2 Background 166 4.8.3 Equity investments by the Investment Corporation Fund 168 4.8.4 Equity investments by Investment Corporation of PNG 179 4.8.5 Investments after the conversion 2002 to 2004 1 82 4.8.6 Examples of Bad Investments 187 4.8.7 Dividends 209 4.8.8 Summary of findings in the context of the terms of reference and recommendations 213 4.9 Terms of Reference 1(t) – Subendranathan/Mawa Investigation 220 4.9.1 Introduction 220 4.9.2 The Findings of Sube/Mawa Investigation 220 4.10 Terms of Reference 1(g) Scoping Study 228 4.10.1 Ministerial Policy Directive of 18 September 2001 231

-

Page 4 of 72

-

4.10.2 Prime Ministerial Policy Directive of 8 November 2001 232 4-10.3 Ministerial Directive of 3 December 2001 232

5 TERMS OF REFERENCE 2, 3 AND 4 – SEPARATION 233

5.1 Introduction 23 3 5.2 Background 233 5.3 TOR 2(a) Corporate Need or Justification 237 5.3-1 Background 237 5.3.2 Findings 239 5.4 TOR 2(b) Compliance with Procedures in Conversion 240 5.4.1 Procedure under the Act 240 5.4.2 Procedure under the Securities Act 240 5.4.3 Procedure under the Management Declaration 241 5.4.4 Legal Advice on Procedure 241 5.4.5 Advise on PFM Act 241 5.4.6 Finding 242 5.5 TOR 2(c) Appointment of MTSL and PEIL 243 5.5.1 Background 243 5.5.2 Government Policy on Privatisation 243 5.5.3 Options for corporatisation/privatisation of the Corporation 244 5.5.4 scoping study report 247 5.5.5 Corporation?s support for MTSL appointment 248 5.5.6 Invitation to Invest by MTSL . 251 5.5.7 Ministerial policy direction 251 5.5.8 Expression of Interests for role of Trustee 252 5.5.9 Findings 252 5.6 TOR 2(d) 4 Preparation of Financial Statements Prior to Conversion 253 5.6.1 Background 253 5.6.2 Engagement of Consultants 253 5.6.3 Finding 254 5.7 TOR 2(e) Board and Management Fiduciary Duties 255 5.7.1 Composition of the Board Management of the Corporation 255 5.7.2 Failures of the Board and Management 255 iii

5.7.3 Response by the Directors 258 5.7.4 Finding against the Directors 259 5.7.5 Finding against the Management 259 5.8 TOR 3 Consultants and Advisors 260 5.8.1 Introduction 260 5.8.2 Background 260 5.8.3 PwC 5.8.4 MCAL 261 5.8.5 FPK MSJ 263 5.8.6 Mawa Lawyers 265 5.9 Terms of Reference No. 4 Appointments of MTSL and PEIL 267 5.9.1 4(a) Conflict of Interest 267 5.9.2 4(b) 272 5.9.3 Terms of Reference 4(c) 273

-

Page 5 of 72

-

5.9.4 Terms of Reference 4(d) 275

6. TERMS OF REFERENCE 5 MANAGEMENT OF PACIFIC BALANCED FUND 277 6.1 Westpac Bank K12 Million Loan and Related Matters 277 6.1.1 Introduction 277 6.1.2 Background 279 6.1.3 Redemption of Units by MVIL 285 6.1.4 Westpac Bank loan 292 6.1.5 Redemption of 1 Million Units 367 6.1.6 Sale of the Units to NASFUND 369 6.1.7 Summary of findings and recommendations 383 6.2 Terms of Reference 5(a) Proposed K37 Million Write off 393 6.2.1 Introduction 393 6.2.2 Background 395 6.2.3 Trust Deed and Legal Requirements 396 6.2.4 Board of Directors 402 6.2.5 Contract Accountants 410 6.2.6 State of the Fund Accounts 431 6.2.7 Findings on the 5(f) 476 6.2.8 The K37 Million Proposed Write?off 478 6.2.9 Findings in relation to the TOR 5(e) 499 6.3 General Management of PEP 500 6.3.1 Background and Limitation 500 6.3.2 Breaches of Statutory Responsibilities 500 6.3.3 management of PBF 501 6.3.4 Imprudent, improper and illegal actions 503 6.3.5 Fees paid to Trustee and Manager 506 6.3.6 Attempted Removal of PEIL 507

7 TERMS OF REFERENCE 6 – PEIL AS CORPORATE MANAGER 509 7.1 Background and Limitation 509 7.2 Conflict of interest, undue pressure or collusion in the appointment of PEIL 509 7.3 management of the Corporation 510 7.4 Cases of imprudent, improper and illegal actions by any person related to the Management of the Corporation 51 1

iv

8 TERMS OF REFERENCE 7 – SECURITIES COMMISSION PERFORMANCE 513 8.1 Background 513 8.2 Legislative Framework 513 8.2.1 Securities Act 1997 513 8.2.2 Securities Regulation 1999 514 8.2.3 Trust Deed 514 8.3 Issues Raised by Stakeholders against MTSL 520 8.3.1 MRDC 520 8.3.2 PEIL 521 8.3.3 MVIL 522 8.3.4 Mr. Kisokau Powaseu 522 8.3.5 Mr. Joe Gabut 522

-

Page 6 of 72

-

8.4 The Securities Commission’s Response to Issues Raised 523 8.5 Summary of Findings in the context of TOR 7 541 8.5.1 Term of Reference 7(a) Whether there was any conflict of interest on the part of the Securities Commission or staff and the Trustee and Manager or any of their staff; 542 8.5.2 Term of Reference 7(b) Whether any person exerted undue pressure on the Securities Commission not to address or to improperly address the concerns; 542 8.5.3 Term of Reference 7(c) Whether in the circumstances, the Securities Commission acted improperly in not suspending or revoking the appointment of the Trustee and Manager and appointing another trustee and manager in their stead; 543 8.5.4 Term of Reference 7(d) Whether there was any irregularity or illegality in the manner in which Pacific Equities Limited sought and obtained approval from the Securities Commission on 12th July 2005 as trustee for a number of other trusts when it was already the Manager of Pacific Balanced Trust 543

APPENDICES OF EXHIBITS 544

1 INTRODUCTION

1.0 THE INQUIRY

1.1 The Instruments of Appointment sets out the reasons why the Prime Minister set up this Inquiry. It is tasked with the responsibility to inquire into certain issues that led to the collapse of what was once a shining example of a successful State owned enterprise and the separation of a statutory Unit Trust into a commercial Unit Trust. This State owned enterprise is the Investment Corporation of Papua New Guinea (Corporation) and the Unit Trust was known as the Investment Corporation Fund of Papua New Guinea (Fund).

1.2 The Corporation was established in 1971 by an Act of Parliament known as the Investment Corporation Act 1971 (the Act).

1.3 Subsequently in 1973, an amendment was made to the principal Act which enabled the Corporation to, amongst other functions, establish and manage Unit Trusts etc. This enabled the Corporation to perform dual roles as fund manager and trustee with investment funds under its own portfolio as well as those in the trust fund portfolio. This dual role was brought about when the Corporation executed the Management Declaration. This document created a trust fund called the Investment Corporation Fund of Papua New Guinea.

1.4 The Management Declaration did not adequately provide for the functions, duties, obligations and rights of the Corporation as Trustee and Manager of the Fund. There were also inadequate provision specifying the usual indemnities governing the relationship of trustee and manager.

-

Page 7 of 72

-

1.5 Consequently this dual role and function became blurred and created serious conflicts of interest situations between the Corporation and the Fund. This situation created a breeding ground for bad governance issues, such as mismanagement, malpractices and irregularities, financial misuse and abuse, abuse of power and authority, breach of fiduciary duties and political interference.

1.6 Over the years, many reviews had been done by various professional terms to address these issues. Unfortunately nothing much was done to implement the reviews and recommendations and the situation was allowed to continue.

vi

1.7 The Terms of Reference under the inquiry are quite wide. They include issues relating to public finance management and procedure, corporate governance, investments, fiduciary duties bank loans and securities, tender procedures, abuse of power and authority.

1.8 A copy of the Instrument of Appointment is attached and marked as Exhibit in the Appendices to this Report.

1.9 Sir Makena Geno withdrew from the Commission before public hearings began for personal reasons. Mr. Richard Kuna was subsequently appointed as Chief Accountant to assist the Commission.

1.10 The Commission began public hearing on Monday 4th September 2006. The last public hearing was held on Wednesday 21St March, 2007. At its first public sitting the Commission set out the procedures under which the Inquiry would be conducted. The Commission decided that all sittings of the Commission would be held in public unless special circumstances warranted a private session. In any event, all hearings have been held in public.

1.11 During the course of the inquiry a total of 8 witnesses gave oral evidence, 681 documentary exhibits were tendered and additional number of files and documents were received into evidence.

1.12 This report is based on an examination and evaluation of the oral evidence and the documentary material referred to in paragraph 1.11 herein. In conformity with the intention announced by the Commission in its opening statement, on 4th September 2006, findings made in the Report are based on evidence of probative value only and not on rumour or suspicion. I have also considered carefully all submissions made by Mr. Yagi, Senior Counsel assisting me and the respective Counsels, for each of the interested parties.

1.13 A full list of witnesses and documents are included in the Appendices

-

Page 8 of 72

-

to the Report.

1.14 A full list of legal representations during the Inquiry is also included in the Appendices to the report. I would like to record my appreciation to those lawyers who assisted in the smooth running of the inquiry.

ACKNOWLEDGEMENTS

2.1 I express my gratitude to The Right Honourable Grand Chief Sir Michael T. Somare GCL, GCMC, CH, CF, who as Prime

vii

Minister, established the Commission of Inquiry and for the duration of the Inquiry gave his support and honoured its independence.

2.2 1 also wish to thank the Chief Secretary and the Staff of the Department of Prime Minister for the responsive manner in which all the Commission?s administrative requirements were met.

2.3 I record my appreciation to all my staff members for their various contributions towards the smooth running of the Commission?s business.

2.4 Particular mention should be made of the tremendous effort and invaluable assistance provided by Counsel Assisting, Mr. Molean Kilepak until he left in January 2007 to undertake further studies. Ms. Annette Kora-Aisa assisted me at the beginning of the inquiry but she too left for personal reasons in the early part the inquiry. When she left Ms. Miriam Kias joined the legal team and assisted Mr. M. Kilepak in assisting me. Their work in preparing the evidence for presentation at the public hearings and maintaining a steady ?ow of witnesses has enabled the Commission to complete it?s mandate expeditiously and efficiently.

2.5 I also wish to record my appreciation to the Secretary to the Commission, Mr. Gerard Dogimab. It was obvious from the beginning that his experience and invaluable assistance in laying the foundation for the administrative support for the commission, such as arranging office accommodation, a public hearing venue, recruitment of support staff and budget allocations. I am grateful for his invaluable assistance and that of Ms. Alexandra Kalinoe.

2.6 My senior staff Joseph Yagi, Richard Kuna and Miriam Kias also provided invaluable assistance in the tedious task of compiling indexes, proof reading, checking transcript and exhibit references and generally overseeing the technical production of the Report. I also wish to acknowledge the tremendous effort put in by my other professional staff Mr. Nolan Kom and Ms. Clarissa Takip in helping me to put together this Report.

-

Page 9 of 72

-

2.7 Special mentioned must be said of my Executive Secretary, Mrs. Aileen Wanu who assisted me with my personal matters and Mrs. Margaret Guina for her tremendous help in typing my Report. It will be remiss of me not to say thank you to all my other staff. All of them either collectively or individually contributed and made my difficult task a little bit easier. They include Security/Personnel, Peter Alu, Allan Kapo’o, Ben Kaiah, and all my other support staff.

viii

2 EXECUTIVE SUMMARY

A. FOREWORD AND LIMITATION

It is important this section must be read for anyone reading the report of the Commission of Inquiry into Pacific Balanced Fund

Guide to the Report

The scope of the Commission?s inquiries were very wide, as required by its Terms of Reference.

The Executive Summary provides an overview of the Commissions findings of the matters requiring investigation under the Terms of Reference.

The detailed report and results of the Commission?s inquiries are reported in Chapters 3 to 8 and are laid out in the order of the Terms of Reference, identified by specific sub topics.

The Commission’s findings and recommendations are contained in the body of the respective reports and these are again summarized at the end of each detailed report, where necessary.

Limitations to the Report

The Commission was set up by the Prime Minister on 3 June 2006 and was required to report to him on or before 30 August 2006. However, the funding of the Commission was not appropriated until in August 2006. Consequently, the Commission was unable to commence hearing until 11 September 2006 when the first public hearing was held.

Extension was granted by the Prime Minister to 30 November 2006 and then to 31 December 2006.

A further extension was granted by the Prime Minister on 25 December 2006 for the Commission to report by 30 May 2007. This extension was amended on 12 March 2007 and a new deadline of 23 March 2007 was set.

By way of a comparison the National Provident Fund and Defence Force

-

Page 10 of 72

-

Retirement Benefit Fund Inquiries with similar terms of references reported within two years six months and one year eight months respectively.

As a result the Commission has not been able to investigate fully and report on all areas of the Terms of Reference. These areas are clearly identified and documented in the detailed section of the report.

ix

BACKGROUND

1.0 In 1971, the Government set up the Corporation under the Act. The objects of the Corporation are set out in Section 5 of the Act. It?s objects were to provide equity holding by eligible persons (mainly Papua New Guineans) in enterprises in PNG in cases where the Corporation is of the opinion that:

it is in the long term interest of the people of Papua New Guinea to do so; and

a significant degree of equity holding by eligible persons would not or might not otherwise be readily achieved.

1.1 The functions of the Corporation are outlined in Section 6 of the Act. These functions were designed, amongst other things to, achieve its principal objectives. These functions are:

take up shares in enterprises and hold them with a View to their future disposal to eligible persons: and

dispose of shares in enterprises to eligible persons; and

arrange Opportunities for eligible persons to acquire shares in enterprises, and arrange for enterprises to offer shares, or rights to future shares to eligible persons; and

underwrite share issues in the country and take from any part of any such issue that is not taken up by any eligible persons; and

in accordance with the law relating to such matters, or in such manner and on such conditions as are approved by the Minister in any particular case-

(i) establish or manage in the country, or join in the establishment or management in the country of, investment companies or unit trusts or other mutual funds; and

(ii) if and when it appears to it desirable, take such action as it appears to it necessary or desirable to sell or otherwise make available to eligible persons shares, units or subunits in any

-

Page 11 of 72

-

such company, trust or fund; and

enter into consortium arrangements as appropriate; and

do any other thing that is necessary or convenient for the purposes of achieving its object.

1.2 Section 7 of the Act imposed restrictions on the Corporation on certain share dealings.

1.3 The Corporation is given very wide powers to do, both internally or externally, all things necessary or convenient to be done for or in connection with the achievement of its objects and the performance of its ?rnctions. The powers included the power to:

borrow money with the consent of and on such terms and conditions as are approved by the Minister; and

lend money and

participate in the formation of a company or other business enterprise; and

subscribe for or otherwise acquire, and to dispose of: (i) shares in, or securities of, a corporation; or (ii) interests in, or securities of, a corporation, or

underwrite issues of shares in, or securities of, a corporation; and

buy back any shares sold by it at a price that, in the opinion of the Investment Corporation, is fair and reasonable in the circumstances.

1.4 In 1973, the Act was amended to allow the Corporation to, amongst other things, create or manage Unit Trusts. To effect this change, the Corporation signed an agreement called the Management Declaration. Thus the Act and the Management Declaration bonded the Corporation with the Fund. Under the Management Declaration the Corporation became the Trustee and Manager for the Fund. As can be seen the Corporation was owned by the State whilst the Fund was owned by the Unit Holders. The umbilical cord that connected the Corporation and the Fund was both the Act and Management Declaration. The two organizations were intimately connected?~one could not live without the other.

1.5 The Act prescribed the investment guideline which was that the corporation and the fund were to ?operate on sound business principles? (see 3.10). The Act also stipulated that any policy issued must be approved by the relevant Minister and the Head of State, acting on advice. (See 5. 10).

1.6 From the day of its inception the Board of Directors and management of the

-

Page 12 of 72

-

Corporation were also the Directors and managers of the Fund. The Directors, the Managing Director and the Deputy Managing Director were appointed by the relevant Minister, thus there was direct and indirect political influence in the appointment process. As a result there were constant changes in those

xi

offices, which also had an adverse impact on its operations and performance as a corporation.

1.7 Since its inception the Corporation and the Fund have played a considerable role in the successful economic development of PNG. However, the Corporation and the Fund had great difficulty in terms of future growth. Their ability to grow was restricted by virtue of the limitations imposed by the enabling Act.

1.8 Because the Corporation was a Public Statutory Corporation and because of the nature of its activities it was subject to other relevant Laws. These included the Public Finances (Management) Act 1995 (PFM Act), the Securities Act and other general laws.

MANAGEMENT OF THE CORPORATION AND THE FUND BEFORE SEPARATION

2.0 The Management of the Corporation and the Fund before the separation rested with the Board of Directors and the senior managers of the Corporation.

2.1 In the performance of its functions, powers and duties the Directors and the management were required to conduct the business activities of the Corporation and the Fund in accordance with sound business principles?. That was its principal investment guideline as set out by the Act. The Act required the Directors and the Management to manage and operate the two organizations in accordance with sound business principles.

2.2 Like all other successful State owned enterprises that have been subjected to legislative constraints and/ or political interferences or influences, the Corporation and the Fund have been no different. There is strong evidence that since its inception political influence or interference has been rife and consistent in the management and administration of the two organizations leading up to the decision to separate the Corporation and the Fund. Up until the decision to separate them, there were consistent political interference, abuse of power and mismanagement by successive Board of Directors and Management.

2.3. The evidence uncovered by the Commission shows that the Directors and the senior management did not live up to the statutory investment guideline or indeed the terms of the Management Declaration. The Inquiry has found that the Directors and/or management did not administer and manage the affairs of the Corporation and the Fund on sound business principles. For example the corporation did not:

-

Page 13 of 72

-

2.4 I Take appropriate action to prevent possible insolvency of the Corporation

xii

Lodge annual return

Take appropriate action to prevent possible insolvency of the Corporation

Lodge tax returns for the Fund since 1990’s;

Have any Annual General Meetings

Keep proper accounting records

Make sound investments

Have audited Accounts for the Corporation for several years Obtained the necessary approval from the Minister for Finance Comply with internal external tender procedures

Have proper control over its finances.

Comply with Public Finances (Management) Act

2.5 These matters to my mind are indicative of the Board and Management failures in the performance of their fiduciary duties as Directors and managers of the Corporation. The same comments may be made in relation to the management of the Fund. For instance:

The Funds accounts were not audited for many years

No income tax returns were lodged for many years

No audit of the register of unit holders

No Annual General Meetings of the unit holders have been held. Operating in breach of the Securities Commission Act Operating in breach of the Companies Act

Operating in breach of the Income Tax Act

Operating in breach of the Management Declaration

2.6 As far back as 1994 and the subsequent years up to 2001, the financial statements of the Corporation and Fund were not only reported very late to Parliament but were heavily qualified due to poor record keeping and financial control. Despite repeated concerns raised by the Auditor General,

-

Page 14 of 72

-

the Board and Management made no concrete attempt to attend to the issues raised. The K37 million proposed write-off is solely caused by the continuous negligence in maintaining proper accounting records.

2.7 As a consequence several reviews by professional fims were conducted. These reviews recommended structural and other management changes. Very little was done or acted upon in reSpect to those recommendations by persons responsible.

2.8 Things came to a head in 1998 when serious issues were raised about the management of the Corporation and the Fund. As a result a number of investigations were carried out between 1998 and 2002 by several different organizations. These raised significant issues about the management of the Corporation and the Fund and other related issues. Very little was done to implement the findings and recommendations.

2.9 In July 1999 a new Government under Sir Mekere Morauta came into office. Upon assuming the office, the Prime Minister made it quite clear that under his leadership the Government would pursue privatization of State Owned Enterprises with some priority. Following this statement, the Board and Management of the Corporation together with external Advisors, prepared the Corporation for corporatisation.

2.10 However, in September 2001 the then Government through the Minister for Privatization issued a policy directive which required the Corporation to retire as a statutory Trustee and Manager of the Fund. The policy required the conversion of the Fund into a fully commercial unit trust under the Securities Act 1997 so as to eliminate political influence or interference in the management of the unit holder?s funds and investments. The directive also required the Corporation to nominate or otherwise facilitate a successor trustee entity to succeed it. In effect the policy directive required the Fund to be separated from the Corporation.

2.11 Consequently, the Board and Management of the Corporation worked towards achieving that policy directive. However, this was all done in haste as evident in the Report.

2.12 As part of that separation process the Corporation, other entities, such as the Defense Force Retirement Benefit Fund, Melanesian Capital Advisors (MCAL), the Fund and others incorporated a trustee Company known as MTSL. It was designed that MTSL would become the new Trustee for the Fund once it was effectively separated from the Corporation. MTSL was subsequently incorporated and registered by the Securities Commission as a Trustee Company.

2.13 At the same time the senior Managers of the Corporation were actively scheming up a scheme to set up their own management company to bid for the management rights to manage the Fund once it was separated. In the midst of

xiv

-

Page 15 of 72

-

the separation process they incorporated a company called Pacific Equities and Investments (PEIL). To my mind this was a well thought out scheme designed to bring maximum financial benefit to the people behind this scheme such as John Ruimb, Chris Gideon, Enoch Pokarop, John Sanday and their associates.

2.14 In December 2001, the Board of the Corporation allowed the Management Declaration to formally lapse. Part of the umbilical cord that joined the Corporation to the Fund was now formally severed. By a Board resolution on 10 October 2001, the Corporation formally appointed MTSL as Trustee of the Fund.

2.15 Generally speaking it is clear from all the evidence that the Board of Directors either individually or corporately were in serious breach of their fiduciary duties to the Corporation and the Fund. The evidence demonstrates that the Directors and or the senior management were either incompetent or negligent in the discharge of their reSpective fiduciary duties. However, there is evidence that some individual Directors, (such as A. Kandakasi) did try their best in the discharge of duties. There were other persons who were appointed as Directors but who did not even take part in any meeting of Directors when their appointments were revoked, (such as Peter Kopunye others).

2.16 The evidence before the Commissions demonstrates clearly that, there was imprudent management of both the Corporation and the Fund during the relevant period under inquiry.

2.17 There is overwhelming evidence of consistent political interference in the Board and senior management of the Corporation which had a direct bearing on the management and operations of both organizations, that there was a corporate need to separate the Corporation from the Fund. Further, the coming into effect of the Securities Act 1997 also meant that the Fund had to Operate under that Act. Moreover, the evidence shows clearly that there were serious breaches committed by the Directors and Management of the Corporation of the Management Declaration, that it was in the best interest of the Unit Holders to separate the Fund and the Corporation. There was therefore an overwhelming need or justification to separate the Fund from the Corporation.

3.0 GOVERNMENT POLICY AND NATIONAL EXECUTIVE COUNCIL DECISIONS

3.1 On 14th July 1999 Sir Mekere Morauta became Prime Minister of Papua New Guinea. He was also the Minister for Treasury. In his maiden speech as Prime Minister in Parliament he referred to Papua New Guinea?s date with destiny. Sir Mekere’s government came into office when the economy of the country was in a crisis. The value of the Kina had fallen to an all time low.

XV

-

Page 16 of 72

-

3.2

3.3

3.4

3.5

3.6

3.7

3.8

3.9

The Government was determined to correct this and set the country in right course and direction. Part of this strategy was to privatize/corporatise State owned Enterprises.

Subsequently in February 2000, the Government by National Executive Council formally adopted and issued a broad and general policy on the issue of privatization /corporatisation of State Owned Enterprises.

In so far as the Corporation and the Fund were concern their relationship, functions, duties and responsibilities were subject to the provisions of the Act. In relation to policies, the Act sets out in clear terms the procedures to be followed by the Corporation in the performance of its operations. In other words the enabling law sets out clearly the procedures relating to any policies involving the operations of the Corporation and the Fund. The relevant provisions are set out in Sections 6 and 10 of the Act.

Following the policy made by the NEC the Board and Management of the Corporation under the leadership of Rex Augwi as Chairman and John Ruimb as Managing Director pursued the privatization of the Corporation and the Fund with determination, vigour and in haste.

The Board and Management of the Corporation then formally adopted and endorsed a privatization policy for the Corporation. This was a major policy submission and under s. 10 (3) of the Act, the submission required Cabinet approval and approval by the Head of State, acting on advice. As will be seen shortly the procedures set out by the Act were not followed in the privatization policy in respect of the Corporation and the Fund.

My inquiries with the relevant offices, such as the Cabinet Secretary reveal that there was no submission from the Minister to Cabinet for the privatization of the Corporation. There is no evidence that the Minister put the policy to the National Executive Council for its deliberations and approval. There is also no evidence that the National Executive Council approved the said policy. Further more there is also no evidence that the Head of State indeed approved

-

Page 17 of 72

-

the said Policy Directive issued by the Minister.

It is clear therefore that the separation /privatization policy for the Corporation and the Fund were unlawful, in that the proper procedures set out by the Act were not followed by the Directors, Managers and the Minister.

The separation of the Fund from the Corporation was done hastily, improperly, and unlawfully. The evidence gathered during the course of the inquiry reveal the following:

that the management of the Corporation and the Fund was not conducted in a transparent manner and in accordance with good management practices;

xvi

3.10

3.11

3.12

4.1

4.2

that the conversion of the Fund was not done transparently and in a manner authorized by law;

that the management of the Fund since its conversion in 2001 has been carried out in a manner not beneficial to and otherwise prejudicial to the interest of the unit holders of the Fund;

failure to adhere to public tender procedures;

failure to declare conflicts of interests;

failure to obtain professional management advice. not fully complying with ministerial directives.

Given the matters I have highlighted above, it is my opinion that the privatization/ separation of the two institutions should not have been done until the matters I have raised and all other necessary issues were properly addressed and settled. Unfortunately this did not happen, but instead the Directors and Managers pushed for the separation hastily. It is obvious from the evidence before the that the Management were motivated by personal interests than the interests of the State and the Unit Holders.

In conclusion the Corporation and the Fund were badly managed. This had management occurred prior to 1998 and it continued until the Fund and the Corporation were separated. To my mind it is clear that the cause of the bad

-

Page 18 of 72

-

state of affairs was due to a number of reasons. The obvious ones include undue political interference in the constant and sometimes unnecessary changes in the Board and Management and incompetence on the part of the Board and Management. The evidence reveals that what was once the pride of Papua New Guineans was on the verge of collapsing. During the period under inquiry the Corporation was possibly technically insolvent

Although the separation was improper and unlawful, nevertheless that action saved the investments of thousands of Papua New Guineans who had investments in blue chip Companies.

MANAGEMENT OF THE FUND AFTER SEPARATION

In January 2002, the umbilical cord that tied the Fund to the Corporation was severed and the two entities were formally separated. The Fund became a fully commercial Unit Trust and became Paci?c Balanced Fund whilst the Corporation remained as a Statutory Corporation and continued to remain as Fund Manager until it retired in May 2002.

The Corporation appointed MTSL as the new Trustee for the Fund. This appointment was not legitimate and improper for several reasons:

xvii

4.3

4.4

4.5

4.6

The policy directive issued by the Minister was contrary to law and therefore the subsequent action by the Board of the Corporation pursuant to that policy directive in the appointment of MTSL was also wrong in law. Its appointment as Trustee was therefore unlawful.

The power to appoint a Trustee rests with the Unit Holders. As the Fund belongs to them, there should have been a properly convened and constituted meeting of Unit Holders to appoint who they wish to have as their Trustee and Manager. In this case, the Corporation was not the only Unit Holder. It had no power to unilaterally appoint MTSL as Trustee.

Further there was no meeting of Unit Holders to appoint MTSL as Trustee. In addition there was no open expression of interest and competitive tender process to select or appoint the Trustee.

After the formal separation in January 2002, MTSL became the Trustee. Apart from a short period (between March April 2002) PEIL has been the

-

Page 19 of 72

-

Fund Manager since April or May 2002.

The Trustee and the Fund Manager have behaved improperly in the management of the Fund. There is overwhelming evidence that both the Trustee and the Manager are guilty of gross breach of fiduciary duties and breaches of statutory duties. They have either individually or collectively abused their powers and hence mismanaged the affairs of the Fund.

As MTSL is a general Trustee firm it was required to comply with its statutory obligations set out by the Securities Act and the Securities Regulations. It was obliged to act honestly, to make sure that the investments and other property of the unit trust are clearly identified as those of the unit trust, and that they are held separately from the property of the unit trustee or manager, and any investment or other property of any other unit trust or scheme.

Since its appointment MTSL has not acted in good faith nor acted in the best interest of the Unit Holders. It has earned huge fees, yet it has committed serious breaches in the discharge of its fiduciary duties. For instance MTSL has not clearly identified certain investments in investee companies as belonging to the Fund and not its own. In some instances it has indicated clearly on the share certificates that MTSL was holding the shares in the name of or in trust for the Fund. However in other share certificates it does not state this and in fact the share certificates are in its own (MTSL) name. For example the shares in Bank South Pacifc Ltd, Amalpack Ltd, Markham Culverts Ltd, Melanesian Metals Corporation Ltd, Melanesian Trustee Services Ltd, and Origin Energy Ltd, are held in the name of the Fund. On the other hand there are shares in other companies that are in the name MTSL per se and which are not clearly marked as belonging to the Fund.

4.7

4.8

4.9

4.10

4.11

These include shares in Associated Mills Ltd, South Pacifc Brewery Ltd, Marsh Ltd, Ramu Sugar Ltd, Toyota Tsusho (PNG) Limited and Trukai Industries Ltd. And yet there is another group of shares which are still registered in the name of the Corporation. These include shares in companies such as Origin Energy (PNG) Ltd, Amalpack Ltd, Kumul Hotels Ltd, Nowra No.8 and Yandama Trading Ltd. These actions are clearly in breach of the Securities Regulations.

Another example of a serious breach of fiduciary duty as trustee is the

-

Page 20 of 72

-

pledging of the Funds assets, in particular the various shares in certain companies as security to obtain a K12 Million loan from Westpac Bank for itself. This was clearly improper and breach of its statutory duty as a Trustee.

One other example of serious breach of duty is that after the sale of units to the National Superannuation Fund Ltd, MTSL made a huge profit of some K8 Million. None of this profit was ever credited to the account of the Fund. All of this profit was deposited in the account of MTSL and subsequently money was withdrawn from that account for the bene?t of John Sanday and his associates. Not one toea of this profit was ever given to the Fund. The Unit Holders of the Fund certainly received nothing for the use of their assets. This was clearly unlawful in that this was in breach of the Securities Act, the Securities Regulations, and the Trust Deed.

The payment of K1.2 Million in fees to Melanesian Capital Advisors Ltd, a company wholly owned and controlled by John Sanday is also another example of breach of its duties as Trustee. This was clearly unlawful and highly improper. There are other highly improper and unlawful activities of the Trustee which I have set out in detail in the Report.

PEIL is the Fund Manager. It too has earned huge fees since 2002 when it took over as Fund Manager, yet its performance in the discharge of its fiduciary duties leaves a lot to be desired. It too has committed serious breaches in the mismanagement of the Fund and its investments. The evidence that is before this Inquiry also reveals that it too is guilty of serious breaches of its fiduciary duties to the Fund and to the ultimate owners, namely the 37,000 or so Unit Holders. Examples of these breaches include, but not limited to:

I Shown no responsibility in ensuring that the requirements of the Securities Act and the Securities Regulations were being met.

I No valuations of the Fund have been done since 2002. . Tax returns for the Fund have not been completed. . No audited annual accounts since 2002.

.- Refusing to ?illy account for the K37 Million proposed write off.

xix

4.12

4.13

4.14

4.15

5.1

-

Page 21 of 72

-

5.2

5.3

I No Annual General Meeting of Unit Holders

Their respective Directors and Managers such as John Sanday and John Ruimb have at best of times acted in self interest rather than in the best interest of the Unit Holders. Both of them have committed numerous serious breaches of many relevant laws, such as the Companies Act, the Securities Act Regulations and the Trust Deed. The evidence reveals that Trustee Manager have committed malpractice irregularities, financial misuse abuse, abuse of power authority, breach of fiduciary duties, breach of statutory duties and obligations. There have been instances of conflicts of interests between the Trustee and the Fund Manager.

Several other entities have acted badly. Their actions and or omissions are at best of times not in the best interest of the Unit Holders of the Trust. For instance several Directors of Motor Vehicles Insurance (MVIL) including the Managing Director, Dr. John Mua have acted improperly and in some case unlawfully. For instance, as MVIL is a Public Company, its sale of the units was subject to the approval of the Minister for Finance under S. 61 of the Public Finances (Management) Act. No such approval was obtained.

Westpac Bank (PNG) also acted imprOperly in accepting the assets of PBF as security to give a loan of approximately K12 million to MTSL. All the evidence on this aspect, demonstrate very clearly that MTSL obtained the loan for itself. Paci?c Balanced Fund, the owners of the shares which were pledged as security did not receive a single toea from this transaction.

The Securities Commission did not take prompt action to stop further breaches from being committed by the Trustee and Fund Manager. As a result of this situation there has been continuous breaches committed by the Trustee and Fund Manager with respect to mismanagement and abuse of power and authority even up to the date of this report.

FINDINGS RECOMMENDATIONS

I have made findings and referrals based on all the evidence as set out in detail in the Report. The findings are based on the probative value of the evidence provided or given before the Commission. The findings are not based on speculation or on suspicion. I have, in the Report made certain recommendations and referrals, against individuals and companies.

There is overwhelming evidence that the Directors and Managers of the Corporation and the Fund failed in the discharge of their respective fiduciary duties.

The Directors and the Management failed to keep or maintain the Financial Statements of the Corporation, the Fund and those of the various subsidiary

-

Page 22 of 72

-

companies in a proper and timely manner resulting in the production of

XX

5.4

5.5

5.6

5.7

5.8

5.9

5.10

inaccurate Financial Statements and furthermore well after the Statutory deadlines set out by the Act, the Companies Act, the PFM Act, the Securities Act and other relevant laws. The Directors of the Corporation either individually or collectively were in serious breach of their ?duciary duties as well.

During the relevant period under inquiry the Corporation was most probably insolvent. They were in effect operating a company that was most probably insolvent. The Board and Management of the Corporation failed to adhere to the prescribed statutory investment guideline.

The taxation aspects of the Corporation, the Fund and their respective subsidiaries were poorly managed by the Directors and the Management, resulting in a situation where even as of today the tax positions of these entities are difficult to ascertain.

The annual statutory returns and other statutory compliance notices needing lodgement required by the Companies Act and the PFM Act in respect of the subsidiary companies and the Corporation and the Fund were poorly maintained and were either not lodged or not lodged in a timely manner as stipulated by the Companies Act. The Directors and Management failed in their fiduciary duty in this respect also.

The Directors and Management of the Corporation also failed in the performance of their respective fiduciary duties as the annual audit of the register of the Unit Holders of the Fund and the annual general meetings of the Unit Holders required to be held by the Management Declaration were never carried out. These significant failures have led to a Unit holder register which, in my opinion is inaccurate in material respects. Once again the directors and management have failed in the performance of their fiduciary duties.

-

Page 23 of 72

-

The Corporation was neither corporatised nor privatized; it remained as a statutory body until it was vested in the Independent Public Business Corporation (IPBC). The effect of the privatization or conversion was merely the separation of the Fund from the Corporation.

The Directors and senior managers of the Corporation were pro?active in the push for and ultimately approved a policy to separate the Fund and the Corporation. This was a major policy shift which had the potential of leading to the demise of the Corporation. During the period under investigation, the Corporation was not in a sound ?nancial position. In fact all the evidence points to the Corporation being insolvent.

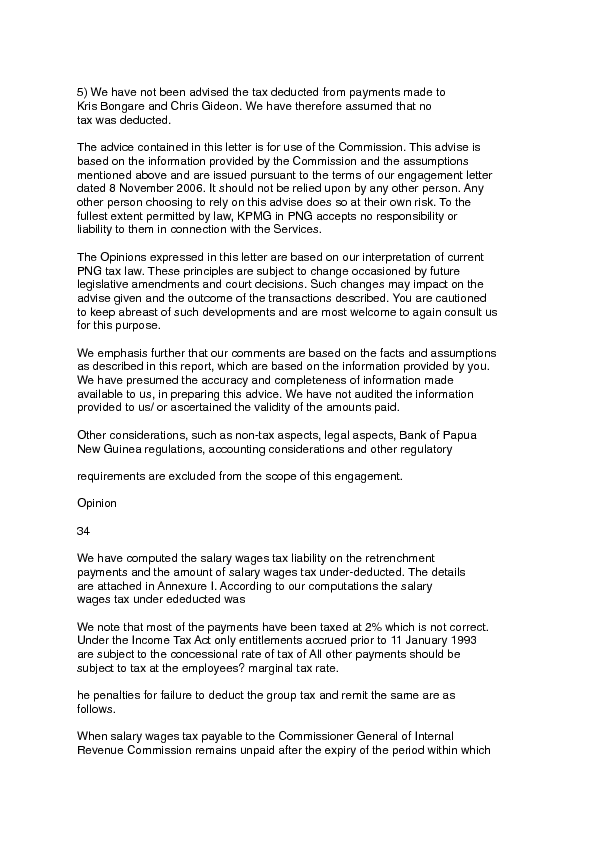

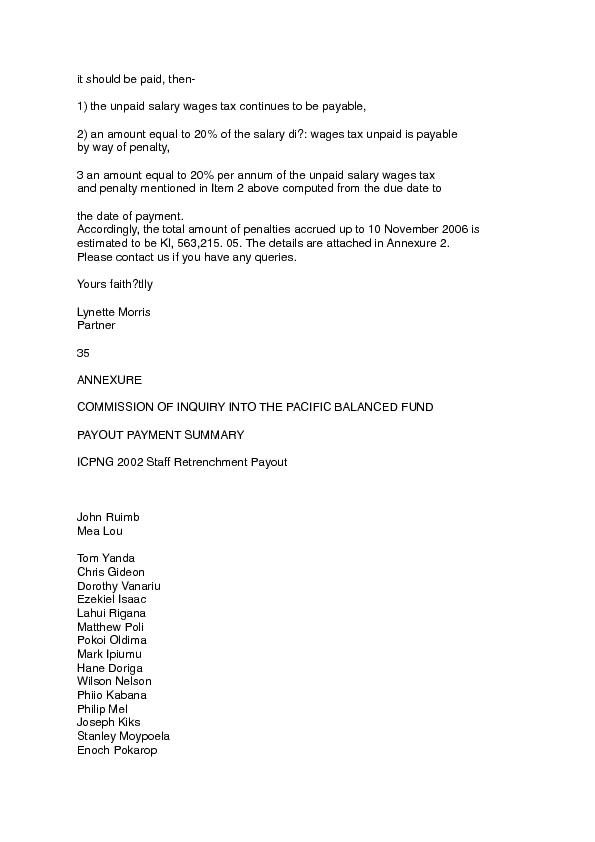

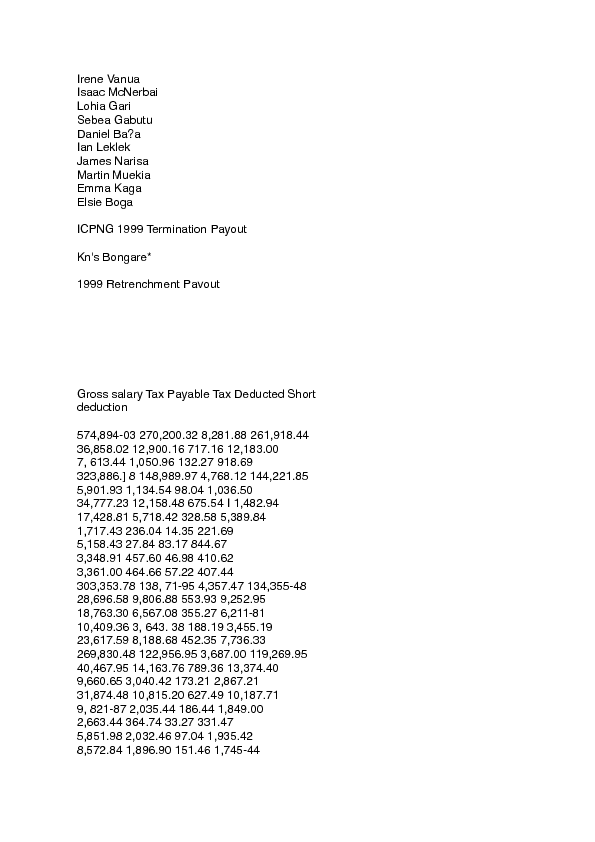

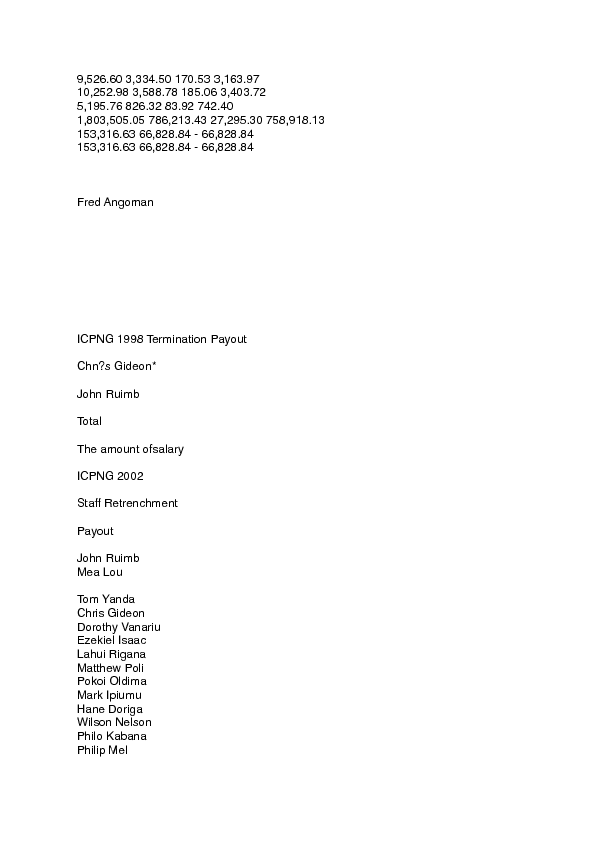

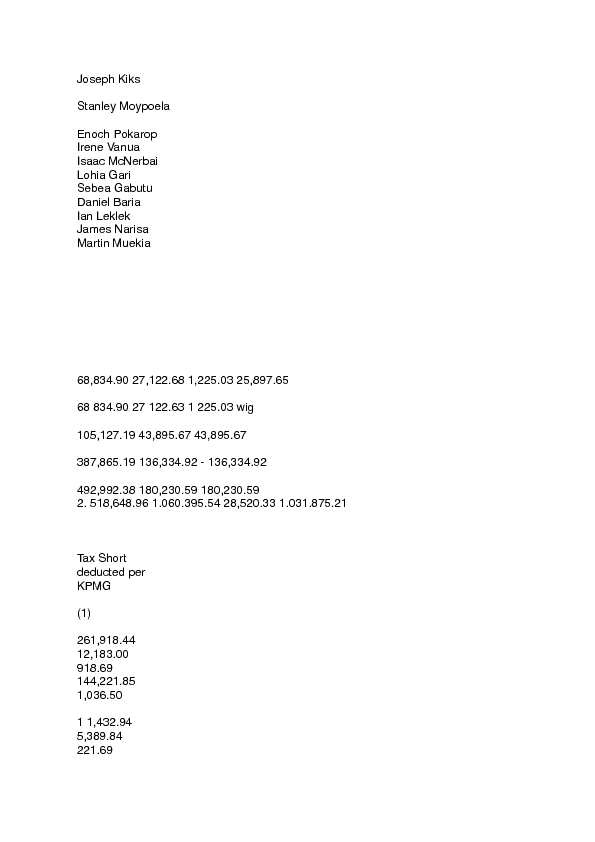

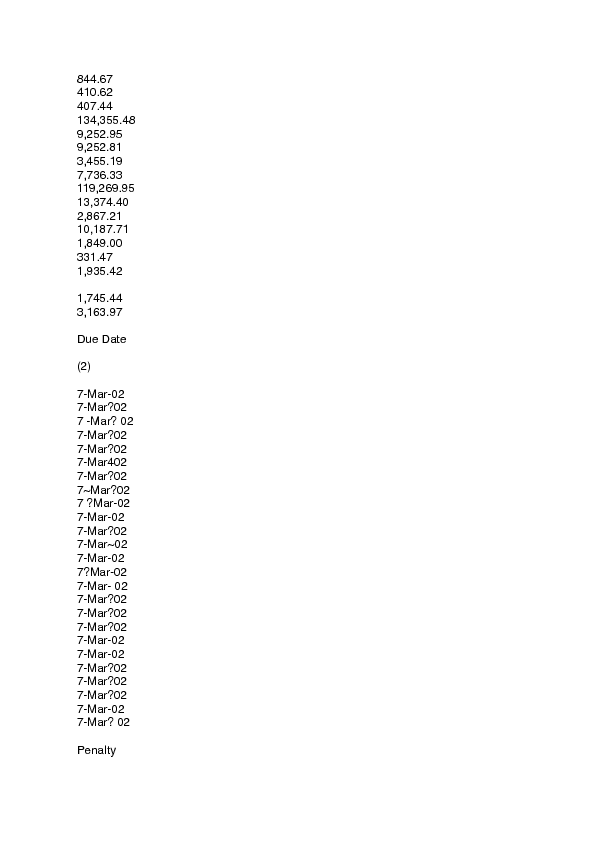

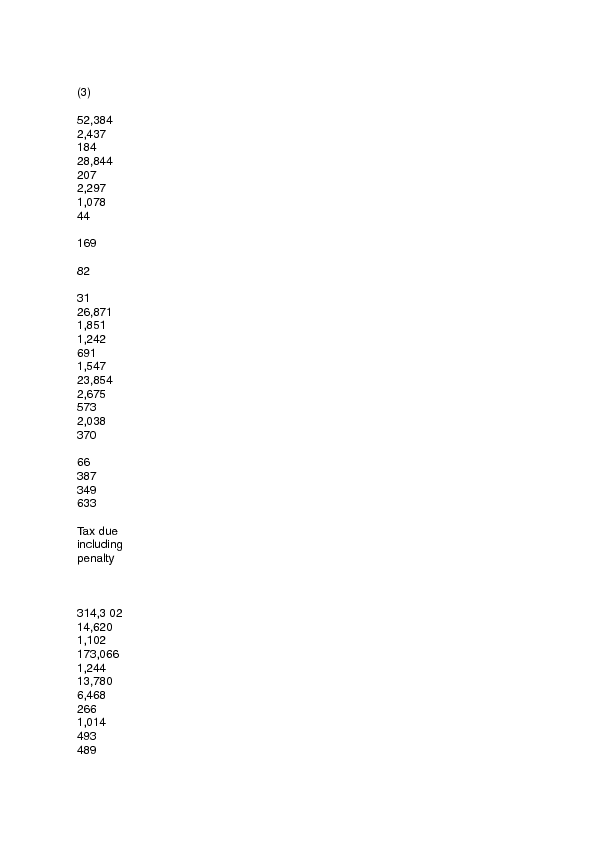

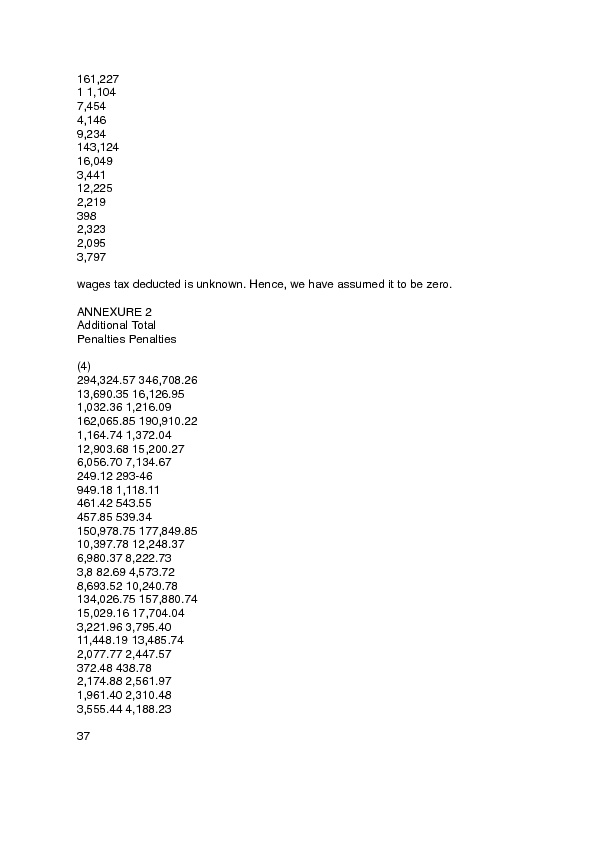

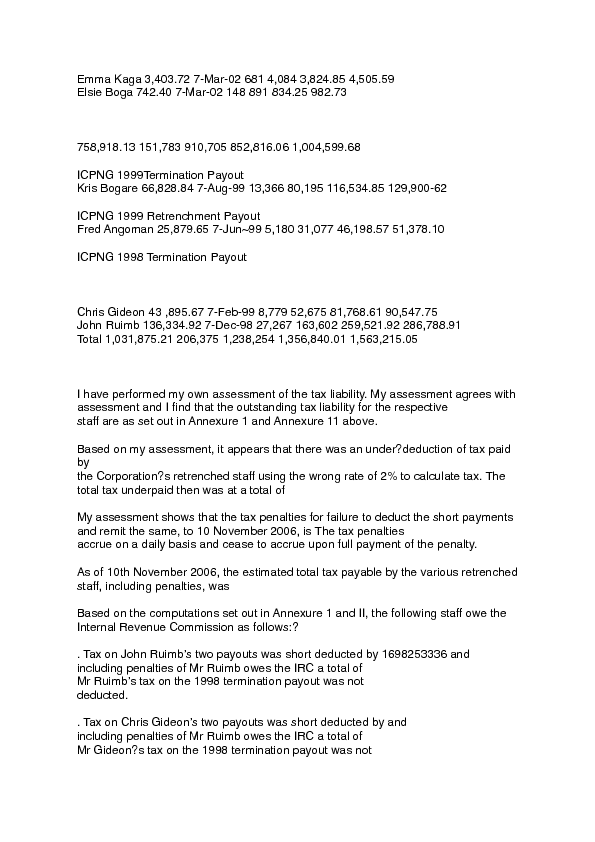

As a result of the separation, all the staff of the Corporation were retrenched. Upon retrenchment all the staff were paid their retrenchment bene?ts. However inappropriate tax rate was used in calculating the appropriate tax

xxi

5.11

5.12

5.13

5.14

5.15

5.16

5.17

payable with the consequence that there was underpayment of income tax in reSpect of all the retrenched staff. This was clearly unlawful and in breach of the Income Tax Act. As at the date of this Report the retrenched staff owe the Internal Revenue Commission (IRC) outstanding taxes inclusive of penalties in excess of One Million Five Hundred Thousand Kina This matter must be referred to the IRC for appropriate action.

Proper procedures set out in the Act and the Management Declaration were not followed in the separation process. The policy directions issued by the Minister for Privatisation did not comply with the relevant law.

The evidence reveals that the Corporation and the Fund were badly managed before the separation. The Corporation was possibly trading as an insolvent entity. There were instances of abuse of power by Board and Management. The evidence also reveals that Directors and Managers in many instances did not comply with the relevant statutes. The Statutory investment guideline was in most instances ignored. The Directors of the Corporation, should be referred to the Ombudsman Commission for ?irther investigations for their

-

Page 24 of 72

-

conduct as public of?ce holders.

Since separation, the Director of the Trustee (MTSL) such as Mr. Sanday have behaved badly in managing the Fund. It has committed numerous breaches of the Securities Act, Securities Regulation and the Trust Deed and other relevant laws. It is guilty of mismanagement; abuse of power and authority. It has failed to discharge its ?duciary duties competently. Its appointment as Trustee must be revoked immediately.

The Manager of the Fund (PEIL) including its Directors, in particular Mr Ruimb is equally guilty of mismanagement, abuse of power and authority and has failed to diligently perform its ?duciary duties. It too has committed numerous breaches that should in my opinion, not continue to remain as a Fund Manager.

In all the circumstances, the licenses of both the Trustee (MTSL) and the Fund Manager (PEIL) should be immediately revoked by the Securities Commission.

The MVIL and some of its directors, including Dr. John Mua acted imprOperly and contrary to law in its dealing with the disposal of its Units, in that no Ministerial approval had been obtained from the Minister for Finance under S. 61 of the PFM Act. Dr. Mua should be referred to the Ombudsman Commission for his conduct.

Westpac Bank (PNG) also acted improperly in its dealings over the loan of K12 million to MTSL, when it accepted shares as security for the loan. The Bank of Papua New Guinea should investigate its conduct over the loan affair.

xxii

5.18

5.19

In relation to the K37 million proposed write off, my inquiries now show that the amount to be written off should be less. It should be around K8 million. The balance should be assessed in detail prior to any action for recovery.

Even though proper procedures were not followed in the process of separation, nevertheless considering the passage of time; the current state of affairs of the Fund, and in all circumstances I consider that it would not be prudent and in the best interest of the Fund to disturb its current status quo. I consider that under the current circumstances it would be in the best interest of the thousand of investors for the Fund to continue to operate as such. In order for this industry to ?ourish, a full regulatory reform is urgently required to ensure that the supervisory, monitoring and enforcement roles of the Securities Commission are closely and adequately de?ned and prescribed.

-

Page 25 of 72

-

Given the growth in the Securities market and the complexity of the securities market, I strongly recommend that the office of the Securities Commission should be adequately funded and resourced. It should be detached from the current set up under the umbrella of the Investment Promotion Authority and given autonomy to function independently.

Hon. Don Sawong, LLB, MBE Chairman Chief Commissioner

Port Moresby

28?? March, 2007

3.1

3.1.1

STRUCTURE OF THE CORPORATION AND THE FUND

The Corporation

Introduction

This Commission of Inquiry is tasked with the responsibility to inquire into certain issues that arose as a result of the separation of the Fund from the Corporation.

The Corporation was established under an Act of Parliament called Investment Corporation Act 1971. It was established as a corporate body and has been endowed with the relevant and appropriate life support capabilities including the necessary powers and functions to operate as a legal entity.

Since 1973 the Corporation was performing dual roles as manager and trustee in dealing with the investment funds under its own portfolio as well as in trust fund portfolio. These dual roles and functions were brought about when the Corporation executed the Management Declaration. The Management Declaration created a trust fund called the Fund.

As I mentioned earlier, the Management Declaration does not adequately provide for the functions, duties and obligations of the Corporation as the trustee. There are also no adequate provisions specifying the usual indemnities governing the relationship of the trustee and manager.

Due to high levels of incidences referred above, a team of professional experts were engaged. This Team reviewed the Corporation?s systems and process and as a result a strong recommendation for major structural changes to the Corporation was made.

-

Page 26 of 72

-

Consistent with standing government policy, the Corporation was initially preparing towards corporatisation. However, the government policy with respect to the Corporation subsequently shifted in late 2001 and this resulted in the separation of the Fund from the Corporation. The Fund ultimately became a commercial unit trust and is now known as Pacific Balanced Fund.

The terms of reference under the inquiry include issues relating to public finance management and procedures, corporate management, investments, ?duciary duties, bank loans and securities, corporate governance, duties and responsibilities. These are the complexities of a modern commercial world order.

It is therefore imperative at the outset for this Report to look at the structures within which Corporation played its dual role as the manager and trustee.

3.1.2

3.1.3

3.1.4

Establishment of Corporation

The Corporation was established by the Act. It was speci?cally established under section 3 of the Act. This provision reads

Establishment of the Corporation.

A body by the name of the Investment Corporation of Papua New Guinea is hereby established

Objectives of the Corporation

The main object and purpose of the Corporation is to provide equity investment opportunity for citizens and national enterprises in Papua New Guinea who are de?ned by the Act as ?eligible persons?. Section 5 of the Act which provides for the objectives is stated hereunder

Object of Investment Corporation.

The object of the Investment Corporation is to provide for an equity holding by eligible persons in enterprises in Papua New Guinea in cases where the Corporation is of the opinion that??

it is in the long?term interest of the people of Papua New Guinea to do so; and

a significant degree of equity holding by eligible persons would not or might not otherwise be readily achieved.

-

Page 27 of 72

-

Functions of the Corporation

The functions of the Corporation are outlined in Section 6 of the Act. These functions were designed, amongst other things, to achieve its principal objectives. These functions are:-

take up shares in enterpiises and hold them with a view to their future disposal to eligible persons;

dispose of shares in enterprises to eligible persons; arrange opportunities for eligible persons to acquire shares in enterprises, and arrange for enterprises to offer shares, or rights to future shares to eligible

persons;

underwrite share issues in the country and take ?rm any part of any such issue that?s not taken up by any eligible persons;

(6)

(1)

in accordance with the law relating to such matters, or in such manner and on such conditions as are approved by the Minister in any particular case?

establish or manage in the country, or join in the establishment or management in the country of, investment companies or unit trusts or other mutual funds;

(ii) if and when it appears to it desirable, take such action as it appears to it necessary or desirable to sell or otherwise make available to eligible persons shares, units or subunits in any such company, trust or fund;

enter into consortium arrangements as appropriate;

generally do any other thing that is necessary or convenient forithe purposes of achieving its object;

the Corporation may, and shall if the Minister so directs, act as agent for the Government in relation to any matter within the objects and functions of the

-

Page 28 of 72

-

Corporation, and the State shall fully and eventually indemnify it and hold it safe against all claims or actions made or taken against it as a result of its acting as such an agent; – –

the Corporation may, shall if the Minister so directs, act as agent for the Government in relation to any matter within the objects and functions of the Corporation, and the State shall fully and effectually indemnify it and hold it safe against all claims or actions made or taken against it as a result of its acting as such and agent;

the Corporation does not have, and shall not exercise or purport to exercise, any power of compulsion on or in relation to any enterprise or its shareholders, except so far as such a power is conferred on it by or under any agreement or arrangement with the enterprise to its shareholders;

the Act does not compel the Corporation (otherwise than as agent for the Government) to take up equity holding or to exercise or perform any of its powers or functions in relation to an enterprise, except so far as a duty to do so is imposed on it by or under an agreement or arrangement with the enterprise or its shareholder or otherwise, or by or under any other law;

the Corporation was prohibited from buying shares on a stock exchange, other than shares in a company that was incorporated in the country.

3.1.5

3.1.6

Scheme of the Legislation

It is apparent that the scheme of the Act is to enable aspiring Papua New Guinean citizens and enterprises to participate in foreign controlled and dominated investment and share markets for their economic well being.

It was envisaged that this product would grow and mature over time and ultimately bring greater economic and ?nancial bene?ts to many ordinary Papua New Guinean investors.

There is no doubt that the object, purpose and the scheme of the Act was indeed very good and with honourable intentions.

The Board

The Corporation is managed by a Board of Directors. The Board is established under section 9 of the Act and is constituted by nine members who are appointed by the Minister. Section 9 of the Act reads –

Board of Directors.

-

Page 29 of 72

-

(1) A Board of Directors of the Investment Corporation is hereby established.

(2) The Board shall be constituted as provided by Part II And Part of the Act provides that the Board of Directors shall consist of:- the Managing Director; and

an of?cer of the Rural Development Bank appointed by the Minister by notice in the National Gazette; and

an of?cer of the Department of Finance appointed by the Minister by notice in

the National Gazette; and

not less than ?ve and not more than nine other members, of whom not less than four are citizens, appointed by the Minister by notice in the National Gazette.

A member appointed under category or holds of?ce during the pleasure of the Minister.

A member appointed under category and who is not an of?cer or employee of the Public Service is appointed for a period of three years and holds of?ce subject to good behaviour and is otherwise eligible for re?appointment.

A member of the Board of Directors is required under section 14 of the Act to make a Declaration of Of?ce provided for by the National Constitution and make a declaration of secrecy in the prescribed form. The content of the form is shown

below:?

AFFIRMTION OF OFFICE.

Schedule of Secrecy.

SCHEDULE 2. Sec. I4. DECLARATION OF SECRECY. I, . . . a member of the Board of Directors of the Investment

Corporation ofPapua New Guinea, do solemnly and sincerely declare that I will at all times maintain secrecy in relation to the a?airs of the Board and of the Investment Corporation of Papua New Guinea and, in particular, that I will not directly or indirectly communicate or divulge any information that comes to my knowledge in the performance of my functions as a member of the Board, except by authority of the Board or under compulsion or obligation of law.

(Signature of Declarant. Declared at. . . Dated. . .

-

Page 30 of 72

-

Before me:

(Signature of Person before whom Declaration is made.)

The declaration of Of?ce under the National Constitution is in the following format:-

3 Sec. Sch.l.2(l) DECLARATION OF OFFICE I do promise and declare that I will well and

truly serve the Independent State ofPapua New Guinea and its people in the o?ice

3.1.7 Appointment to the Board of Directors

The members of the Board of Directors are appointed by the Minister. The Act does not impose any requirement as to quali?cation, skill or experience as criteria for appointment to the Board.

However, due to the nature of the duties and responsibilities of the of?ce of the Managing Director one would expect in practice that persons possessing appropriate experience and quali?cation be appointed to that of?ce, although this is not a legal requirement.

Therefore the Minister has fairly wide discretion as to whom he desires to appoint. In almost all cases and especially in the recent times, except few, the appointments were politically motivated. There is no doubt that this was a major contributing factor giving rise to the issues before the inquiry.

The Minister?s power to appoint persons to the Board of Directors is vested in section 12 of the Act and is stated in the following way:-

?12. Constitution of the Board of Directors.

(1) The Board of Directors shall consist of? the Managing Director; and

an o?icer of the Rural Development Bank appointed by the Minister by notice in the National Gazette; and

an o??icer of the Department of Finance appointed by the Minister by notice in the National Gazette; and

not less than five and not more than nine other members, of

-

Page 31 of 72

-

whom not less than four are citizens, appointed by the Minister by notice in the National Gazette.

(2) A member appointed under Subsection or and a member appointed under Subsection who is an o?icer or employee of the Public Service, holds o?ice during the pleasure of the Minister.

(3) A member appointed under Subsection who is not an officer or employee of the Public Service~

shall, subject to Subsections (4) and (5), be appointed for a period of three years; and

holds o?ice subject to good behaviour; and

3.1.8

is eligible for re-appointment.

(4) In the event of a member appointed under Subsection ceasing to hold o?ice before the expiration of the period of his appointment, and the appointment in his place of a person other than an o?icer or employee of the Public Service, the period of the appointment is the remainder of the period of o?ice of the member ceasing to hold of?ce.

(5 An o??icer or employee of the Investment Corporation or the Rural Development Bank shall not be a member of the Board appointed under Subsection

Under section 15 of the Act, a member of the Board, other than category and appointees ceases to hold of?ce under the following circumstances:?

permanent incapacity

bankruptcy or insolvency

resignation

is absent without leave granted by the Minister, from all meetings of the Board

fails to give disclosure of matters he has interests in.

Powers of the Corporation

Because the law gave legal life to the Corporation, the law also bestowed on it certain powers and functions. These powers and functions were to enable and allow the Corporation to serve its purpose in life.

The powers of the Corporation are contained in section 8 of the Act. The Corporation

-

Page 32 of 72

-

is given very wide powers to do all things necessary or convenient to be done for or in connection with the achievement of its objects and the performance of its

functions. The powers included the power to:

borrow money with the consent of and on such terms and conditions as are approved by the Minister.

lend money. participate in the formation of a company or other business enterprise.

subscribe for or otherwise acquire, and to diSpose of –

shares in, or securities of, a Corporation (ii) interests in, or securities of, a Corporation underwrite issues of shares in, or securities of, a Corporation.

buy back shares sold by it at a price that, in that opinion of the Investment Corporation, is fair and reasonable in the circumstances.

3.1.9 Of?cers and Service of the Corporation

The Act recognized that people need to be employed to provide service to the Corporation. It therefore made provision for appointment of of?cers. These of?cers constitute the service of the Corporation. The relevant provisions of the Act are sections 21 25. Essentially these provisions provide that

-: we)

The Corporation may appoint such of?cers as are necessary for the purposes of this Act.

The of?cers constitute the service of the Corporation.

The provisions of the Public Services (Management) Act 1995 apply to certain of?cers in respect to certain rights and bene?ts only.

-

Page 33 of 72

-

The of?cers hold of?ce on such terms and conditions as are determined by the Corporation.

The regulations may make provision in relation to the service of of?cers, and in particular may:-

prescribe the terms and conditions of employment of of?cers; and

(ii) make provision for the establishment of a superannuation scheme to provide bene?ts for the Managing Director, Deputy Managing Director and of?cers of the Corporation, on retirement.

Appointment of temporary and casual employees “may be made as deemed necessary.

The Corporation may make available to its officers and employees, or any of them, such housing or other accommodation and on such terms and conditions, as it thinks proper.

3.1.10 Management structure

The head of the Corporation Management team is the Managing Director. The next in hierarchy is the Deputy Managing Director. Both are appointed by the Minister.

The Deputy Managing Director acts in the absence of the Managing Director.

3.1.11

3.1.12

Their terms and conditions of appointment are determined by the Minister, subject to the Salaries and Conditions Monitoring Committee Act 1988 (SCMC Act).

At all relevant and material times the management structure of the Corporation is reflected by the organisational flow chart contained in the PWC Scoping Study Report which is attached and marked as Exhibit in the Appendices to this Report.

Financial structure

Under section 26 of the Investment Corporation Act the capital of the Corporation consists of:?

budgetary appropriations; and monies transferred from the Corporation?s Reserve Fund.

The Reserve Fund consists of monies that are pooled together from capital investments and pro?ts earned.

-

Page 34 of 72

-

The other major income generation source for the Corporation is the management fees derived pursuant to the Management Declaration.

Tender Procedures

The Corporation has adopted a tender procedure manual in dealing with the supply of goods and services. The tender procedure manual is incorporated into a main manual called the Accounting Policies and Procedures Manual? (?the Financial Manual?).

The Financial Manual is in two parts. The ?rst part deals with tender procedures and the second part deals with accounting procedures. The Financial Manual is marked as

Exhibit ?95? and is attached to the schedule to this report.

The Financial Manual appears to possess the standard features and characteristics that are common to most state?owned or statutory bodies, organisations and entities.

The Financial Manual sets out the levels of ?nancial limits and the corresponding ?nancial approval authorities or delegates.

The approving authorities and their respective ?nancial limits are

Minister – Board of Directors – Managing Director 5,000 100,000

Delegated Financial Authority

appointed by the Managing Director Nil 5,000

3.1.13

The objectives of the tender procedure manual is ?to provide guidelines that will ensure the most pmdent manner of ?nding the right supplier for goods and services required, by inviting tenders (Exhibit

A Tender Committee appointed by the Managing Director is charged with the reSponsibility in ensuring that the objectives of the Financial Manual is attained or achieved.

Some of the salient aSpects of the tender procedures that are captured in the Financial Manual are

-

Page 35 of 72

-

For contracts under the invitation to tender may be restricted to suppliers with necessary capabilities and ?nancial viability to perform the contract and a minimum of three (3) suppliers must be invited to tender for every contract.

For contracts over the invitation to tender must be conducted in public through press advertisement with calling of interested bidders to register their interest and also providing their background, experience, expertise, etc.

(0) All tenders are to be submitted in sealed envelopes. There should not be any extension of time after the of?cial closing time, except only in exceptional circumstances, and in which case all interested parties shall

be noti?ed and con?rmed in writing.

Tenders submitted by fax and late tenders should not be opened and should be returned unopened.

Tenders opened by error should be rescaled and by the Secretary of the Tender Committee, initialled and put back in the tender box.

At the time of Opening of the tender box, at least three of the members of the Tender Committee must be present and all must each initial every tender.

Tender documents given to all tenderers should be identical. Any changes to tender documents must be communicated in writing to all tenderers.

Accounting Procedures

The accounting procedures established and operated by the Corporation is quite simple and basic in scope.

The objective of the accounting procedure as stated in the Financial Manual is ?to

design and maintain an e?ective system to monitor and control payments other than the payments to sundry debtors.

10

The responsibility for the administration of the requirements in respect to the accounting procedures is vested in the Financial Controller and the senior accountants.

The requisite elements pertaining to accountability, transparency and checks and balances generally are present in the accounting procedures and these include such things as –

I Petty cash ?oat is to be used solely for minor expenses. Minor expenses are de?ned as ?small amounts payable which do not warrant orjusti?) the need for producing a cheque?. However, it is a requirement that even small

-

Page 36 of 72

-

amounts be properly documented and controlled.

I Petty cash voucher is required to be prepared for each payment.

I Receipts must be attached to each voucher in support of payments, or failing which a statutory declaration by the Receiving Of?cer.

I Payments should be evidenced by stamp showing the date on the “face of the vouchers as well as on the supporting receipts or declaration.

I A petty cash book should be maintained and every voucher to be entered in the book in sequential order.

I Reimbursement claims with all vouchers and supporting documents attached must be submitted to the Financial Controller for approval.

3.1.14 Tax Liabilities

Under section 34 of the Act, the Corporation is liable to taxation under any law. Section 34 states as follows:?

?34. Liability to taxation. The Investment Corporation is liable to taxation under any law?

3.1.15 State Guarantee

Under section 33 of the Act, the State is deemed to provide a guarantee for all monies due to the Corporation. However, such guarantee is not absolute. Section 33 which deals with the guarantee is as follows?

?33. Guarantee by the State.

11

3.1.16

3.1.17

3.1.18

The State is responsible for all moneys due by the Investment Corporation, but this section does not authorize a creditor or other person claiming against the Corporation to sue the State in respect ofthe claim?

Power of Attorney

The Corporation is authorised under its enabling Act to appoint a person to act on its behalf either within or outside of Papua New Guinea. Section 34 of the Act states as

-

Page 37 of 72

-

follows

?32. Attorney.

The Investment Corporation may, by instrument under its seal, appoint a person (whether within or outside the country) to be its attorney and, subject to the instrument, a person so appointed may do any act or exercise or peiform any power or function which he is authorized by the instrument to do, exercise or perform

Returns

The Corporation is obliged to ?irnished returns to the Minister periodically. Section 35 of the Investment Corporation Act 1971 imposes this obligation in the following terms

?35. Returns

The Investment Corporation shall furnish to the Minister such periodical statements as are prescribed?

Investment Guidelines

A signi?cant part of my task is to assess whether investments were properly conducted by the Board and Management of the Corporation. As a result it is important that I establish the investment guidelines under which the Corporation and the Fund were required to adhere to.

The all encompassing guideline is set out in Section 10(1) of the Act where it states the following:?

?Notwithstanding anything in this Act, in the exercise of its powers and the

performance of its functions the Investment Corporation shall act in

accordance with sound business principles and in particular, but without

limiting the generality of the foregoing, it shall not:-

acquire shares or interests in, or participate in the formation of an enterprise unless in its opinion the enterprise will operate in an e?icient manner and on a profitable basis; or

12

3.1.19

(29) dispose of shares at less than?? their fair market value; or

-

Page 38 of 72

-

(it) where there is in its opinion no significant trading in the shares, a price that, in its opinion, is fair and reasonable in the circumstances?

It follows that the Board and Management of the Corporation were required to employ best practice standards and procedures in the investment of the funds of the Corporation and the Fund. Ideally the standards and procedures would have been approved by the Board and Management and communicated to all relevant staff.

Essentially this would require the establishment of procedures in writing to staff to follow and parameters to observe. The parameter should address among others acceptable returns and portfolio mix.

In the period covered by the of this Inquiry I ?nd that the Board and Management did not have a clearly defined investment guideline to give effect to the requirements of Section 10(1) of the Act.

Policies of the Corporation

Under the Act, the Corporation is required to observe and implement any framework of policies issued from time to time by the Minister and approved by the Head of State.

The Board of the Corporation is obliged to inform the Minister on any changes to the policies it may deem desirable. The provision that deals with the policies of the Corporation is section 10 of the Act and is stated as follows

?10. Policies of the Corporation.

(1) Notwithstanding anything in this Act, in the exercise of its powers and the performance of its functions the Investment Corporation shall act in accordance with sound business principles and in particular, but without limiting the generality of the foregoing, it shall not?-

acquire shares or interests in, or participate in the formation of an enterprise unless in its opinion the enterprise will operate in an e?icient manner and on a profitable basis; or

(b dispose of shares at less than??

their fair market value; or

13

(2)

(3)

(4)

-

Page 39 of 72

-

(5)

(6)

(7)

(8)

(9)

(it) where there is in its opinion no signi?cant trading in the shares, a price that, in its opinion, is fair and reasonable in the circumstances.

Subject to Subsection (I), in the exercise of its powers and the performance of its functions the Investment Corporation shall have regard to the likely contribution of any enterprise to the development of Papua New Guinea.

Subject to Subsection (I the Investment Corporation shall operate within any framework of policy laid down from time to time by the Minister and approved by the Head of State, acting on advice.